This represents a fundamental strategy shift for most of telecom carriers. A Senior Analyst at InfoCom commented: “Exclusive and compelling content offers aim at increasing the attractiveness of services over fibre. Incumbents such as Deutsche Telekom, France Telecom, PCCW as well as TeliaSonera are all pursuing this “content is king”-strategy in order to trigger the demand”. All players have new services in their pipeline — 3DTV, HDTV, smart home, smart metering, high definition videoconferencing — to offer an attractive portfolio of bandwidth-hungry services. InfoCom’s Senior Analyst commented further: “Carriers seek to increase the value of their fibre networks”, adding content through partnerships with other players, such as content or solution providers. Or else, they develop cloud storage solutions, PCCW, for instance, who launched its uHub service in August 2011: network operators want to cash in on the popularity of over-the-top contents, as Waoo!’s strategy in Denmark.

A shift in business models was also observed with some carriers pursuing different models for their various networks. Some — for instance Dutch incumbent KPN or the Scandinavian carrier TeliaSonera — would act as vertically integrated operators for their FTTC/VDSL networks while they pursue open access models for FTTH/B in order to maximise return on the single networks. In the UK, instead, BT is obliged to provide an unbundling offer for its FTTC network and sells fibre via its “BT Infinity” brand, while other service providers use BT’s network to re-sell fibre using their own brand. In Denmark, 15 utility companies opened their network to service provider Waoo!, for instance, in order to position themselves more on a national scale. In Germany, Deutsche Telekom and Vattenfall are exploring open access models for their FTTH deployments in smaller towns.

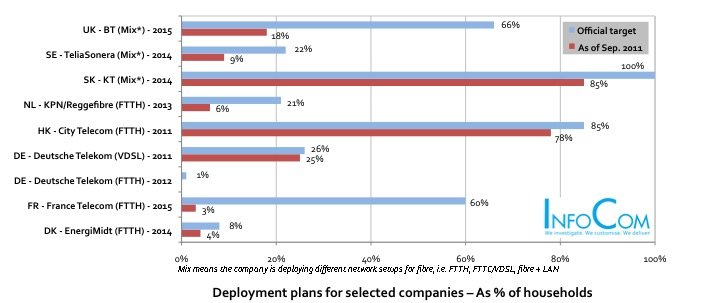

Overall, though, no dramatic shifts in deployment strategies are expected in Europe, especially as demand for very high bandwidths is not yet picking up. Although carriers are looking at accelerating a bit their FTTH deployments, the bulk of the infrastructure investments will still go to FTTC/VDSL as this is, currently, the most cost-effective alternative to realise fibre given the current economic landscape. Some European carriers have set quite ambitious FTTH targets for the next 3-5 years: by 2015, both BT and France Telecom plan to connect more than 60% of households with fibre. However, some European operators — such as Deutsche Telekom and KPN — are lowering down their short and mid-term targets due to economic and regulatory uncertainties. A still limited availability of bandwidth-heavy services and a consequent low demand may also contribute to slow down FTTH deployments in the region. Currently, competition is mostly in the 10 to 30 Mbit/s range supporting the VDSL strategy. Thus, some companies like TDC and KPN encourage local communities to sign up their residents for fibre in order to put their towns on the roll out priority list.

About this extract: This extract in based on InfoCom recent study TRENDS IN THE MAJOR FIBRE MARKETS

Incumbents run faster in the fibre race. This large-scale research identified major trends regarding FTTx deployments worldwide, The report illustrates best practises, new business models, trends in different world regions, including open access strategies. If you are interested in this report, do not hesitate to get in contact with us. Talk to us. We listen.