The tin market is dominated by the Asia-Pacific region. Australia is the leader in lithium. The automotive industry in particular needs tin. Automotive applications that require tin include fuel tanks, cables, radiators, seams, screws, nuts, sealing materials and bolts. China ranks first in the automotive market in terms of vehicle production and annual sales. And the country is one of the largest consumers and producers of tin.

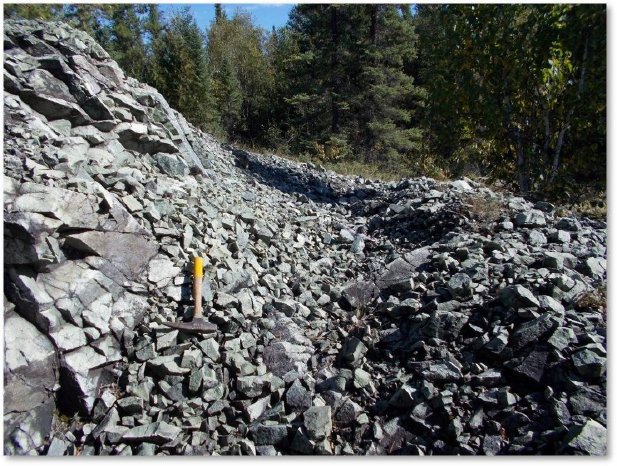

Tin is used on printed circuit boards as a connecting element during soldering, making it indispensable for the electrical and electronics industry as well as for the packaging and heavy engineering industries. Due to digitalization and growing information and communication technologies, the demand for tin is also growing worldwide, as semiconductors are increasingly in demand. TinOne Resources - https://www.commodity-tv.com/ondemand/companies/profil/tinone-resources-inc/ - has tin/tungsten and lithium projects in Tasmania and New South Wales, Australia. In Tasmania in particular, the company controls some of the most important tin areas.

As climate change, electromobility and electricity storage become increasingly important, the automotive sector, among others, is not only increasing demand for tin, but also for lithium. Lithium, the white gold, is contained in lithium-ion batteries, which are conquering our world in more and more areas. Although the price of lithium has fallen, global demand is rising and the current low price environment should ensure an upturn in lithium demand.

Even if a renewed boom is perhaps not as strong as it was in 2022, solid lithium companies should then benefit. One such company would be Green Bridge Metals - https://www.commodity-tv.com/ondemand/companies/profil/green-bridge-metals-corp/ -. Its projects in Ontario and Manitoba contain battery metals such as nickel, copper and platinum metals.

Current company information and press releases from Green Bridge Metals (- https://www.resource-capital.ch/de/unternehmen/green-bridge-metals-corp/ -).

In accordance with §34 WpHG, I would like to point out that partners, authors and employees may hold shares in the companies mentioned and that there is therefore a possible conflict of interest. No guarantee for the translation into German. Only the English version of this news is valid.

Disclaimer: The information provided does not constitute a recommendation or advice. The risks involved in securities trading are expressly pointed out. No liability can be accepted for damages arising from the use of this blog. I would like to point out that shares and in particular warrant investments are always associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the correctness of all content. Despite the utmost care, I expressly reserve the right to make errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but in no way claims to be accurate or complete. Due to court rulings, the contents of linked external pages are also to be answered for (e.g. Hamburg Regional Court, in the ruling of May 12, 1998 - 312 O 85/98), as long as no explicit dissociation from these is made. Despite careful control of the content, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/....