- Business performance in the first quarter of 2020 impacted by Covid-19, first in Asia, then in Europe and North America

- Buoyant aftermarket business underlines resilience of business model

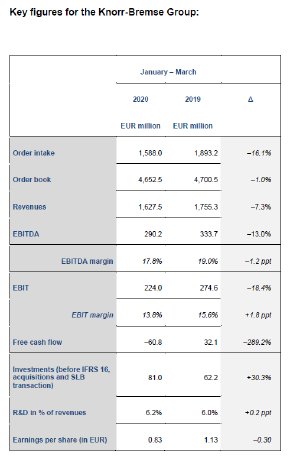

- Solid development: revenues down just -7.3% to EUR 1,627.5 million

- Robust profitability levels thanks to early action: EBITDA margin of 17.8% compared with 19.0% (Q1 2019), more stable than competition

- Order book in RVS division up +6.6% despite Covid-19 impact

- CVS division outperforms the market in all regions

- Cash funds of EUR 2.0 billion ensure flexibility for operations

Bernd Eulitz, CEO of Knorr-Bremse AG: “In the first quarter, our operations began to be impacted by Covid-19, especially in Asia. Our top priority was the health protection of our employees and then the stable supply of our customers. And yet this pandemic has shown Knorr-Bremse’s business model to be very resilient: With the aftermarket business accounting for a large share of revenues and thanks to the cost control measures we implemented early on, we have been able to cushion the effects of the market decline. In the European and North American markets we expect the Covid-19 pandemic to have the greatest impact in the second quarter of 2020, while our Asian markets – particularly China – have already recovered. Overall, we see 2020 as an opportunity to demonstrate the robustness of our business model with solid figures.”

Resilient business model thanks to stable aftermarket

The market in which the Knorr-Bremse Group operates was weaker on the whole in the first three months of the 2020 fiscal year than in the months before and was impacted by the Covid-19 pandemic – particularly in Asia, and here especially in China. As expected, global commercial vehicle production recorded a palpable downturn, reflected in falling order volumes.Order intake of the Group in the first quarter of 2020 was down -16.1% on the yearearlier period at EUR 1,588.0 million (previous year: EUR 1,893.2 million).

Thanks to solid business performance in the fourth quarter of 2019, the order book of Knorr-Bremse AG in the first quarter of 2020 came to EUR 4,652.5 million, just 1.0% below the figure for the prior-year period (EUR 4,700.5 million).

Overall, revenues of the Knorr-Bremse Group declined by -7.3% in the first quarter of 2020, sliding to EUR 1,627.5 million (previous year: EUR 1,755.3 million). While revenues in the RVS division fell only marginally short of the prior-year level on the whole, the anticipated slowdown in truck production mainly in North and South America, but also in the European business and shuttered customer manufacturing facilities, particularly in China in the first half of the quarter, had a noticeable impact on revenues in the CVS division. As a result RVS division’s share of total revenues rose to 55% (previous year: 52%).

The Knorr-Bremse Group aftermarket business’s share of total revenues climbed to 37.0% (previous year: 31.0%). In absolute terms, this rose by 11.0%, thus going a long way toward stabilizing revenues and earnings. This improvement can be attributed to the change in customer preferences resulting from Covid-19.

In spite of the initial effects of the Covid-19 pandemic in Asia-Pacific and a significant slowdown in business in Europe as well as in North and South America, regional contributions to revenue remained stable in the first quarter of 2020. The regional breakdown of revenues as of the end of Q1 2020 was as follows:

- Europe/Africa 48% (previous year: 48%)

- Asia/Pacific 29% (previous year: 27%)

- North America 22% (previous year: 23%)

- South America 1% (previous year: 2%).

Stable EBITDA margins thanks to early action

In view of the forecasted downturn in revenues in the North American and European commercial vehicle market, the CVS division had already initiated strict cost control in 2019 along with a program to improve efficiency. This was considerably intensified in the first quarter of 2020, expanded to the entire Group and systematically implemented, which mitigated the negative impact of Covid-19 on the Group’s EBITDA margin. Despite the savings measures, investments into the future continued with a high rate of research and development.

The Knorr-Bremse Group generated EBITDA of EUR 290.2 million in the first quarter of 2020 (previous year: EUR 333.7 million). The EBITDA margin in the first three months of 2020 remained relatively stable at 17.8% (previous year: 19.0%). The decrease is attributable to currency effects, among other factors.

In tandem with the decline in revenues, Knorr-Bremse Group EBIT decreased to EUR 224.0 million in the first three months of 2020 (previous year: EUR 274.6 million), giving an EBIT margin of 13.8% (previous year: 15.6%).

Segments

Rail Vehicle Systems (RVS) with a strong order book and solid margin despite Covid-19

The Covid-19 pandemic led to customers’ manufacturing facilities being shuttered temporarily in the first quarter of 2020, causing project delays in the business of the RVS division. Market stimulus measures announced at short notice will not take effect until later on in the fiscal year. The order intake in the first quarter of 2020 initially fell by -15.5% to EUR 874.2 million (previous year: EUR 1,035.0 million). By contrast, the order book benefited from the positive effects of particularly strong business performance in the previous quarters, rising by 6.6% to EUR 3,555.1 million in spite of the Covid-19 pandemic (previous year: EUR 3,336.1 million).

Revenues of the RVS division in the first quarter of 2020 were almost stable on the prior-year level, decreasing by –2.1% to EUR 892.2 million (previous year: EUR 911.3 million). On the whole, RVS benefited from a strong aftermarket business. The services business and the freight and locomotives business grew particularly robustly in Europe, whereas Asia recorded a declining OE business, especially in China, through a stronger metro car business. The North American freight and locomotives business turned in a weaker performance in the first quarter of 2020, while the aftermarket business recorded gratifying growth. The aftermarket business was higher than the previous year.

Exchange rate effects had a negative impact on the EBITDA of the RVS division, causing the EBITDA margin to contract slightly by -1.0% compared with the first quarter of 2019. EBITDA declined to EUR 186.1 million (previous year: EUR 199.5 million), giving an EBITDA margin of 20.9% (previous year: 21.9%).

Commercial Vehicle Systems (CVS) division outperforms the market in all regions

After several strong fiscal years in the CVS division, the expected slowdown in the commercial vehicle industry continued in the European and North American markets in the first quarter of 2020. Along with initial customer cancellations as a result of the Covid-19 pandemic this led to an order intake of the CVS division of EUR 714.7 million (previous year: EUR 859.4 million), a minus of --16.8%. The order book fell by -19.2% to EUR 1,113.2 million after a strong prior-year quarter that had been boosted by pull-forward effects (previous year: EUR 1,377.1 million).

As expected, all markets saw commercial vehicle production plummet in the first quarter of 2020, exacerbated by the incipient effects of the Covid-19 pandemic. Compared with the first quarter of 2019, the global truck production rate was down -27%. By contrast, revenues of the CVS division in the first quarter of 2020 fell only -13.0% short of the previous year, amounting to EUR 735.8 million (previous year: EUR 846.1 million). The CVS division gained market share in all regions and cushioned the sharply declining market trend with continued growth in content per vehicle. A strong aftermarket also boosted performance with a share of 29% of revenues, up from 23% in the previous year.

EBITDA fell by -23.5% to EUR 107.6 million in the first three months of 2020 (EUR 140.7 million). Thanks to a global cost-cutting program and systematically implemented measures to increase efficiency, the EBITDA margin at 14.6% was only 200 basis points lower than in the previous year (16.6%).

Capital expenditure on production and automation projects, headcount down year-onyear

In the first quarter of 2020, Knorr-Bremse invested 5.0% of its revenues in intangible assets and property, plant and equipment. This corresponds to EUR 81.0 million (previous year: EUR 62.2 million) and underscores the Group’s long-term growth and innovation priorities. In addition to the ongoing expansion of production capacity at the North American sites in Huntington and Bowling Green, investments were made especially in replacement and expansion projects for production facilities and their automation, as well as in supplier tools and IT projects. Moreover, strategic investments were made in continued software development in the steering systems business.

The number of employees as of March 31, 2020 was slightly down year-on-year 28,663 (December 31, 2019: 28,905). In some countries, Knorr-Bremse used short-time working to adjust staff capacity to the changed workload without having to lay off qualified employees.

Cash funds of EUR 2.0 billion ensure flexibility for operations

Back in March, Knorr-Bremse had announced its intention to draw on additional lines of credit in the amount of EUR 750 million. This will ensure flexibility for operations, even if the Covid- 19 pandemic escalates further and the economic slowdown accelerates. With cash funds of EUR 2.0 billion in total as of the end of the first quarter of 2020 and net debt close to zero, the Company is on a very solid financial footing.

Outlook for 2020 as a whole: below 2019

Given the spread of the Covid-19 pandemic worldwide and its effects on the global economy, it remains impossible to provide a reliable estimation of business performance for the rest of the year. For North America in particular, there is a high degree of uncertainty regarding the further economic development. The Management Board of Knorr-Bremse AG expects revenues and EBITDA in 2020 to be substantially lower than in 2019. Consequently, the EBITDA and EBIT margins are also expected to contract significantly.

Knorr-Bremse aims to minimize the effects on the Group with an extensive and consequent action program. For example, personnel and cost-cutting measures have been implemented to further stabilize revenue, building on the preparations made in 2019. These include costcutting programs in all regions that also entailed workforce reduction measures.

The current circumstances are a challenging time for many employees of the Knorr-Bremse Group with, for example, short-time work and home office. The Executive Board would like to thank all employees for their strong commitment.

The full quarterly statement is available on the website www.knorr-bremse.com.

DISCLAIMER

This publication has been independently prepared by Knorr-Bremse AG (“Knorr-Bremse”). It may contain forward-looking statements which address key issues such as strategy, future financial results, events, competitive positions and product developments. Such forward-looking statements are subject to a number of risks, uncertainties and other factors, including, but not limited to, those described in Knorr-Bremse’s disclosures. Should one or more of these risks, uncertainties or other factors materialize, or should underlying expectations not occur or shall assumptions prove incorrect, the actual results, performances or achievements of Knorr-Bremse may vary materially from those described in the relevant forward-looking statements. Such forward-looking statements may be identified by words such as “expect,” “want,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project” or words of similar meaning. Knorr-Bremse does not intend, nor does it assume any obligation, to update or revise its forward-looking statements regularly in light of developments which differ from those anticipated.

This publication may include – in the applicable financial reporting framework not clearly defined – supplemental financial measures that are or may be alternative performance measures (non-GAAPmeasures). For the assessment of the net assets, financial position and results of operations of Knorr- Bremse, these supplementary financial figures should not be used in isolation or as alternatives to the financial figures presented in the consolidated financial statements and determined in accordance with the relevant financial reporting framework. The calculation by other companies that report or describe similarly titled alternative performance measures may vary despite the use of the same or similar terminology.