Gerard Bond, President & CEO of OceanaGold said, “Our 2022 drill programs delivered strong results, supporting our focus on creating value through near-mine resource conversion and growth. At Wharekirauponga, conversion drilling continues to define outstanding intercepts within the high-grade East Graben Vein Zone. Notably, our drilling to date has defined only a portion of the East Graben Vein Zone which remains open in multiple directions and, with two parallel veins having seen limited follow-up drilling, highlights the tremendous upside potential of this outstanding deposit. Haile exploration focused on conversion and expansion of the resource at Palomino, with the objective of enabling resource growth and profitable mine life extension. At Didipio, the discovery of two new mineralized structures outside of the existing resource represents potential upside to our current mine plan and will be a key focus area for the exploration program in 2023.”

Highlights from the Company’s 2022 resource conversion and growth programs are summarized below.

Waihi, Wharekirauponga resource conversion drilling (estimated true width):

- 4 g/t Au and 133.0 g/t Ag over 12.9 m from 448.7 m, East Graben (“EG”) Vein, (WKP109)

- 8 g/t Au and 136.2 g/t Ag over 11.8 m from 445.7 m, EG Vein Zone, (WKP115)

- 4 g/t Au and 97.8 g/t Ag over 9.8 m from 488.8 m, EG Vein, (WKP107A)

- 7 g/t Au and 38.4 g/t Ag over 10.5 m from 405.3 m, EG Hanging Wall Splay, (WKP112)

- 9 g/t Au and 42.9 g/t Ag over 5.2 m from 354 m, EG Hanging Wall Splay (WKP116)

- 83 g/t Au over 100.6 m from 410.2 m (DDH1121)

- 43 g/t Au over 73.2 m from 395.1 m (DDH1142)

- 46 g/t Au over 83.1 m from 349.2 m (DDH1119)

- 60 g/t Au over 61.7 m from 421.5 m (DDH1125)

- 90 g/t AuEq (0.87 g/t Au and 0.74% Cu) over 54.3 m from 4.7 m (RDUG449)

- 83 g/t AuEq (1.27 g/t Au and 1.12% Cu) over 40.4 m from 3.6 m (RDUG450)

- 74 g/t AuEq (1.91 g/t Au and 1.32% Cu) over 30.0 m from 4.0 m (RDUG453)

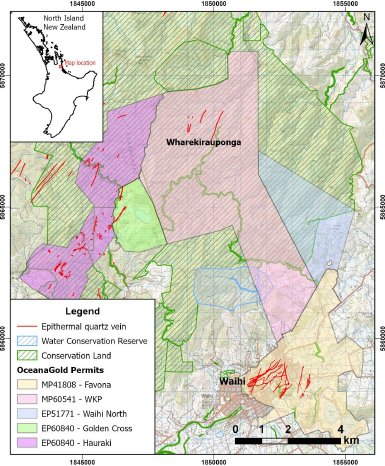

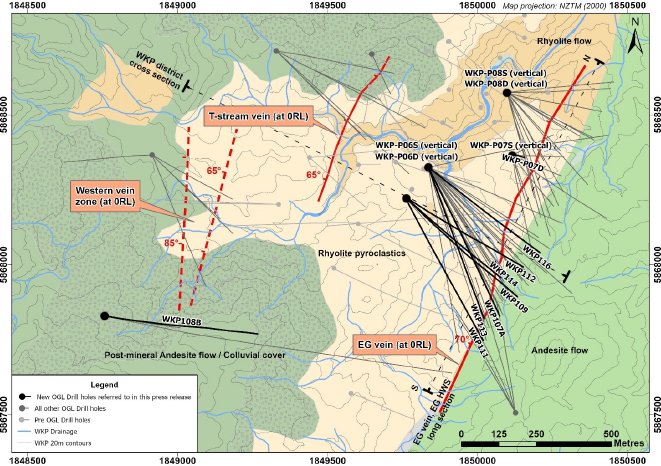

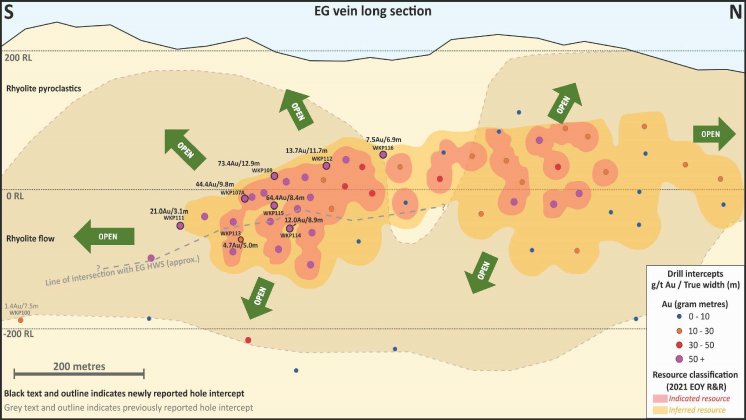

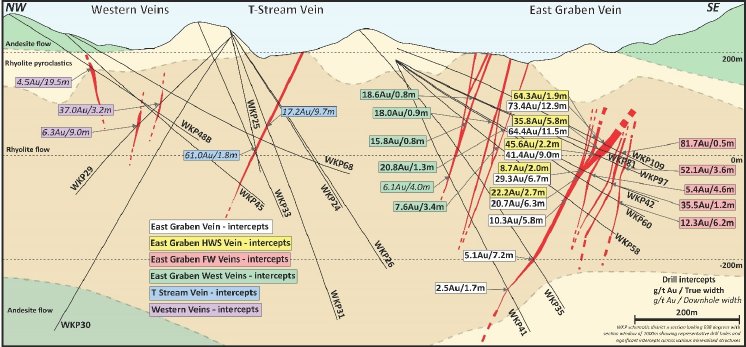

The Wharekirauponga low sulphidation epithermal Au-Ag vein system is located approximately 10 kilometres to the north of the Company’s Waihi Gold Mine. Wharekirauponga hosts an existing Indicated Resource of 1.5 million tonnes grading 13.5 grams per tonne gold (“g/t Au”) and 26.6 grams per tonne silver (“g/t Ag”) for 0.64 million ounces of gold and 1.26 million ounces of silver within the East Graben Vein (“EG”). Inferred Resources total 2.3 million tonnes at a grade of 9.4 g/t Au and 21.8 g/t Ag for 0.70 million ounces of gold and 1.62 million ounces of silver, with more than 80% of the Inferred Resource contained within the EG and two high-grade footwall veins (collectively, the “EG Vein Zone”) (see R & R Annual Statement, March 31, 2022).

Since the March 2022 mineral resource estimate, 5,829 meters (“m”) has been drilled at Wharekirauponga, predominantly on resource conversion of the EG Vein Zone, in addition to a further 679 m supporting geohydrological and geotechnical studies. Results are in-line with expectations and are anticipated to increase confidence in the geological and grade continuity of the deposit. Best intersections from the EG Vein include:

- 4 g/t Au and 133.0 g/t Ag over 12.9 m from 448.7 m, EG Vein, (WKP109)

- 8 g/t Au and 136.2 g/t Ag over 11.8 m from 445.7 m, EG Vein Zone, (WKP115)

- 4 g/t Au and 97.8 g/t Ag over 9.8 m from 488.8 m, EG Vein, (WKP107A)

- 7 g/t Au and 38.4 g/t Ag over 10.5 m from 405.3 m, EG Hanging Wall Splay, (WKP112)

- 9 g/t Au and 42.9 g/t Ag over 5.2 m from 354 m, EG Hanging Wall Splay (WKP116)

The EG Vein Zone remains the primary, near-term target for drilling with a focus on resource conversion and growth. The southern shoot of the EG and hanging wall splay is currently defined by multiple high-grade intercepts with opportunities for both up and down-dip and along strike extension. Step-out drilling in hole WKP100 (previously released) has also confirmed the EG continues along strike ~200 m to the southwest. This along strike opportunity provides up-dip potential within the currently recognised window of mineralisation within the favourable host rhyolite flow. The EG Vein Zone also remains open both to the southwest and northeast of the currently defined 1,200 m strike length. Additionally, the T-Stream and Western veins have historic intersections (See November 7, 2019 news release) that remain a focus for future drilling to understand their potential within the larger Wharekirauponga epithermal system.

Wharekirauponga is part of the Waihi North Project, which has the potential to create significant socio-economic contributions for the communities in the Coromandel region and for New Zealand. This includes significant in-country investments and a substantial increase to direct and indirect employment opportunities. We are envisaging the development of a mine that aligns well with the Company’s commitment to reducing its carbon footprint. OceanaGold operates to the highest environmental and social standards which has enabled it to run a successful and responsible mining business in New Zealand for over three decades. The Company has lodged a resource consent application for its proposed Waihi North Project with Hauraki District Council and Waikato Regional Council, and public consultation is expected next year.

For maps and sections see Figures 1-4 and Table 1 for full results.

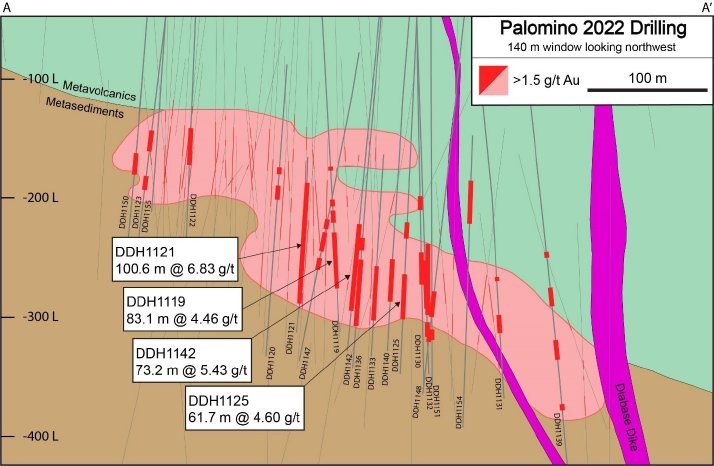

Haile 2022 Palomino Drill Program

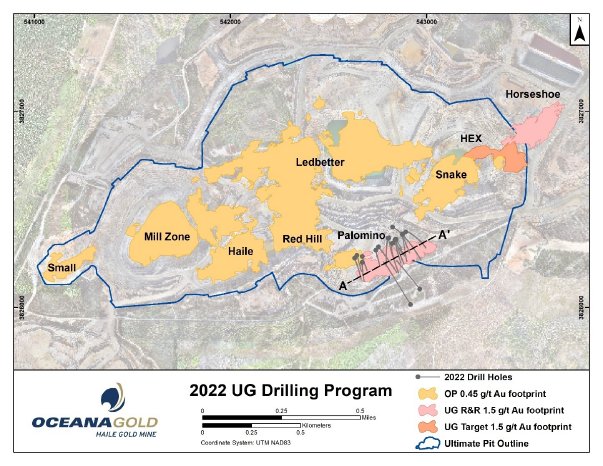

At Haile, the Company has defined a pipeline of underground, sediment hosted gold, exploration opportunities including Horseshoe, Horseshoe Extension and Palomino, all of which occupy similar structural settings across a strike length of 800 m. This pipeline of exploration targets is now in various stages of development from Reserves and current underground development (Horseshoe), Indicated and Inferred Resources (Palomino), and resource definition (Horseshoe Extension).

Based on the 2021 program consisting of 7,046 m in 16 holes, a Palomino resource was reported in March 2022 with an Indicated Resource of 2.3 million tonnes grading 2.79 g/t Au for 0.20 million ounces of gold and an Inferred Resource of 3.6 million tonnes at a grade of 2.3 g/t Au for 0.26 million ounces of gold[1] (see R & R Annual Statement, March 31,2022).

In 2022, a further 9,977 m in 20 holes having been completed with a focus on converting the remaining Inferred resource to Indicated in support of an internal economic analysis and an updated resource estimate, the later expected to be released on March 31, 2023.

The latest program of resource conversion drilling has returned intercepts that have improved confidence in grade distribution and continuity of mineralisation and in general support the block model. Best intersections include:

- 83 g/t Au over 100.6 m from 410.2 m (DDH1121)

- 43 g/t Au over 73.2 m from 395.1 m (DDH1142)

- 46 g/t Au over 83.1 m from 349.2 m (DDH1119)

- 60 g/t Au over 61.7 m from 421.5 m (DDH1125)

For plan view and long section see Figure 5 and 6 and Table 2 for full results.

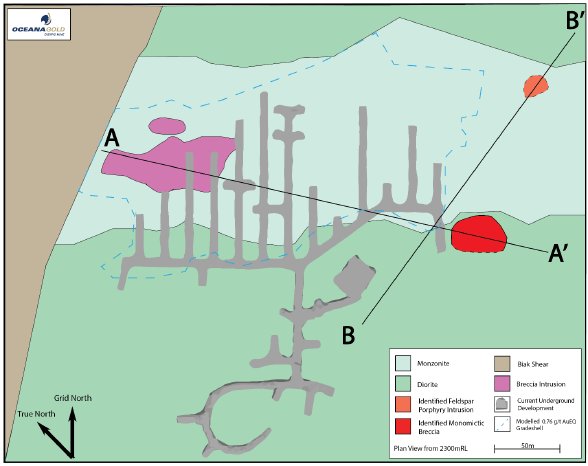

Didipio 2022 Drill Program

At Didipio, mining of the alkalic porphyry copper-gold system commenced in 2013 and hosts a 2P Reserve of 42.2 Mt @ 0.91 g/t Au and 0.35% Cu for 1.23 Moz gold and 0.15 Mt copper, a Measured and Indicated resource of 47.8 Mt @ 0.92 g/t Au and 0.36% Cu for 1.41 Moz gold and 0.17 Mt copper, and an Inferred resource of 15 Mt @ 0.9 g/t Au and 0.3% Cu for 0.4 Moz gold and 0.04 Mt copper (see R & R Annual Statement, March 31, 2022).

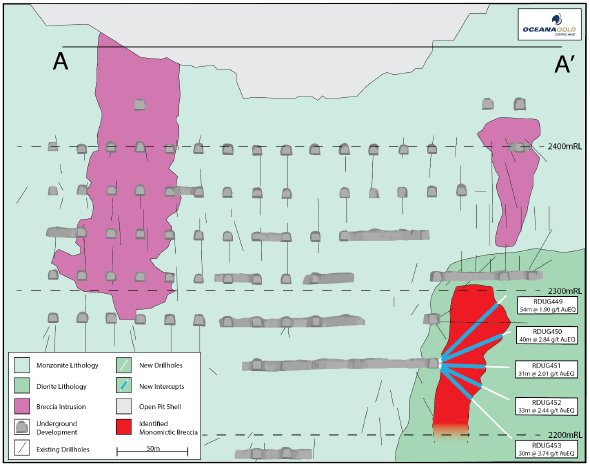

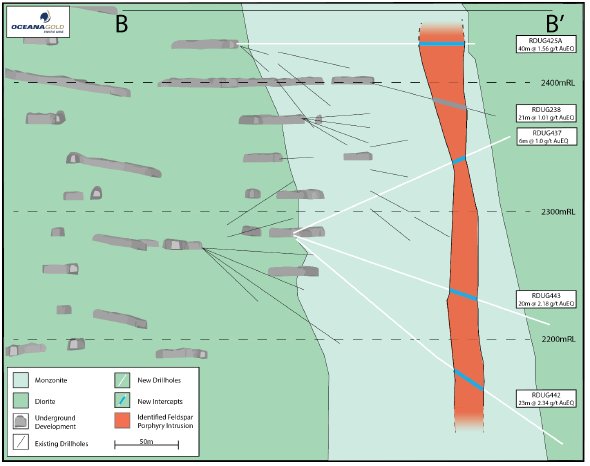

Immediately outside the known extents of underground copper-gold mineralisation and within 200 m of existing mine development, five high-potential copper-gold targets have been identified. Initial drilling of the first of five targets included 3,852 m and has returned positive results with two previously unknown zones of mineralisation being intersected; a copper-gold mineralised Feldspar Porphyry intersected in four holes at the northeast end of the mine and a cemented Monomictic (Eastern) Breccia in five holes. The plan view extent of the Feldspar Porphyry has been largely defined between 2,200 and 2,400 mRL and the Eastern Breccia between 2,200 and 2,300 mRL. However, mineralisation remains open vertically. Further drilling is being prioritised and is required to better define these targets and understand their full potential, however early results are very encouraging.

Significant intercepts from the Eastern Breccia include:

- 90 g/t AuEq (0.87 g/t Au and 0.74% Cu) over 54.3 m from 4.7 m (RDUG449)

- 83 g/t AuEq (1.27 g/t Au and 1.12% Cu) over 40.4 m from 3.6 m (RDUG450)

- 74 g/t AuEq (1.91 g/t Au and 1.32% Cu) over 30.0 m from 4.0 m (RDUG453)

- 33 g/t AuEq (1.44 g/t Au and 0.64% Cu) over 23 m from 166.0 m (RDUG442)

- 18 g/t AuEq (1.37 g/t Au and 0.58% Cu) over 20 m from 130.0 m (RDUG443)

Although mine development had not recognised depth extensions of the Eastern Breccia, the source of the breccia remained in question. Drilling from the 250 m level was therefore undertaken and immediately intercepted a copper-gold mineralised quartz-breccia up to 48 m wide with a current vertical extent of 75 m consisting primarily of quartz clasts cemented by chalcopyrite and bornite. Drilling continues to better define the geometry of the structure, that remains open at depth, and grade continuity.

For maps and sections see Figure 7, 8, 9 and Table 3 for full results.

QA/QC at Wharekirauponga, Waihi Gold Mine

All exploration samples are assayed for gold by 30g fire assay with AAS finish. Holes WKP40-45 had core samples shipped for sample preparation to SGS in Westport (New Zealand). Prepared pulps were then shipped to independent Australian Laboratory Services Pty Ltd (ALS) in Brisbane, accredited to ISO/NATA 17025 for gold analysis by fire assay and 4-acid digest, and 42 element ICP geochemical analysis. Holes drilled after WKP45 (i.e., WKP46 to WKP116) were prepared and analyzed at SGS Waihi NZ Ltd (Au by 30g fire assay and Ag by aqua regia digest and 0.3gm AAS finish). Selected pulps are periodically sent to ALS in Brisbane for a 4-acid digestion and 42 or 48 element ICP geochemical analysis.

Quality of exploration assay results has been monitored in the following areas:

- Sample preparation at the SGS Waihi and Westport labs through sieving of jaw crush and pulp products.

- Monitoring of assay precision through routine generation of duplicate samples from a second split of the jaw crush and calculation of the fundamental error.

- Monitoring of accuracy of the primary SGS assay and ALS results through insertion Certified Reference Materials (CRM’s) and blanks into sample batches.

- Sample intervals where visible electrum is logged are followed up by a subsequent screen fire assay after the routine 30g fire assay.

QA/QC at Palomino, Haile Gold Mine

Since July 2017 all Haile core samples have been prepared at the ALS lab in Tucson, Arizona, and analysed at the ALS lab in Reno, NV. Samples are pulverized from a 450g sample to 85% passing 75 mesh. Approximately 225g of pulp sample is used for fire assay. Assays are based on a 30g fire assay aliquot for gold with Atomic Absorption finish <3 g/t Au and gravity finish >3g/t Au. Some holes are composited and analysed for carbon, sulphur and multi-elements using LECO and ICP-OES methods. ALS labs used for Haile OceanaGold samples are ISO 17025 certified.

Blanks and standards are inserted every 20th sample. Check assays are submitted to the SGS lab in Kershaw, SC for 5% of the intervals each quarter. Assays are duplicated for >95% of the samples within 5% of their original assay. ALS samples show no evidence of contamination or instrument drift. Precision and accuracy of CRMs compared to expected values have been consistently with 5% RSD and often within 3%. Graphs showing expected values and two standards of deviation have been produced and evaluated. Barren marble and sand are inserted as blanks every 20th sample. Certified reference materials from Rock-Labs are inserted every 20th sample. All blanks and CRMs are handled by the Geotech Supervisor and are stored in the locked OceanaGold office.

All drill hole samples are handled and transported from the drill rigs to the secured Haile Exploration warehouse by OceanaGold personnel. Access to the property is controlled by locked doors and cameras monitored by OceanaGold security. The main gate requires an electronic employee badge to enter. Samples are packaged at the Haile Exploration warehouse by the Geotech Supervisor and geotechnicians. Samples are trucked in sealed plastic barrels by certified couriers with submittal forms that are verified during sample pick-up and delivery to ALS. No sample shipments have been recorded as missing or tampered with.

QA/QC at Didipio Mine

Exploration diamond core samples at the Didipio mine are typically drilled with HQ core barrel equipment. The HQ samples are then cut, with half of the core retained at the secure core shed facility on site to which access is controlled. In cases where OceanaGold has collected metallurgical samples, a further quarter of the core has been taken with only one-quarter core retained. Following core cutting the half-core sample is submitted for analysis.

Since 2013, all OceanaGold samples have been processed on-site at a laboratory facility operated by SGS Philippines Inc (SGS). After dispatching to SGS, samples are dried at 105 degrees C for 8 to 12 hours, allowed to cool, and then weighed. Within the sample assay workflow, the SGS lab randomly inserts laboratory duplicate and replicate samples as well as certified reference materials for quality control (QC) monitoring. Samples are crushed to produce 500 to 1000g of material for the primary analysis and any lab duplicates. The remaining coarse reject material is retained during the assay process. The sample (and any lab duplicates) are then pulverized to 75% passing 2mm, followed by a subsequent pulverizing to 85% passing 75um. The primary sample is then split down to 200g (with an additional 200g for replicate sampling when applicable). A scoop of 30g is then taken from the 200g sample with the remaining pulp retained.

Gold analysis is by Fire Assay with AAS finish. Copper analysis is either by AAS on a 3-acid digest or XRF. These methods are considered appropriate for the type of mineralisation and expected grade tenor. The quantity and quality of the lithological, geotechnical, and geochemical data collected in the exploration, surface resource delineation, underground resource delineation, and grade control drill programs are considered sufficient to support the Mineral Resource and Ore Reserve estimation.

In addition to the internal SGS QC controls, OceanaGold also monitors laboratory performance with the following processes:

- Inserting duplicate samples;

- Inserting CRM blanks and coarse blanks;

- Inserting CRM standards for Au, Cu, Ag; and,

- Monthly monitoring of SGS duplicate, replicate, and CRM performance.

About OceanaGold

OceanaGold is a multinational gold producer committed to the highest standards of technical, environmental and social performance. We are committed to excellence in our industry by delivering sustainable environmental and social outcomes for our communities, and strong returns for our shareholders. Our global exploration, development, and operating experience has created a strong pipeline of organic growth opportunities and a portfolio of established operating assets including the Haile Gold Mine in the United States of America, Didipio Mine in the Philippines, and the Macraes and Waihi operations in New Zealand.

Qualified Person Statement

The exploration results in this press release were prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators ("NI 43-101").

Information relating to Waihi exploration results in this document has been verified by, is based on and fairly represents information compiled by or prepared under the supervision of Lorrance Torckler, a Fellow of the Australasian Institute of Mining and Metallurgy and an employee of OceanaGold. Information relating to the Didipio and Haile exploration results in this document has been verified, and is based on and fairly represents information compiled by or prepared under the supervision of Craig Feebrey, a Member of the Australasian Institute of Mining and Metallurgy and an employee of OceanaGold. Both Messrs Torckler and Feebrey have sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as Qualified Persons for the purposes of the NI 43-101. Messrs Torckler and Feebrey consent to the inclusion in this public report of the matters based on their information in the form and context in which it appears.

Technical Reports

For further information, please refer to the following NI 43-101 compliant technical reports (collectively, the Technical Reports) and the Company’s news release titled “OceanaGold Reports Growing High-Grade Resources at WKP in New Zealand” dated February 24, 2020:

- “Technical Report for the Didipio Gold / Copper Operation Luzon Island” dated March 31, 2022, prepared by D. Carr, Chief Metallurgist, P. Jones, Group Engineer and J. Moore, Chief Geologist, each of Oceana Gold Management Pty Limited;

- “Waihi District Study - Preliminary Economic Assessment NI 43-101 Technical Report” dated August 30, 2020, prepared by T. Maton, Study Manager and P. Church, Principal Resource Development Geologist, both of Oceana Gold (New Zealand) Limited, and D. Carr, Chief Metallurgist, of OceanaGold Management Pty Limited; and

- “NI 43-101 Technical Report Haile Gold Mine Lancaster County, South Carolina” dated March 31, 2022, prepared by D. Carr, Chief Metallurgist, G. Hollett, Group Mining Engineer, and J. Moore, Chief Geologist, each of OceanaGold Management Pty Limited, Michael Kirby of Haile Gold Mine, Inc., J. Poeck, M. Sullivan, D. Bird, B. S. Prosser and J. Tinucci of SRK Consulting, J. Newton Janney-Moore and W. Kingston of Newfields and L. Standridge of Call and Nicholas.

Cautionary Statement for Public Release

Certain information contained in this public release may be deemed “forward-looking” within the meaning of applicable securities laws. Forward-looking statements and information relate to future performance and reflect the Company’s expectations regarding the generation of free cash flow, execution of business strategy, future growth, future production, estimated costs, results of operations, business prospects and opportunities of OceanaGold Corporation and its related subsidiaries. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those expressed in the forward-looking statements and information. They include, among others, the accuracy of mineral reserve and resource estimates and related assumptions, inherent operating risks and those risk factors identified in the Company’s most recent Annual Information Form prepared and filed with securities regulators which is available on SEDAR at www.sedar.com under the Company’s name. There are no assurances the Company can fulfil forward-looking statements and information. Such forward-looking statements and information are only predictions based on current information available to management as of the date that such predictions are made; actual events or results may differ materially as a result of risks facing the Company, some of which are beyond the Company's control. Although the Company believes that any forward-looking statements and information contained in this press release is based on reasonable assumptions, readers cannot be assured that actual outcomes or results will be consistent with such statements. Accordingly, readers should not place undue reliance on forward-looking statements and information. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements and information, whether as a result of new information, events or otherwise, except as required by applicable securities laws. The information contained in this release is not investment or financial product advice.

NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES.

[1] The resources are reported within a conceptual stope design using a US$1,700/oz gold price, approximating a 1.39 g/t cut-off grade.