1. Introduction

It took a bit of time, but hybrid prospect generator Avrupa Minerals (TSXV:AVU)(OTC:AVPMF) and JV partner Sandfire Miniera Portugal (subsidiary of Sandfire MATSA) intercepted a substantial mineralized interval at Sesmarias, Portugal again, after the impressive high grade result from June last year: 26.95m @ 2.18% Cu, 2.58% Pb, 5,6%Zn and 88.2g/t Ag. This time the intercept was a bit lower grade but thicker, returning 41.2m @1.59% Cu, 1.71% Pb, 3.36% Zn, and 54.90 g/t Ag, unraveling piece by piece the quite complex mineralized structure, containing a lot of folding and faulting. As Sandfire Mineira Portugal is looking for >1% Cu deposits in the Iberian Pyrite Belt, this result should confirm the likewise potential of Sesmarias in my view.

The recently completed small raise of C$350k should be enough to start up drilling at one of their Finnish projects and pay the bills, so with the interest rates heading for quite a steep path downwards, the US Dollar is projected to go down too, which usually supports metal prices, and in turn should have a positive effect on juniors like Avrupa.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. The company

Avrupa Minerals is a Canadian exploration and development company focused on creating shareholder value through advancing base metal and gold projects in Europe. Their company model is a modified prospect generator model, as Avrupa is financing exploration at their Finnish projects themselves, besides exploring its flagship Alvalade project in Portugal with JV partner Sandfire/MATSA. Alvalade is located in the prospective Iberian Pyrite Belt (IPB), the largest iron/copper/zinc massive sulfide belt in the world.

The management team has industry veteran CEO Paul Kuhn at the helm, who, as a geologist, has several decades of experience ranging from exploration to production. He has been exploring for gold, silver, base metals, uranium and phosphate, and has been involved in several significant discoveries, including polymetallic, gold and copper-gold deposits in Turkey, of which the most significant ones were Tac, Corak and Cöpler (now owned by SSR Mining). Kuhn was also the CEO of the former owner of the Portuguese projects now owned by Avrupa, and came over in 2010 when Avrupa bought these projects.

Another key figure is Executive Chairman Mark Brown who founded Avrupa Minerals in 2008, as President of Pacific Opportunity Capital, his family fund which is basically an incubator for many junior mining companies. Their most successful exit was Rare Element Resources. Brown was the CFO of Miramar Mining and Eldorado Gold before he joined his father John Brown to build out Pacific Opportunity Capital. He is the largest shareholder with 10M shares (18% of O/S) and regularly supports the stock at lows.

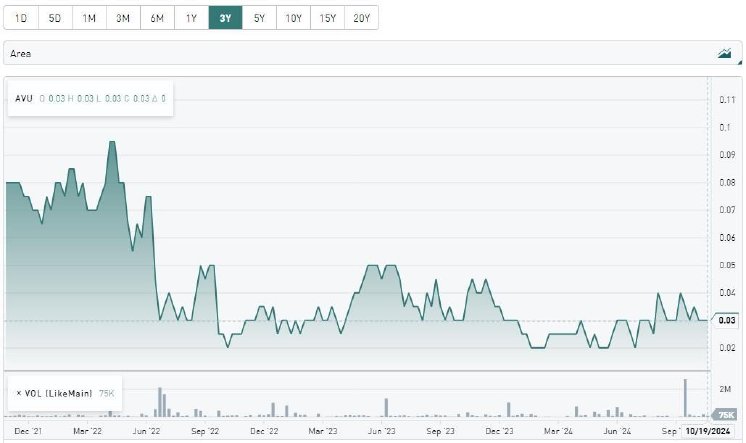

Avrupa Minerals has its main listing on the main board of the TSX Venture, where it’s trading with AVU.V as its ticker symbol. With an average volume of about 94,945 shares per day, the company’s trading pattern is fairly illiquid at the moment, and I expect this to improve when more drill results will be announced, and Sandfire/MATSA has added a second rig.

The company currently has 64.67M shares outstanding (fully diluted 92.6M). Avrupa sports a tiny market capitalization of C$2.26M based on the September 22, 2024 share price of C$0.035. The company is basically controlled by management, as 46.7% is held closely by management, Board of Directors and insiders. With the recent small financing of C$350k @ C$0.035, Avrupa will have a working capital position standing at about C$400k.

Since juniors seem to endure more negative sentiment than all other categories in mining land, this is especially true for junior explorers that didn’t have loads of drill results or even a resource, like Avrupa. With another potential bull market for metals coming up, led by gold, I view these levels as a potential buying opportunity, although I have been saying this in the not too distant past for several years, and not just for Avrupa. However, if the junior market turns, it often turns quite violently on a dime, as we have seen on several occasions (2016 and 2020).

3. The hybrid prospect generator model

Avrupa Minerals uses a hybrid prospect generator model as mentioned, after it used a pure prospect generator model since inception (2008). The business model of a prospect generator consists of buying or optioning exploration projects at an early stage or even with a historic resource, do first stages of exploration before drilling, and try to joint venture with much larger companies, usually producers, in order to have their intended drill program financed by these larger companies. There is never a free lunch, so the prospect generator usually ends up as a minority JV partner, surrendering most of the project in return. I called it a hybrid as Avrupa decided to raise money for exploring the Finnish projects themselves, as the company had to spend a certain amount of exploration dollars (in this case euro's) within a certain timeframe.

This can still be a very profitable business for a junior when advancing a project into a resource could be successful, as we have seen with for example Reservoir Minerals at Timok. Reservoir held on to an unusually big stake in Timok along the way, but in most cases the junior converts into a 10-20% minority JV partner, and/or this small stake gets converted into a royalty. If exploration programs are not providing the desired success for the majority partner, the project often returns completely to the minority partner again at no cost, as a "tested and killed" opportunity. But often this doesn't have to mean that the project is worthless, as the stakes for a major are often much higher before it moves needles for them. A junior could very well still generate a company building flagship asset out of such a drilled project, which could attract medium sized producers instead of majors with higher Tier I demands.

There are some advantages and disadvantages to the prospect generator model. In favor of this model is the spread-out risk over an entire portfolio of exploration projects, usually between 3-5 active at the same time, compared to the usual single asset juniors, which have much more binary outcomes from drill programs. The budgets are provided by the majority partners in the JVs, which prevents more dilution when raising money by the junior itself.

Avrupa management estimates that 65% of their exploration and claim holding costs since 2011 have been financed by the majority partners throughout, so they had to raise about 35% themselves, which helps the share structure meaningfully of course. Investors in prospect generators are usually long-term investors, as there is no quick buck to be made. On the other hand, there isn't as much downside like with a single asset junior as well, when a drill program on the first project doesn't indicate a future deposit.

An important disadvantage for a prospect generator is the difficulty of the valuation of the company for investors. On top of this, the junior is always dependent on the majority JV partner regarding determining drill programs, timelines, reports and continuation of the JV. The interests of the majority partner are not always aligned with the minority partner's interests as well. Sometimes the majority partner has reasons to keep drilling success or a resource or economic profitability as limited as possible, sometimes even below agreed terms on thresholds, etc., so in case of a buyout it has to pay the junior as little as possible.

Besides all this, a key aspect of good prospect generator management is the necessary ability to identify eligible projects and find majority partners for them. In other words, they have to be excellent geologists and networkers. Considering the fact that Avrupa has been able to do exploration/drilling programs consistently since 2011 with large JV partners, it seems they fit the bill just nicely in this regard.

4. Projects

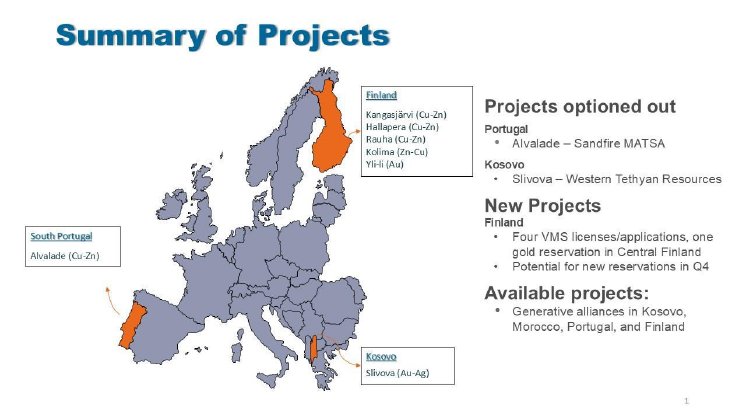

As mentioned earlier, Avrupa Minerals has a portfolio of projects in Europe, to be more specific in Finland, Portugal and Kosovo, with a focus on Finland and Portugal, so I will discuss these projects predominantly in this article.

The Slivova project in Kosovo was formerly the second flagship project of Avrupa, alongside Alvalade. Presently, Avrupa has optioned the property to Western Tethyan Resources (a 75%-owned subsidiary of Ariana Resources), who is advancing the project through feasibility stage and permitting, and has enlarged the total gold resource from 99koz to 176koz. At the moment, WTR plans to drill another 3,000m program at Slivova this year, concentrating on infill, geotechnical, and hydrogeological drilling. WTR continues with an active ESG program in the project area, and has started baseline environmental studies, as well.

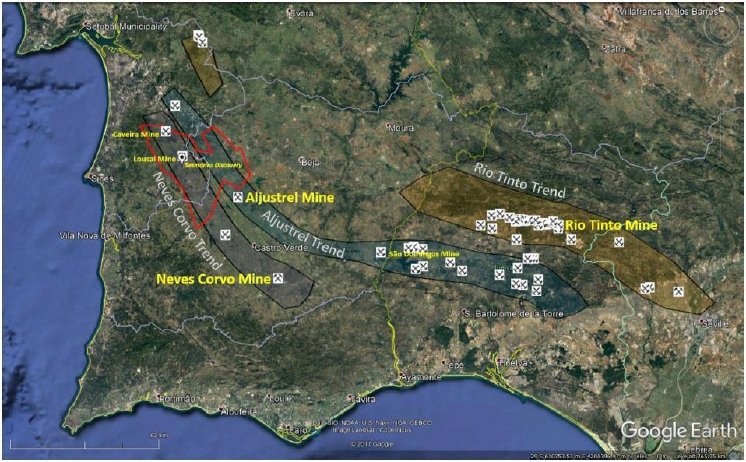

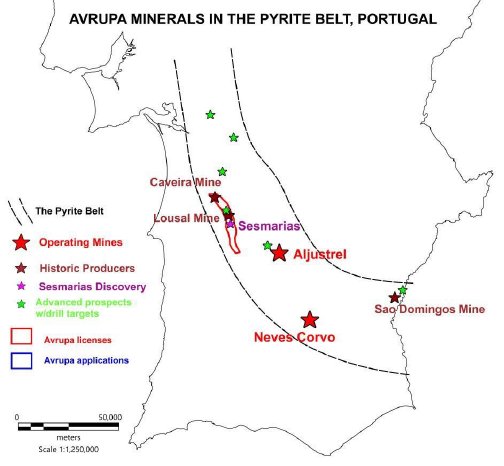

In the past, Avrupa Minerals held a large land package in Portugal, but has since whittled the amount of quality permitted exploration area down to approximately 115 km2 within the Alvalade Experimental Exploitation License (EEL). The white colored areas on the map above represent the IPB.

Prior to moving forward from an exploration permit, the Alvalade claims, are shown in red, covered both the Aljustrel Trend and Neves Corvo Trend in the northern reaches of the Pyrite Belt. However, after mandatory size reductions and granting of the Alvalade EEL, zooming in, we see the best part of the license covering prospects, including Sesmarias, along the Neves Corvo trend.

The Alvalade project consists out of two formerly producing mines, Lousal and Caveira, and two important exploration targets: Sesmarias and Monte da Bela Vista. All have seen sampling and drilling in the recent past, and the massive sulfide mineralization at Sesmarias, about 7 km away from Lousal, is the current focus of management, as it believes it might be a faulted-away extension of the nearby reclaimed Lousal mine, which, for now, is a mining museum.

This former mine produced predominantly pyrite for sulfuric acid production, and a little copper and zinc from massive sulfide ore. Historic data indicates that only 15-20Mt of mineralized material has been mined of a total estimated orebody of about 50Mt. Besides the pyrite, this deposit reportedly contains 0.7% Cu, 1.4% Zn and a bit of lead (Pb), which could point towards a possibly economic deposit of 30-35Mt according to management. The Lousal mine is situated on the Alvalade license. The museum is owned by the Lousal Foundation, and the government has provided funding and support for a remediation project there. However, this foundation is open to discussion about exploration in/around the mine area. A later phase of work might include verification and upgrade of the deposit. For now, Avrupa eventually hopes to prove up an estimated target of 20-25Mt @ 1-2%CuEq for starters. Meanwhile, the main goal for the present is to upgrade the central core zone of the Sesmarias deposit, and provide enough information to submit a proper mining license application during Q1/Q2 2025.

5. Exploration

With ongoing funding from Sandfire, for the moment Avrupa will continue to drill the central and northern zones of the Sesmarias VMS target, as the operator of the Alvalade JV. So far, Avrupa has drilled 58 holes for 25,084 meters since 2014, financing the 2018-2020 period themselves. This year, they have now completed 4 holes totaling 2473.5m, as part of a 7+2 - hole program. The assays of the first two holes returned from the lab, with the absolute highlight being hole SES24-054, intercepting 41.2m @1.59% Cu, 1.71% Pb, 3.36% Zn, and 54.90 g/t Ag from 377m depth. Management expects to have a second drill rig on site soon, which they were hoping for, for quite some time. Getting the second rig was a bit more problematic than expected, slowing down the work. Partner Sandfire is a dynamic group with a keen interest in the mineralized potential of Alvalade and a strong eye towards getting the mining license application submitted in a timely fashion prior to expiration of the license. CEO Paul Kuhn is very happy about this development, and is excited about the latest results:

“These are exciting new assay results, as we continue to develop a potential high-grade polymetallic core zone in the SES Central area. The ongoing drilling program is designed to test for further high-grade copper and zinc-lead-silver mineralization along a 600-meter strike length in the Sesmarias Central zone. Extending both north and south of SES Central, known massive sulfide mineralization totals over 1,700 meters, and is open in both directions along the strike of the targeted, mineral-host black shales in the Sesmarias synform.”

As mineralization seems to be located deep, I wondered if using directional drilling or wedges isn’t an option, as it would save a lot of time and money.

CEO Kuhn answered: “We have discussed this at various times over the course of the present joint venture, and decided to stick with the status quo for the time being. However, if we continue to hit good mineralization, then we will re-consider our strategy for the next phase of exploration at Sesmarias Central.”

Avrupa management believes the represented structure above is a continuation from the structure found at Sesmarias North.

This is an interesting graphic, developed by the Sandfire Portugal team, although it might be a tad positive about dimensions and grade zoning considering the amount of drilling in my view, it provides guidance to estimate tonnage of copper/zinc/lead/silver-bearing massive sulfide mineralization at Sesmarias. A conservative envelope of 1,700m x 150m x 20m thickness at a density of 4t/M3 generates 20.4Mt @ 1.5-2%CuEq, which is pretty decent for a starting point for Sandfire.

This wraps up the Alvalade project, let’s have a look at the 5 Finnish properties of Avrupa Minerals. This is an overview of the locations of the 5 properties, which are held by a Finnish company called Akkerman Finland Oy (AFOy), with Avrupa earning in for an eventual 100% interest.

Avrupa earned an initial 49% of AFOy in Stage One by issuing 1,470,000 common shares, paying €150,000 and depositing €200,000 into an account dedicated for first year exploration expenditures. As a Stage Two earn-in, Avrupa could acquire the remaining 51% of AFOy by issuing a further 1,530,000 common shares and depositing an additional €200,000 into the dedicated account for further exploration expenditures. Avrupa will also pay out the remaining advances of approximately €15,000 to AFOy’s parent company at this stage. However, at the time of the second earn-in, Avrupa faced a cash shortage, and elected to remain the junior partner for the time being. The exploration program remains a 49-51 partnership until further notice.

The first project is the Kangasjärvi Property. The exploration permit covers the small, but high grade Kangasjärvi zinc deposit, which was exposed to surface and mined partially in the mid-1980’s. The latest known historic resource was reported at about 300kt @ 5.4% Zn. The grade is extremely good for open pit zinc, but 300kt isn’t economic. 3 more mineral occurrences have been identified, but not followed up since.

AFOy completed an airborne SkyTEM survey over the Kangasjärvi project, and both companies have reviewed and analyzed the data together, and defined a set of drill targets. According to CEO Kuhn, the 3-hole, 1,000m, scout drill program has just commenced, and is set to target two, previously un-drilled geophysical targets delineated by the SkyTEM survey. The first target is a large EM anomaly located across a significant fault from the old workings. The second target is another large EM anomaly located several kms north of the Kangasjärvi Mine.

The second project is the 8km2 Kolima Property. Historic exploration efforts defined a 2000 x 200-400m zone with zinc mineralization, but also numerous boulders containing gold and copper are present, in typical VMS fashion and geology. A resource wasn’t defined despite 70 drill holes completed. I asked Kuhn if he could disclose more information on this project, and he stated: “Mineralization occurs in thin layers and laminations of sphalerite, which are possibly indicative of distal portions of a massive sulfide body. The mass has not yet been located. The 70 holes are not all drilled in one area, but spread around the district. No economic resource was discovered, and vectoring has not yet been defined. We have high hopes for this project and will review all the old work and see if we can find potential vectoring information. The airborne geophysics will undoubtedly help us here.” However, the permitting process has been held up by a private citizen appeal, and for the moment, while we concentrate on the Kangasjärvi work, advancement at Kolima will be on hold.

AFOy holds two other projects in the Vihanti-Pyhäsalmi District. These are Hallaperä in the Pyhäsalmi sector and Rauha in the Vihanti sector. Both projects cover known, historic massive sulfide mineralization. The Hallapera exploration permit has been issued to AFOy, and the Rauha permit is in the application process.

The Rauha deposit, a satellite showing of the Vihanti Mine, was discovered in 1985. Historic work suggests that it may be a sedex deposit, rather than a volcanogenic massive sulfide showing. Exploration work in the 1980’s indicates that the deposit is about 600 meters long, with a thickness up to 6 meters. An historic mineral resource (non – NI 43-101) comes to 1.7 mt @ 1.3% Cu, 5% Zn, 0.4 g/t Au, 53 g/t Ag

The fifth and last property is the Yli-li Gold property. The 11.5 km2 Yli-li exploration permit application covers part of the possible southern strike extension of the Oijärvi greenstone belt, major shear zone that hosts the Kylmäkangas gold deposit, presently held by Barsele Gold. The application is currently in progress.

Initial studies over a period of 13 years (2001 to 2014) turned up gold-in-till anomalies over intensely sheared and altered rocks. Limited shallow drilling resulted in one intercept of 3 g/t gold over two meters at the Kupsusselkä prospect, located within the Yli-li application area.

When originally glossing over all the projects, the first impression was one of size: all projects covered large land areas. I have learned from Zach Flood (CEO from former client Kenorland Minerals) that large land packages in prospective areas are good as you increase the odds. I did wonder, however, if this wouldn’t take up too much resources to drill, permit, sample, define targets, pay holding costs, etc. CEO Kuhn answered, “These large projects, or reservations, have been selectively whittled down to the best areas of interest, as defined by geology, airborne geophysics, historic drilling, mining, et., and applications for the actual exploration permits are then made to cover these much smaller, more manageable, higher quality target areas. Obviously, this lowers the monetary risk factors and much better defines the areas of potential success.”

Regarding Avrupa’s Finnish projects, the status of exploration work at the copper-zinc Kangasjärvi project is as follows: 3 holes for 1,000m, targeting strong, previously-undrilled geophysical anomalies. For Kolima: presently maintain on-hold status until the government-approved permit passes through the appeals process. For Hallaperä, Rauha, and Yli-li, commence data compilation, review of old drilling, possible re-sampling of selected core intervals, as funding allows.

6. Conclusion

I was hoping for robust drilling news by Avrupa at their Alvalade project, and they certainly didn’t disappoint, with the 41m @ 3.74% CuEq at Sesmarias which is pretty economic regardless of 300m+ depth, as the gross metal value would be US$330/t at hypothetical 100% recoveries. Avrupa is looking to explore the complex and folded structure at Sesmarias further, and I’m looking forward to upcoming results for the remaining 7 drill holes being released in the next few weeks/months. When they hit even bigger, this could prove to be a real game changer. On the other hand, the company is quietly starting up proceedings at Kangasjärvi to drill it themselves with some freshly raised cash, so who knows what kind of results could come out it this. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Avrupa Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.avrupaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.