The Philippines was hit particularly hard by hard disk drive (HDD) supply shortages as manufacturing plants in Thailand had their operations thrown into disarray by severe flooding. Other macroeconomic factors also contributed to the local PC market's decline. The strengthening peso against the U.S. dollar meant that the remittances of Overseas Foreign Workers (OFW) were worth less than before. In addition, the seasonal typhoons that hit Metro Manila further crimped consumer spending.

In the consumer segment, mininotebooks, which are usually a major contributor to the Philippines PC market, faced the most significant drop in 4Q11 at 44%. Vendors prioritized their limited HDD allocations to larger form factor PCs as they are more profitable and the move protected their overall revenue share. Telco bundling programs also ground to a halt in 4Q11 and this too affected overall mininotebook shipments. From a channel perspective, distributors and retailers were reluctant to bring in high levels of stock as they normally prefer to end the year with low inventory levels in preparation for the new year.

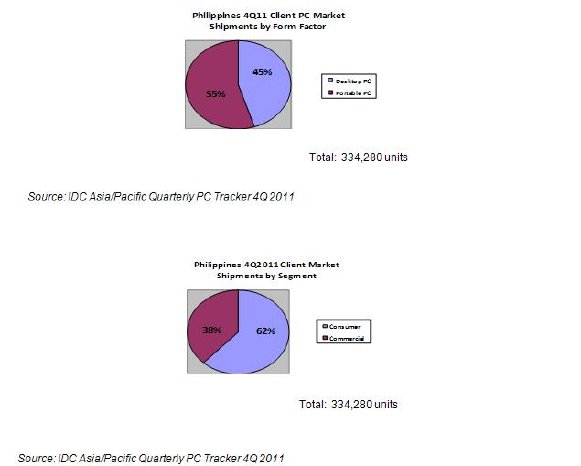

Juan-Jin Ng, Market Analyst for Personal Systems Research at IDC Asia/Pacific says, "The commercial segment was not spared from the HDD crisis as vendors had to delay the delivery of secured projects to 1Q12 as there was simply no supply of PCs and notebooks locally. Continued delays from the new administration in approving public sector fulfillments also compounded the commercial market's abysmal performance. In fact, the commercial market in 4Q11 recorded its lowest quarter in four years with 128,000 units shipped."

The SME segment performed poorly as well, declining 22% sequentially as end user demand stagnated and vendors focused on fulfilling their Large/Very Large Business deals in the overall enterprise sector.

Figure 1

Despite the gloomy nature of the 4Q11 PC market, the outlook for 2012 appears more promising. Juan-Jin adds, "With HDD supply expected to normalize by March or early April 2012, the Philippines market should show signs of improvement in 1Q12 from public segment rollouts and a further bump-up in 2Q12 from pent-up consumer demand as well as from the launch of Intel's new Ivy Bridge processor lineup."

For further information on the findings contained in this report, please contact Harsha Sundararaman at +65-6829-7716 or hsundararaman@idc.com.