The Schüco Group employed an average of 6750 employees worldwide in 2023 (2022: 6750 employees), split as follows: 2750 people worked for Schüco outside Germany. Within Germany, there were 4000 employees (2022: 4100 employees), with 2408 of those working in the East-Westphalia-Lippe region. A total of 2068 employees (2022: 2100 employees) worked for the company at the headquarters in Bielefeld.

1. Highest number of new junior staff

Schüco places a great deal of importance on apprenticeships and further training, not just because of the lack of skilled workers and general labour shortage. The company therefore offered a range of dual work/study courses as well as technical, commercial and industrial training courses in 2023, too. Across the sites, 64 apprentices and 19 students began their careers in 2023. That is the highest number of new junior staff since the company was founded. As is traditional, the junior staff began their career at Schüco with a group induction week at the company's headquarters in Bielefeld, in order to get to know the company and to network with one another. At the end of 2023, a total of 195 junior staff (apprentices and students) were employed at Schüco worldwide.

2. Investments

The economic equity continues to be stable, with a balanced capital structure even during this challenging time. As the extensive construction work to expand the Bielefeld site was successfully completed in 2022, the investment total of €52.6 million was below the previous year (2022: €89.5 million). Part of this investment sum went towards the acquisition of a 100,000 m2 area at Gewerbepark Flugplatz Gütersloh GmbH. A new site for product supply and distribution is to be created at the north end of this former British military airfield, as the Bielefeld headquarters are not big enough to accommodate any major growth opportunities, particularly in the commercial field.

On 2 May 2023, Wertingen-based Schüco Coating Solutions GmbH & Co. KG celebrated the official start of its operations. This joint venture combines the core expertise of two companies – Kemper Oberflächentechnik GmbH & Co. KG in the field of surface finishing and Schüco International KG with aluminium profiles. As a result of increasing our production capacities in surface finishing by powder coating aluminium profiles, it has been possible to expand the service offering for southern Germany.

3. New subsidiaries

To bolster local business activities, Schüco Norway AS, Oslo and Schüco Sweden AB, Stockholm, have been established as independent Schüco subsidiaries that are fully consolidated within the Group. Both companies were already operating as branches of Schüco KG in the respective countries. As part of this expansion of regional business activities, the Regional Headquarters of Schüco International KG LLC subsidiary was established in Riyadh, Saudi Arabia. The focus of this company is the development of large commercial projects on the Arabian peninsula.

4. Shareholdings and collaborations

4.1 AWB Aluminiumwerk Berlin GmbH – sustainable aluminium profiles

AWB Aluminiumwerk Berlin GmbH has been a major supplier of aluminium profiles to Schüco International KG for many years. Schüco cemented this long-standing partnership in 2022 by acquiring a 26 percent share in the company. The two companies worked together in 2023 on strategic topics within the field of sustainability. The intention is therefore for AWB to produce billets made from standard aluminium as well as the two new grades of aluminium in future: Low Carbon (LC) and Ultra Low Carbon (ULC) aluminium with a significantly reduced carbon footprint.

5. Development of the Metal business

5.1 Development worldwide

The Metal business division (aluminium and steel) achieved a global turnover of €1770 million, placing it 2.7 percent below the previous year. (2022: €1820 million)

5.2 Sales regions outside Europe

Outside Europe, the Metal business division was almost able to reach the previous year's level with a turnover of €421 million (2022: €425 million). India was able to continue its positive growth trend this year, too, and China was able to noticeably regain momentum following the Coronavirus pandemic. South America also made good progress. There were equally positive effects driven by significant demand, particularly in Saudi Arabia, which is why Schüco has made a long-term investment in developing the market there.

5.3 Sales regions in Europe

The 2023 fiscal year – which continued to be affected by supply-chain issues worldwide, sharply increasing raw material prices, the ongoing war in Ukraine and the huge rise in energy costs and rates of inflation – presented enormous challenges for the Europe sales region this year, too, and negatively impacted the turnover achieved. Although the strong organisations in Italy and France managed to remain stable, they also had to contend with the construction crisis. Lithuania and Czechia were able to demonstrate positive developments, and the markets on the Iberian peninsula remained stable, too. The remaining regions of Benelux and the Nordic countries lagged behind expectations. The Europe sales region achieved a turnover of €649 million, putting it 8.8 percent below the previous year (2022: €712 million).

5.4 Germany sales region

High energy and material costs, rising wage bills and interest rates, labour shortages, regulatory hurdles and a lack of planning certainty have plunged the building industry in Germany into crisis. Therefore, at €556 million, turnover in the Metal business division's home market remained 7.3 percent below that of the previous year (€600 million).

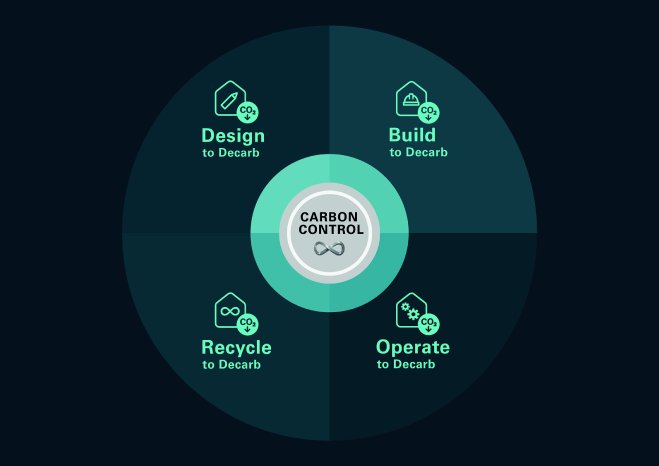

Another major challenge of our time is achieving climate neutrality in the building sector. The construction industry has the task of achieving the ambitious targets set by politicians and reducing the CO2 emissions generated during the construction, operation and dismantling of buildings to net zero. Schüco saw this as an opportunity and took on these challenges, setting itself a future-oriented course to tackle them in its role as a trailblazer. With Schüco Carbon Control, it has created a modular solution to drive forwards the decarbonisation of the real estate industry in Germany and other European countries. This solution was launched at the start of the year in Munich at BAU 2023, the world's leading exhibition for architecture, materials and systems. Carbon Control consists of individual consultations and different products and services throughout the entire lifecycle of a building, incorporating all of the responsible parties.

6. Development of the PVC-U business

The PVC business area was also unable to continue its successful increase in turnover in 2023, and was seriously affected by the major decline in orders in the residential construction market, especially in the core market of Germany. At €118 million, turnover in Germany was 18.6 percent below the previous year (2022: €145 million). In contrast, the markets in Belgium, the Netherlands, Luxembourg and Turkey were able to exceed their previous year's turnover. Globally, the PVC-U business division achieved a turnover of €345 million, which corresponds to a 17.9 percent decrease compared to the previous year (2022: €420 million).

Like the Metal division, the Weißenfels-based PVC-U division concentrated on the development of solutions for the decarbonisation of the building envelope with its process and system optimisations. The 2024 Fensterbau Frontale exhibition was set as the target for these to be launched. Profiles with a higher content of recycled material, a PVC GWP indicator and polymers made from renewable raw materials were presented to the industry there. With this further developed PVC-U portfolio, the division is expanding the modular Schüco Carbon Control range to include significant components that will ensure an improved CO2 balance, especially in the residential sector.

7. Development of Schüco Global Services KG – maintenance and servicing

On 30 May 2022, Schüco Global Services KG, Bielefeld, was entered into the commercial register. Within a year and a half, this business has developed as planned and established itself as a growth area with a turnover of €28 million in 2023. The aim of this company is to combine the After Sales area of the business with maintenance and servicing, and to expand them internationally so that the partner companies are supported with the increase in demand. This company focuses on the maintenance, repair, installation and servicing of solutions by Schüco and other well-known competitors. After all, the only way to ensure durability and value retention is through regular maintenance of the building envelope and its opening units – potentially by retrofitting sensor systems, too. Furthermore, the best way to reduce CO2 is to use an existing, functioning product for longer.

8. Product development

The development of holistic solutions for the building envelope was a focal point in 2023 as well. The emphasis here was on design-oriented and durable solutions for windows, doors and façades which feature comfort, security and flexibility. That is why, among other things, we have developed a sliding system platform with a compatible sun shading solution, fire protection for the outside area and our first ever partition wall system for internal use. The focus was also on the development of simpler and more efficient designs. This is in response to the demand for cost-effective solutions that help lower building costs. Another focus area for product development was circularity and the reduction of the carbon footprint of the building envelope. Products such as the IoF ID (Internet of Façades) and building-integrated photovoltaics, as well as different services and tools, were brought together to drive forwards sustainability in the construction industry.

9. Carbon Control – decarbonisation in the real estate industry

9.1 Ambitious targets in Europe

The aim of the “Fit for 55” package of measures within the European Union's European Green Deal is a 55% reduction in greenhouse gas emissions within the EU by 2030 compared to 1990, and for the EU to be climate neutral by 2050. The Federal Government of Germany has actually enacted a reduction of 65% by 2030 in its Climate Change Act and greenhouse gas neutrality has been enshrined by 2045. The construction and use of buildings accounts for almost 40% of global greenhouse gas emissions. Aside from the transport sector, it is therefore likely that the construction industry will face the biggest challenges.

9.2 CO2 reduction with Schüco Carbon Control

In future, the lifecycle global warming potential of a building, which is calculated by the GWP (Global Warming Potential) value, will be critical for it to retain its value in the long term. The GWP value is expressed as a CO2e value (which stands for CO2 equivalent) and results from the interaction between operational carbon emissions and embodied carbon emissions. Operational carbon emissions arise during the operation of a building, while embodied carbon emissions show how much CO2 is embodied in the products used. The conservative use of material resources, building-integrated photovoltaics, intelligent building management systems or Cradle to Cradle certified products can considerably reduce overall emissions.

In April 2023, Schüco presented Carbon Control, a modular solution that can be used to tackle the project-specific decarbonisation of windows, doors and façades. Schüco Carbon Control is organised according to the four stages in the lifecycle of a building: planning, construction, operation and dismantling. As a supplement to the service and product portfolio, it includes project-specific advice and support, and will help architects, developers and fabricators to actively minimise the carbon footprint of the building envelope.

9.3.1 Design to Decarb

The course for the subsequent CO2 balance of a building is already set as early as the design and planning stage. With a holistic approach in mind, that's why the Schüco Carbon Control range and accompanying support begins with investors, architects and specialist developers, because the shape of a building, the choice of materials and surface finishes, the unit sizes and the use of smart building technology can minimise the CO2e value as early as the planning stage. It is becoming increasingly common for investors and clients to strive for certificates such as LEED, BREAM, QNG or DGNB, which serve as proof that a building satisfies the required criteria in each case and therefore increase its value and attractiveness, while also helping to maintain this in the long term. Just like the GWP value, these building certificates take into account the entire lifecycle, which is why the later phases must also be factored in at the very beginning. Hence the ability of each individual component of a unit to be separated out is a necessary development requirement. The use of Cradle to Cradle certified Schüco aluminium systems guarantees the harmlessness and circularity of the materials.

9.3.2 Build to Decarb

During the construction phase, Schüco Carbon Control enables fabricators to actively reduce the carbon footprint of the unit they are designing. As 3D calculation software, SchüCal constantly calculates and displays the carbon footprint as a CO2e value, making it the perfect tool for precise planning. SchüCal also allows the user to select their material. In addition to standard aluminium, there are the two new grades of aluminium: Low Carbon (LC) and Ultra Low Carbon (ULC) aluminium. What's more, Schüco is continuously improving its management of sustainable packaging by setting up recycling systems and thereby conserving resources. With Build to Decarb, Schüco is ensuring the long-term competitiveness of its customers and partners while helping them to reduce their CO2 emissions.

9.3.3 Operate to Decarb

To achieve the perfect energy balance, Schüco also offers the right products and services that enable buildings to be operated in a highly efficient way with reduced CO2 emissions. Ranging from intelligent building management systems for highly thermally insulated building envelope units all the way through to the generation of energy by means of building-integrated photovoltaics, smart product solutions make a significant contribution to reducing CO2 emissions during the operating phase. With Schüco IoF ID, a tag that is fixed to the unit links the unit to its digital twin. The component can therefore be clearly identified, located and automatically linked to all the digital information and documentation related to the product. Maintenance and product upgrades can be planned and carried out efficiently. This ensures sustainable building operation in the long term and also extends the service life of the installed systems.

9.3.4 Recycle to Decarb

The reuse of materials offers huge potential for saving CO2. Cradle to Cradle certifications ensure that the construction products used in buildings will become a raw material reserve for the future. The aim of this concept is that all the materials used in the system can be recycled and reused as new material at the end of their service life. This means that Cradle to Cradle certified systems meet the requirements of the circular economy, to which so much importance has been attributed by politicians in the European Green Deal in order for climate neutrality to be achieved. When it comes to implementing the Cradle to Cradle principle in the construction sector, Schüco currently leads the way with over 75 certified aluminium systems. As a result, it is contributing to the long-term reduction of carbon emissions and conservation of resources. Schüco PVC-U products also contribute towards the circular economy and reducing CO2 emissions. This has been confirmed by the award of the VinylPlus® product label, which Schüco was the first company in its industry to receive. To create a PVC-U material cycle, Schüco is offering its partner companies in the PVC-U sector an exclusive recycling service for old windows and profile offcuts from the window industry through the company RE:CORE. As part of the BAU exhibition, Schüco made a promise to take back any Schüco products that are currently installed or that will be installed in future and to feed the materials back into the material cycle as far as possible.

10. Corporate sustainability

A key component of the overarching sustainability strategy at Schüco is the company's own climate targets. Back in 2018, the company worked together with the WWF (World Wide Fund for Nature) to set ambitious CO2e reduction targets. The climate protection targets that were formulated together were also validated by the independent organisation Science Based Targets initiative (SBTi). Schüco has launched the focus project “Emission Zero”, with the aim of achieving its net zero target throughout the entire value chain by the year 2040.

10.1 The relationship between growth and CO2e emissions

The 2021/2022 Sustainability Report that was published in September 2023 shows that the overall emissions of the Schüco Group in 2022 were 1.3 percent below the reference value of 2018. As turnover increased by over 35% during the same period compared to 2018, this demonstrates a negative correlation between turnover and CO2e emissions for the first time. The trend is moving in the right direction, motivating the company to keep working to reduce its CO2e emissions.

11. Industry campaign to tackle the shortage of skilled workers

No other trade in Germany has a tailored industry initiative with its own application portal to tackle the labour shortage. The metal construction industry does. The industry recruitment campaign, which was established by Schüco in 2021 and developed together with Studio Schober+Richter, became linked to the German Federal Employment Agency in December 2023. Since November 2023, the Bundesverband Metall (German Association of Metalworking Companies) has also been an official partner of the initiative. At the heart of the campaign is the website www.metallbaut-zukunft.com, where people can find out key facts about the metalworking industry, learn about relevant jobs and career opportunities, and look for vacancies at participating companies.

12. Review and outlook for 2024

The situation in the construction and real estate industry does not look positive for 2024 either. Investors – private and commercial – are continuing to hold back when it comes to newbuilds and renovations. The rate of renovations, which needs to increase significantly in order to achieve the climate targets, is currently decreasing. The factors described above, which were responsible for the construction crisis in 2023 (high energy and material costs, rising wage bills and interest rates, labour shortages, regulatory hurdles and a lack of planning certainty) will continue to have a negative impact on development in 2024 and slow down any improvements to the order book. Even if it seems likely that we have reached the lowest point, there are no signs of improvement in the near future. Despite this challenging situation, there are still opportunities for the construction and real estate industry, and therefore for Schüco, too. The spring report recently published by the Zentraler Immobilien Ausschuss e. V. (ZIA – German Property Federation) calculated a deficit of 600,000 residences for Germany in 2024, a number which is predicted to grow to 830,000 by 2027. The renovation of existing buildings is an important task in this context too as, without it, it will not be possible to overcome the social challenges of the housing shortage or achieve the climate targets. Globally, the building industry is undergoing a period of upheaval and everyone involved in this market will have to adapt accordingly – by means of digitalisation, sustainable product innovations and a circular economy in the construction industry.

With Carbon Control, its modular decarbonisation solution, the company has already laid the foundations for the future. This solution will enable renovations and newbuilds to become secure investments for the future that will still be able to comply with the legal requirements of 2030, 2045, 2050 and beyond. The company will also consistently pursue this direction in its business areas in 2024. With its further developed PVC-U portfolio, Schüco already expanded its modular Carbon Control range in March 2024 to ensure an improved CO2 balance, especially in the residential sector. For example, PVC-U profiles with bio-attributed PVC made from tall oil form part of the new portfolio. PVC-U made from tall oil has the same properties and material benefits as conventional PVC-U, except that its polymer matrix consists of 100 percent plant-based raw materials.