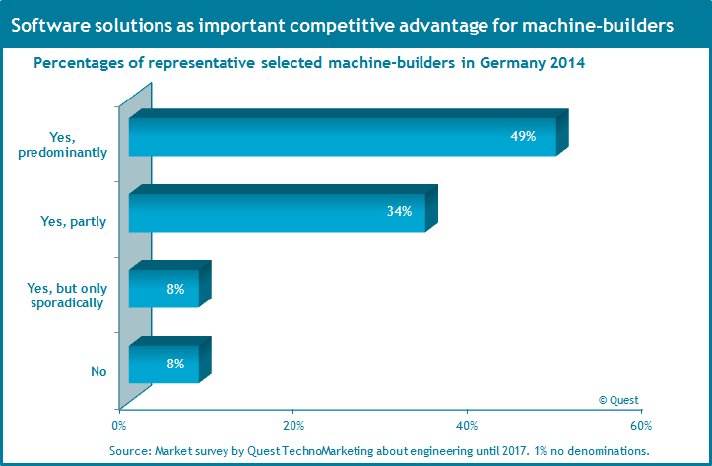

For 92% of the machine-builders software solutions at the machines act as important competitive advantage. That may not be surprising. However, the extent of this important competitive advantage is strongly differently determined.

For half of the machine-builders software solutions at the machine are mostly determining the competitive advantages. That underlines the role of the software and relates it at the same time. That is why for the other half of the machine-builders such a predominant determination of competitive advantages by software solutions is not (or not yet) given.

Also the sectors are showing a different picture. The shares of software solutions as a predominant competitive advantage range from 33% to 70%.

The new report outlines in detail the emphases machine-builders are organizing software solutions as competitive advantage. Seven priorities show up: 1. higher flexibility for both the machine-builder and the end-user, 2. operating advantages, 3. higher productivity of machines resp. increased performance, 4. advantages of the integration into existing systems or with external components, 5. higher product quality with the end-user, 6. higher availability of machines by shorter downtimes and 7. enhanced process control e.g. by more comprehensive diagnosis.

Numerous detailed alive statements of the machine-builders from the different sectors concretize these priorities.

The link to the new report is http://www.quest-trendmagazine.com/...

This report is based on the market survey “The engineering of the machine automation until 2017 in the German machinery industry". This study offers a wealth of representative trends on 136 pages, based on interviews with 23% of the machine-builders in the ten relevant sectors with 100 and more employees. Table of contents, highlight and budget of the study on http://www.quest-technomarketing.com/...