Although the price of lithium, the key battery metal, has experienced a significant drop, Rio Tinto's commitment to investing in this resource indicates that the outlook may not be as bleak as it seems. At the Rincon Mine, Rio Tinto aims to build a processing facility with an annual capacity of 60,000 tons of lithium carbonate. For Rio Tinto, lithium is a cornerstone of its resource portfolio. In October, the company already reached an agreement to acquire the U.S. mining operation Arcadium Lithium. Additionally, Rio Tinto is exploring opportunities for lithium mines in Chile and Serbia. The Rincon Mine is located in the renowned South American Lithium Triangle.

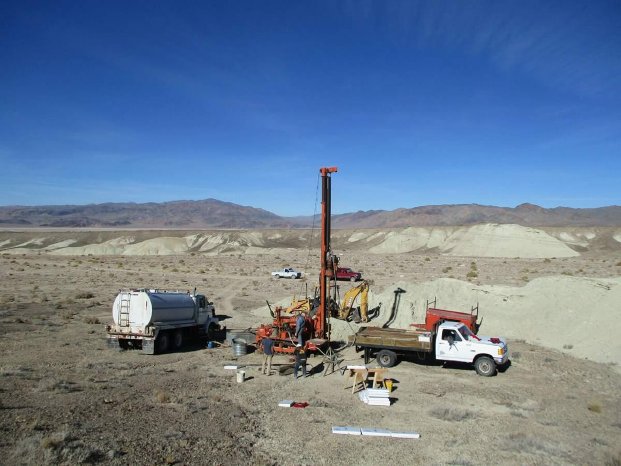

However, lithium is not exclusive to South America. In Nevada, Century Lithium - https://www.commodity-tv.com/ondemand/companies/profil/century-lithium-corp/ - is producing lithium carbonate with a purity of 99.5% at its pilot plant.

According to forecasts, the lithium market will face a surplus until around 2027. Nearly a dozen lithium producers have reduced production, delayed expansions, or even temporarily shut down mines. Yet, with global lithium demand on the rise, a tipping point could come when prices recover. When electric vehicle sales surged in 2021, lithium prices skyrocketed. A similar scenario could unfold again, potentially after 2027.

Beyond lithium, materials like cobalt and nickel are also crucial for electric mobility, energy storage, and portable devices. For rechargeable batteries, no viable substitutes for lithium and cobalt are expected in the near future. Between 2016 and 2024, cobalt prices experienced significant fluctuations. Cobalt sourced outside the problematic Congo region is likely to be particularly sought after.

In Canada, the Canada Nickel Company - https://www.commodity-tv.com/ondemand/companies/profil/canada-nickel-company-inc/ - owns cobalt and nickel resources. Its flagship Crawford project is 100% owned by the company.

For the latest company updates and press releases, visit Canada Nickel Company (- https://www.resource-capital.ch/de/unternehmen/canada-nickel-company-inc/ -) and Century Lithium (- https://www.resource-capital.ch/de/unternehmen/century-lithium-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/