Right at the beginning of 2022, the European envelope industry suffered from major supply problems in paper due to a longer strike in Finland. The effects of this strike were still to be felt far into the third quarter of 2022 and, in conjunction with rising energy costs, led to an explosive increases in paper prices. At times prices for woodfree envelope paper were up to € 1,800/t. Due to existing contracts, it was difficult for the envelope industry to implement new sales prices that matched the rapidly changing paper prices and also the extended lead times for paper. Often, the manufacturers were also forced to use alternative, often more expensive papers for existing orders.

In the middle of the year, the concerns about secure energy and raw material supply as well as the long delivery times at all levels led to a great nervousness in the markets and subsequently to a large number of early orders, which then led at the end of the 3rd quarter to overfilled warehouses and high security stocks. With the stabilization of the raw material and energy markets at a high level in autumn 2022 suddenly there was a lack lot of expected connection orders and customer calls and the order intake was far below expectations for many FEPE members. The normally strong 4th calendar quarter was therefore very disappointing in the envelope area.

The business with e-commerce packaging, which is becoming increasingly important for the FEPE members, has continued to grow in 2022, but here the quantities were left behind the expectations in some segments too. The reason for this was the surprising decline in online trading, which, according to BEVH 2022, was quite clear in Germany with -8.8%. But also in other European regions there was a damper in online trading after the Corona boom of the two previous years.

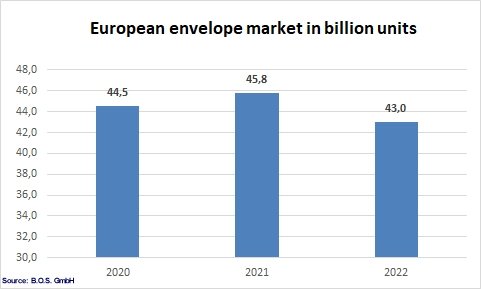

Due to the available data, the FEPE for 2022 calculates a total amount of the envelopes and pockets sold in Europe of 43 billion units (-6%). Due to price increases and the growing e-commerce business, industry sales in 2022 have increased for the first time in years.

Also at the beginning of 2023, the raw material and energy costs remain at an unusually high level, which leads to an unchanged high cost pressure in the envelope industry. Further price adjustments are therefore not excluded. Overall, the expectations of the industry for 2023 are only moderate.