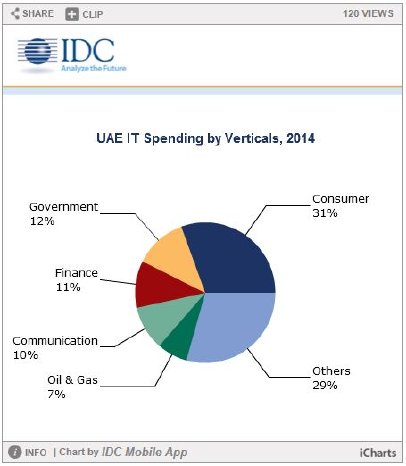

The public sector, which includes government, education, and healthcare organizations, will account for most of the business IT spending in 2014. Organizations in this vertical are predicted to invest $1.12 billion in IT and account for 24.3% of the spending, driven primarily by government-led initiatives to bring more public services to online and mobile platforms. Government-backed projects to increase the use of ICT in educational institutions, together with regulations in the healthcare sector that mandate a reduction in paper-based processes, are other major factors driving IT spending in this sector.

'Combined Finance' is the second-biggest vertical in the UAE with respect to business IT spending. Organizations in this vertical, which includes banking, insurance, and securities services providers, are predicted to invest $719.77 million in IT in 2014. The rapid expansion of branch and ATM networks, investments in online and mobile banking channels, and the need for better regulatory compliance are the primary drivers of ICT investments in the banking sector.

Consumer IT spending in the UAE is expected to account for 30.5% of total IT spending in 2014, though it will contract 8.4% year on year. This decrease in spending is a result of the stagnating PC market, which is being cannibalized by the growing demand for tablets.

The strong infrastructure backbone, business-friendly government, and ongoing and planned large-scale investments make the UAE more prepared for growth than its regional peers. IDC expects total IT spending in the UAE to increase at a compound annual growth rate of 6.0% over the five-year forecast period to total $8.06 billion in 2017.

"Robust growth of the UAE's IT market is expected to continue throughout the 2013-2017 forecast period," says Jebin George, a senior research analyst at IDC Middle East, Africa, and Turkey. "IT vendors will find the biggest opportunities in the government sector, as it is the largest and fastest growing market. Communications finance, and oil and gas will continue the other major vertical markets for IT spending, while healthcare, transport, and utilities are growing the fastest."

IDC's United Arab Emirates Vertical Markets 2013–2017 IT Spending Forecast (IDC #ZV11V) provides a detailed overview of IT spending trends and forecasts for 17 vertical markets and 10 product categories, including hardware, packaged software, and services in the UAE. The study includes an overview of key industry developments, industry challenges, vertical-specific IT drivers and trends, and tables detailing IT spending by vertical market for each product for the 2012–2017 period. Analysis is based on continuous research and monitoring of users' IT spending, emerging purchasing patterns, and supply- and demand-side research. For more information about this report, please contact Jebin George at jgeorge@idc.com.