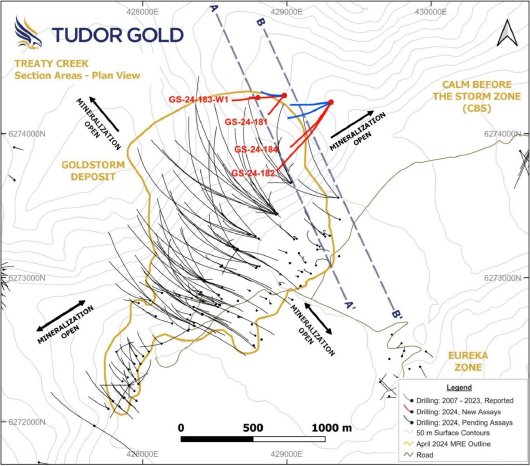

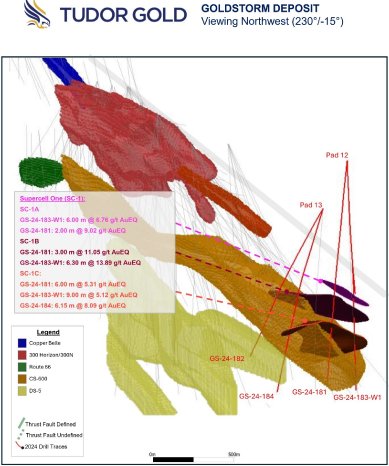

The first four drill-holes reported in this release specifically targeted the Supercell-One Zone (SC-1) which was identified earlier this year as representing a significant potential economic target within and expanding beyond the CS-600 Domain (see press releases dated February 1 and May 9, 2024). The results from the recent drilling strongly confirm this new discovery, characterizing a high-grade gold system that falls within an area that currently measures up to 800 m in length by 400 m in depth, with three sub-parallel structures that remain open in all directions and to depth.

Click the following links to:

- watch a video of President & CEO, Ken Konkin’s interpretation of SC-1 Zone;

- view the 3D modeling of the Goldstorm Deposit and SC-1 Zone: https://vrify.com/decks/16581

- view a plan map and cross sections of the drill results reported below.

Hole GS-24-181 intersected 3 separate high-grade intervals of the Supercell System

- SC-1A; 9.02 g/t AuEQ over 2.00 m (8.97 g/t Au, 3.73 g/t Ag, 0.01% Cu); and

- SC-1B; 11.05 g/t AuEQ over 3.00 m (8.28 g/t Au, 126.50 g/t Ag, 1.21% Cu); and

- SC-1C; 5.31 g/t AuEQ over 6.00 m (5.02 g/t Au, 3.32 g/t Ag, 0.21% Cu)

- SC-1A; 6.76 g/t AuEQ over 6.00m (6.44 g/t Au, 26.62 g/t Ag, 0.04% Cu); and

- SC-1B; 89 g/t AuEQ over 6.30m (4.25 g/t Au, 224.59 g/t Ag, 5.96% Cu); and

- SC-1C; 5.12 g/t AuEQ over 9.00m (5.08 g/t Au, 1.24 g/t Ag, 0.02% Cu)

- SC-1C; 8.09 g/t AuEQ over 6.15m (5.44 g/t Au, 63.77 g/t Ag, 1.62% Cu) within a wider structure of 54 g/t AuEQ over 19.65m (1.96 g/t Au, 39.05 g/t Ag, 0.96% Cu)

GS-23-176-W1:

- SC-1C; 15.64 g/t AuEQ over 15.00 m (14.89 g/t Au, 4.72 g/t Ag, 0.60% Cu)

- SC-1C; 9.96 g/t AuEQ over 25.50 m (9.66 g/t Au, 1.23 g/t Ag, 0.24% Cu); including 20.86 g/t AuEQ over 4.50 m (20.61 g/t Au, 1.50 g/t Ag, 0.20% Cu)

- SC-1C; 10.07 g/t AuEQ over 12.00 m (9.78 g/t Au, 1.35 g/t Ag, 0.23% Cu)

Equally impressive, a second drill hole, GS-24-183-W1, also intersected high-grade gold and silver values in three, sub-parallel, hydrothermal, quartz-stringer stockwork limbs. SC-1B had the best grades of 13.89 g/t AuEQ over 6.30 m (4.25 g/t Au, 224.59 g/t Ag, 5.96% Cu). This was a unique intercept due to the strength of the silver and copper mineralization. This may represent a semi-massive sulphide component, or pulse, to the Supercell-One system. We have witnessed this association in the earlier years of exploration of the Goldstorm Deposit within similar structures. We are now examining historical intercepts that contain gold values of greater than 4.0 g/t gold to assess the potential that these Supercell structures may be originating from within the CS-600 Domain and extending outwards from that Domain as a late-stage event. Our latest interpretation is that the Supercell-One system is a set of sub-parallel composite-lode breccia stockworks that trend obliquely to the Goldstorm Deposit rather than simply a singular parallel breccia system that occurs adjacent to the upper contact of the CS-600 Domain, as previously thought. An enormous amount of economic potential exists for expanding the size of the known three Supercell structures, as well as the possible discovery of additional gold-silver-copper structures within the Goldstorm Deposit and peripheral to it. Among our highest priorities is the outlining of two to three million ounces of high-grade gold within the Supercell-One complex; this would be a major pivotal point for the Treaty Creek Project.

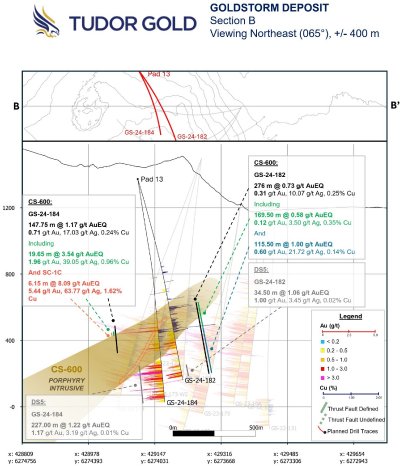

Additionally important has been the expansion, and conversion to Indicated category, of the higher AuEq grades within the Inferred category of CS-600 and DS5 Domains, which stands at 6.03 million ounces of 1.25 g/t AuEq. The step-out drilling in 2024 has been very successful in continued expansion of both of these domains, with impressive results from GS-24-184 including 147.75 m grading 1.17 g/t AuEQ (0.71 g/t Au, 17.03 g/t Ag, 0.24% Cu) from the CS-600 Domain and 227.00 m of 1.22 g/t AuEQ (1.17 g/t Au, 3.19 g/t Ag, 0.01% Cu) from the DS5 Domain. Drilling continues at a very fast pace at Treaty Creek and we look forward to providing more updates on the results as they become available.”

Drilling Discussion

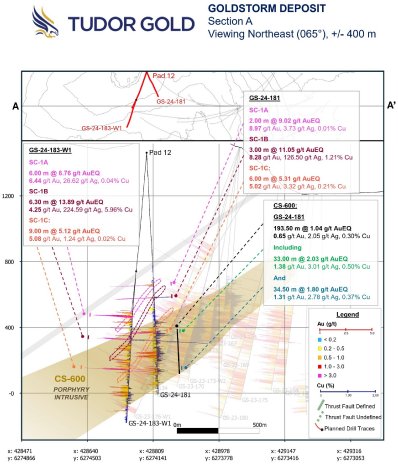

Section A

- GS-24-181: This hole was drilled to step out 150 m from previously drilled SC-1 mineralization, as well as infilling CS-600 mineralization at depth. The hole intersected visible gold within an interval of 00 m grading 9.02 g/t AuEQ (8.97 g/t Au, 3.73 g/t Ag, 0.01% Cu), as well as 3.00 m grading 11.05 g/t AuEQ (8.28 g/t Au, 126.50 g/t Ag, 1.21% Cu) as part of a network of subparallel brecciated SC-1 complex structures. The hole intersected a CS-600 intercept of 270.00 m grading 0.95 AuEQ (0.61 g/t Au, 2.28 g/t Ag, 0.26% Cu). The upper portions of this CS-600 intercept contained an additional SC-1 sub-structure of 6.00 m grading 5.31 g/t AuEQ (5.02 g/t Au, 3.32 g/t Ag, 0.21% Cu).

- GS-24-183-W1: This hole successfully intersected similar SC-1 structures along trend, 200-300m down dip of GS-24-181 including 00 m grading 6.76 g/t AuEQ (6.44 g/t Au, 26.62 g/t Ag, 0.04% Cu) and 6.30 m grading 13.89 g/t AuEQ (4.25 g/t Au, 224.59 g/t Ag, 5.96% Cu). Additionally, a third SC-1 intercept occurs slightly up-dip of the CS-600 Domain with 9.00 m grading 5.12 g/t AuEQ (5.08 g/t Au, 1.24 g/t Ag, 0.02% Cu), followed by a CS-600 intercept of 90 m grading 0.81 g/t AuEQ (0.58 g/t Au, 3.48 g/t Ag, 0.15% Cu).

- GS-24-182: This hole was drilled to increase the drilling density in the CS-600 and DS5 Domains where the current Mineral Resource Estimate is categorized as Inferred mineral resources. The hole intersected mineralization associated with the CS-600 Domain that consisted of 00 m grading 0.73 g/t AuEQ (0.31 g/t Au, 10.07 g/t Ag and 0.25% Cu) and DS5 Domain mineralization of 34.50 m of 1.06 g/t AuEQ (1.00 g/t Au, 3.45 g/t Ag and 0.02 % Cu).

- GS-24-184: This hole was targeted to achieve a 150 m eastward step out to the CS-600 Domain and a 200 m eastward step out on the DS-5 Domain. The upper contact of the CS-600 Domain contained an enriched portion interpreted as an additional SC-1 intercept of 15 m of 8.09 g/t AuEQ (5.44 g/t Au, 63.77 g/t Ag, 1.62% Cu) within a wider structure of 19.65 m grading 3.54 g/t AuEQ (1.96 g/t Au, 39.05 g/t Ag, 0.96% Cu), contributing to a complete CS-600 intercept of 147.75 m grading 1.17 g/t AuEQ (0.71 g/t Au, 17.03 g/t Ag, 0.24% Cu). An underlying DS5 Domain interval of 227.00 m of 1.22 g/t AuEQ (1.17 g/t Au, 3.19 g/t Ag, 0.01% Cu) contained an enriched portion of 12.00 m grading 4.20 g/t AuEQ (4.13 g/t Au, 3.46 g/t Ag, 0.03% Cu).

The Qualified Person for this news release for the purposes of National Instrument 43-101 is the Company’s President and CEO, Ken Konkin, P.Geo. He has read and approved the scientific and technical information that forms the basis for the disclosure contained in this news release.

QA/QC

Diamond drill core samples were prepared at MSA Labs’ Preparation Laboratory in Terrace, BC and assayed at MSA Labs’ Geochemical Laboratory in Langley, BC. Analytical accuracy and precision are monitored by the submission of blanks, certified standards and duplicate samples inserted at regular intervals into the sample stream by Tudor Gold personnel. MSA Laboratories quality system complies with the requirements for the International Standards ISO 17025 and ISO 9001. MSA Labs is independent of the Company.

About Treaty Creek

The Treaty Creek Project hosts the Goldstorm Deposit, comprising a large gold-copper porphyry system, as well as several other mineralized zones. As disclosed in the “NI-43-101 Technical Report for the Treaty Creek Project”, dated April 5, 2024 prepared by Garth Kirkham Geosystems and JDS Energy & Mining Inc., the Goldstorm Deposit has an Indicated Mineral Resource of 27.87 million ounces (Moz) of AuEQ grading 1.19 g/t AuEQ (21.66 Moz gold grading 0.92 g/t, 2.87 billion pounds (Blbs) copper grading 0.18%, 128.73 Moz silver grading 5.48 g/t) and an Inferred Mineral Resource of 6.03 Moz of AuEQ grading 1.25 g/t AuEQ (4.88 Moz gold grading 1.01 g/t, 503.2 Mlb copper grading 0.15%, 28.97 Moz silver grading 6.02 g/t), with a pit constrained cut-off of 0.7 g/t AuEQ and an underground cut-off of 0.75 g/t AuEQ. The Goldstorm Deposit has been categorized into three dominant mineral domains and several smaller mineral domains. The CS-600 Domain largely consists of nested pulses of diorite intrusive stocks and hosts the majority of the copper mineralization within the Goldstorm Deposit. CS-600 has an Indicated Mineral Resource of 15.65 Moz AuEQ grading 1.22 g/t AuEQ (9.99 Moz gold grading 0.78 g/t, 2.73 Blbs copper grading 0.31%, 73.47 Moz silver grading 5.71 g/t) and an Inferred Mineral Resource of 2.86 Moz AuEQ grading 1.20 g/t AuEQ (1.87 Moz gold grading 0.79 g/t, 475.6 Mlb copper grading 0.29%, 13.4 Moz silver grading 5.63 g/t). The Goldstorm Deposit remains open in all directions and requires further exploration drilling to determine the size and extent of the Deposit.

About Tudor Gold

TUDOR GOLD CORP. is a precious and base metals exploration and development company with claims in British Columbia’s Golden Triangle (Canada), an area that hosts producing and past-producing mines and several large deposits that are approaching potential development. The 17,913 hectare Treaty Creek project (in which TUDOR GOLD has a 60% interest) borders Seabridge Gold Inc.’s KSM property to the southwest and borders Newmont Corporation’s Brucejack property to the southeast.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including the completion and anticipated results of planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the Company’s planned exploration activities will be completed in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s plans or expectations include risks relating to the actual results of current exploration activities, fluctuating gold prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.