Seasonal conditions can reveal trends for investors and help to identify good months for investments.

Historical data can be used to explore the seasonality of silver. Looking at the last 52 years, a strong upward trend can be observed from January to March. Around June, the silver price is then generally in a weak phase. From July to September, a price recovery sets in, while from October to December the price is usually relatively stable, i.e. it looks like a consolidation. Peaks are therefore usually in March and September.

The picture is similar from 1986 to 2016. Again, the price is high from January to March, probably because industrial and investment sectors ensure increased demand. This is followed by a decline in the middle of the year and then a lack of a constant pattern in the second half of the year. What was the situation from 2005 to 2024? January and October were again the strong silver months. February, May and July show more mixed results compared to the previously discussed time intervals. Currency fluctuations, geopolitical events and the publication of economic data all had an impact. A comparison of these time intervals with the period from 2020 to 2024 shows that April, October and December have been very good months for the silver price in recent years.

February, June and September were less positive. Overall, long-term historical data should be considered together with current trends, as there are changes in the performance of the silver price. Investors need to be adaptable, with global economic conditions, monetary tensions and industrial demand also having an impact. Particular attention could be paid to the coming April. As the price of the precious metal could then rise significantly. MAG Silver and Endeavour Silver are taking care of silver.

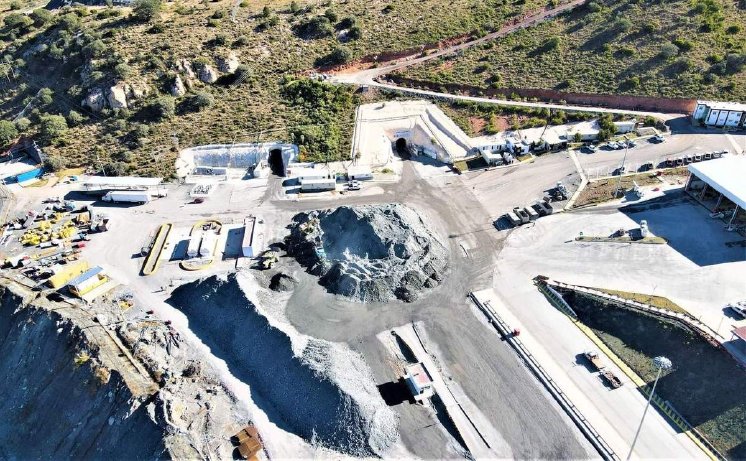

MAG Silver - https://www.commodity-tv.com/ondemand/companies/profil/mag-silver-corp/ - holds a 44 percent stake in the successful Juanicipio silver mine in Mexico and a 56 percent stake in Fresnillo. The processing rates and exceptional ore grades speak for themselves.

Endeavour Silver - https://www.commodity-tv.com/ondemand/companies/profil/endeavour-silver-corp/ - is a successful mid-tier silver producer with silver projects in Mexico, Nevada and Chile.

Current company information and press releases from MAG Silver (- https://www.resource-capital.ch/en/companies/mag-silver-corp/ -) and Endeavour Silver (- https://www.resource-capital.ch/en/companies/endeavour-silver-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/