- New evaluation of Concardis merchant transactions: today more than 70 percent of cashless payments cross-sectoral are contactless

- The trend towards contactless payment is also continuing after the reopening of bricks-and-mortar retailing

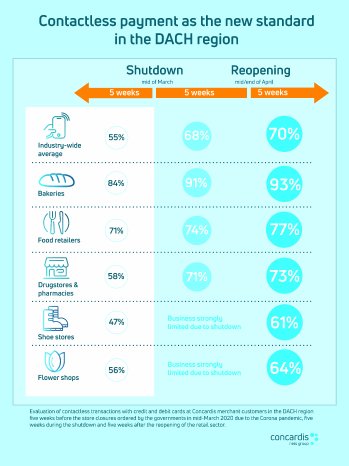

- Before the shutdown the proportion of contactless card payments was 55 percent, rising to 68 percent after most shops closed

- Evaluation of payment data five weeks before, during and after the shutdown respectively

New payment habits as "New Normal

"Our analysis shows very clearly that new payment practices are very much part of the much talked-about ‘new normal’. Within weeks the DACH region has reached a level here that we in the Nets Group know from the Nordic countries, where people have for the most part been paying cashlessly and contactlessly with cards and smartphones for years," says Hoffmann.

How often contactless payments are made continues to vary widely across the individual sectors. In bakeries and food stores, for example, contactless payments were already commonplace before the shutdown (84 percent and 71 percent respectively), and the figures rose again significantly during the pandemic, reaching 93 percent and 77 percent respectively. In drugstores and pharmacies, on the other hand, an average of around 58 percent of transactions were carried out contactlessly prior to the state-ordered measures in March. During the closures in the retail sector this proportion rose to 71 percent, and after the relaxation it increased further to 73 percent.

Contactless rate in shoe shops increases by 14 percent

Retailers who had to close their stores for five weeks after the shutdown switched to e-commerce and other distribution channels to conduct their business. In the case of shoe shops, for example, sales at the cash register also clearly indicate that whereas before the shutdown not even half (47 per cent) of payment transactions were processed contactlessly, the average figure since the stores re-opened is around 61 per cent. The number of contactless transactions in flower shops associated with Concardis also rose significantly, from around 56 to 64 percent.

"This shows very clearly that contactless payment is not only an acute safety precaution for consumers in the pandemic. Customers have also come to appreciate this simple, secure and convenient method of payment, and are continuing to use it wherever card payments are possible," says Hoffmann, adding: "This has made contactless payment the standard payment method for many people in the DACH region, too."

As one of the leading payment service providers in the DACH region, Concardis has evaluated transaction figures from its associated merchants in Germany, Austria and Switzerland. The period under review covered five weeks before the shutdown, five weeks during the shop closures and five weeks after the reopening of the retail sector. The majority of the transactions were made by credit card, with debit cards accounting for around a quarter of the payment transactions surveyed.