PUR is also pleased to announce the appointment of Colin Healey as Chief Executive Officer, effective immediately. Colin holds a Masters Degree in Business Administration and is a Mechanical Engineering Technician with over 20 years experience, the majority of which was spent as a mining research analyst at a recognized Canadian broker dealer covering uranium and other commodities. Tim Rotolo is now Chairman of the Board of Directors (the “PUR Board”).

Under the terms of the Arrangement, shareholders of American Future Fuel (“AMPS Shareholders”) will receive 0.170 of a common share of Premier American Uranium (each whole share, a “PUR Share”) for each AMPS Share held (the “Exchange Ratio”). Existing shareholders of Premier American Uranium and American Future Fuel will own approximately 64.2% and 35.8% (on a basic basis), respectively, of the pro forma outstanding PUR Shares on closing of the Arrangement. The Exchange Ratio implies consideration of C$0.507 per AMPS Share based on the closing price of PUR Shares on the TSX Venture Exchange (the “TSXV”) on March 19, 2024. The Exchange Ratio implies a premium of 66.1% to the closing price of the AMPS Shares on the Canadian Securities Exchange (the “CSE”) and a 57.3% premium to the 20-day volume weighted average price (VWAP) of AMPS Shares on the CSE for the period ending March 19, 2024[1]. The implied equity value of the combined company (the “Company”) is estimated at approximately C$129 million[2].

To view a summary of today’s news release delivered by Tim Rotolo, Chairman of PUR, Colin Healey, CEO of PUR and David Suda, CEO of AMPS, click here.

Strategic Rationale for the Acquisition

- Builds Critical Mass in the U.S.: Consistent with PUR’s opportunistic M&A strategy, this Arrangement positions the Company in three of the top uranium districts in the U.S., including the Grants Mineral Belt in New Mexico, the Great Divide Basin of Wyoming, and the Uravan Mineral Belt of Colorado, while adding past production on private land to the portfolio.

- Enhances Capital Markets Profile and Shareholder Base: The pro forma Company is expected to have a market capitalization of over ~C$129 million and ~C$11 million[3] in combined cash to fund exploration, allowing increased access to capital and trading liquidity. Additionally, the Company is expected to have a suite of uranium corporate and institutional investors including, Sachem Cove Partners, IsoEnergy Ltd., Mega Uranium Ltd., and enCore Energy Corp.

- Adds an Advanced Project in a Top Uranium District:

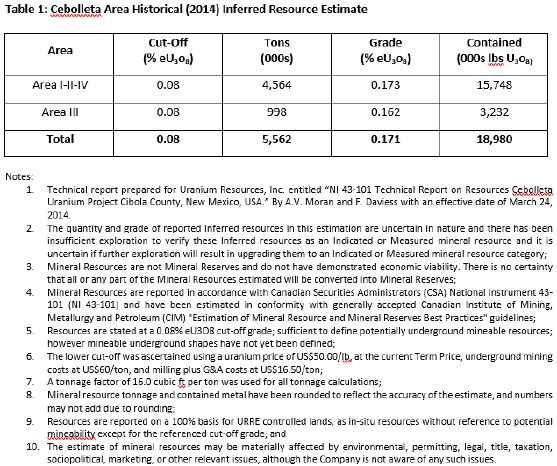

- Cebolleta has a historical inferred mineral resource estimate of 5.6Mt at an average grade of 0.171% U3O8 containing approximately 18.9M lbs U3O8[4];

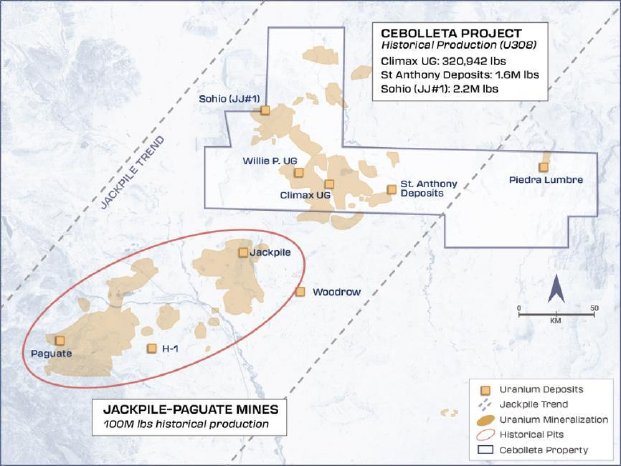

- Past production of 3.8M lbs U3O8 (1975-1990)[5] produced from the JJ#1 and St. Anthony Mines is adjacent to 100M lbs U3O8 of historic production from the Grants Mineral Belt (4th largest uranium district in the world)[6];

- Two target areas that host several shallow, semi-contiguous deposits;

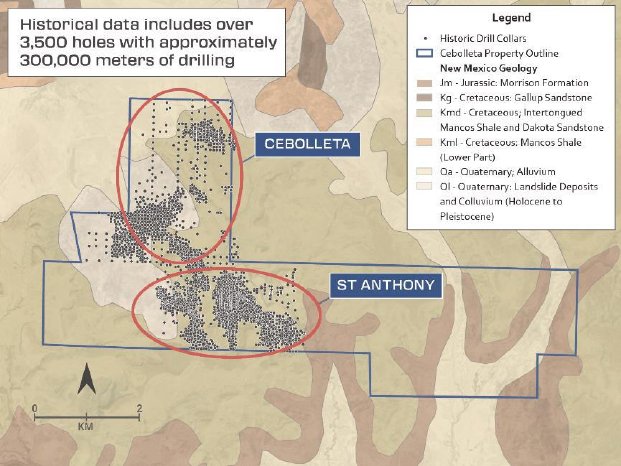

- Extensive historical exploration including approximately 569,000m drilled in 3,594 holes ($75 million of historical expenditures); and

- 6,700 acres of mineral rights, and 5,700 acres of surface rights on private land, providing permitting advantages.

- Provides Significant Exploration Upside:

- AMPS’ 2023 drill program confirmed reliability of historical data, which may support the preparation of a current compliant resource estimate, which is expected to be completed in the near term;

- The historical inferred mineral resource estimate excludes known uranium mineralization from the St. Anthony area, which produced 1.6M lbs U3O8 (1975 to 1980) and hosts two deposits that could potentially connect to the area that hosts the historical Cebolleta historical inferred mineral resource estimate; and

- Additionally, exploration potential has been identified in the Westwater Canyon Member of the Morrison Formation, approximately 100m beneath the current defined mineralized horizon, and is the principal host rock in the Grants Mineral Belt, which hosts +300M lbs of uranium resources, which remains unexplored at Cebolleta[7].

Colin Healey, CEO of Premier American Uranium commented, “I am extremely excited to be joining Premier American Uranium at a time when uranium sector fundamentals are the strongest I have witnessed in my career and poised to accelerate, backed by a global push toward net-zero emissions. ‘Company building’ is a foundational part of Premier American Uranium’s DNA and I look forward to working with this incredibly talented and experienced team to continue to shape that legacy, executing on a multi-pronged growth strategy that includes plans to unlock value within the current portfolio of uranium properties through exploration, resource delineation and development, systematically de-risking the assets. In parallel, PUR will continue to leverage its deep knowledge of the premium uranium districts of the United States and plans to accretively expand our project pipeline through acquisition. Today’s transaction represents a significant step in our asset building strategy, targeting sizable historic inferred resources on past-producing land in New Mexico’s Grants Mineral Belt, which has a prolific history of uranium production.”

Benefits to American Future Fuel Shareholders

- Significant and Immediate Premium: The Exchange Ratio represents a 57.3% premium to the 20-day VWAP of the AMPS Shares on the CSE for the period ended March 19, 2024[8].

- Diversified Exposure to Top U.S. Uranium Districts: AMPS Shareholders will retain approximately 35.8% ownership in the Company and mitigate single asset risk by gaining exposure to Premier American Uranium’s five projects in Colorado and Wyoming, which includes a past-producing mine.

- Bolstered Capital Markets Profile: The Company will have a market capitalization of over C$129 million and approximately C$11 million2 in cash, an enhanced ability to raise capital, increased trading liquidity, a broader shareholder base and sell-side research coverage.

- Aligning with a Team and Strategy with Proven Results: Premier American Uranium has unparalleled U.S. uranium exploration, development, permitting and operating experience, along with corporate finance and M&A expertise with proven results. AMPS Shareholders can expect to benefit from a disciplined and opportunistic M&A strategy, focused on building critical mass in the U.S.

About the Cebolleta Project

Cebolleta is an advanced uranium exploration project located in Cibola County, New Mexico. The Project is approximately 35 miles (56km) west of Albuquerque and lies within the prolific Grants Mineral Belt, one of the largest concentrations of sandstone-hosted uranium deposits in the world. The Grants Mineral Belt has historically produced 347M lbs U3O8, or ~37% of all uranium produced in the United States.6 American Future Fuel has a 100% lease-hold interest in Cebolleta (6,700 acres mineral rights, 5,700 acres surface rights), which is comprised of multiple known uranium deposits and several previously operating uranium mines.

Cebolleta has been subject to extensive exploration and development from the 1950s through the 1980s. Past efforts revealed several significant sandstone-hosted uranium deposits ranging from 200 to 800ft (60-240m) deep in the Jurassic Jackpile Sandstone. These deposits were amenable to both surface and underground mining, which culminated from 1975-1981 when over 3.8M lbs U3O8 was produced from the JJ#1 and St. Anthony Mines4.

The vast majority of known uranium mineralization still exists at Cebolleta – namely from the Sohio Area (mineralization in Areas I-V) and the St. Anthony Area (mineralization adjoining the St. Anthony open pits and the Willie P underground mine) (Figure 1).

The Sohio Area (Cebolleta Area) of the Project is host to a historical uranium Inferred Mineral Resource (Table 1) according to a 2014 Technical Report commissioned by the previous owner, Uranium Resources, Inc.4 The reliability of the historical estimate is considered reasonable, but a Qualified Person has not done sufficient work to classify the historical estimate as a current Mineral Resource and neither American Future Fuel nor Premier American Uranium is treating the historical estimate as a current Mineral Resource. The St. Anthony deposits, in and adjoining the St. Anthony open pits, have not been modeled, as the large amount of historical data for St. Anthony has not yet been synthesized into a database for resource modeling and estimation. The Company believes the St. Anthony Area mineralization represents exploration potential for the Project (Figure 2).

Board of Directors and Management Team

Upon completion of the Arrangement, the PUR Board will be comprised of six directors including (i) the four directors currently on the PUR Board, and (ii) two directors to be mutually agreed upon by American Future Fuel and Premier American Uranium. Tim Rotolo will continue to serve as the Chairman of the PUR Board.

Upon completion of the Arrangement, the senior management team is expected remain the same with Colin Healey as Chief Executive Officer, and Greg Duras as Chief Financial Officer. David Suda, current CEO of AMPS is expected to join PUR as President.

In connection with Mr. Healey’s appointment, pursuant to PUR’s long term incentive plan, Premier American Uranium has granted him options to purchase 300,000 PUR Shares and 100,000 restricted share units. The options are exercisable at a price of $2.98 per PUR Share for a period of five years and vest as follows: one-third vesting immediately, one-third vesting after six months and one-third vesting after one year. The restricted share units, each of which entitles the holder to receive one PUR Share, vest as follows: one-third vesting after one year, one-third vesting after two years and one-third vesting after three years. The options and restricted share units are subject to approval of the TSXV.

Board of Directors’ Recommendations

The Arrangement has been unanimously approved by the Board of Directors of American Future Fuel (the “AMPS Board”) and the AMPS Board unanimously recommends that AMPS Shareholders vote in favour of the Arrangement. Cairn Merchant Partners LP (“Cairn”) provided a fairness opinion to the AMPS Board, stating that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications stated in its opinion, the consideration to be received by the American Future Fuel shareholders (other than Sachem Cove) pursuant to the Arrangement is fair, from a financial point of view, to the American Future Fuel shareholders (other than Sachem Cove).

The Arrangement has also been unanimously approved by the PUR Board, with the exception of Tim Rotolo who did not vote with respect to the Arrangement.

Material Conditions to Completion of the Transaction

The Arrangement will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia), requiring the approval of (i) at least 662/3% of the votes cast by AMPS Shareholders, and (ii) if applicable, a simple majority of the votes cast by AMPS Shareholders, excluding certain related parties as prescribed by Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions, voting in person or represented by proxy at a special meeting of AMPS Shareholders to consider the Arrangement (the “AMPS Meeting”). An information circular regarding the Arrangement will be filed with regulatory authorities and mailed to AMPS Shareholders in accordance with applicable securities laws. The Arrangement is expected to be completed in the second quarter of 2024, subject to satisfaction of the conditions under the Arrangement Agreement.

Each of the directors and executive officers of American Future Fuel, along with certain key shareholders, including Sachem Cove Partners, representing an aggregate of approximately 6.54% of the issued and outstanding AMPS Shares, have entered into voting support agreements with Premier American Uranium and have agreed, among other things, to vote their AMPS Shares in favour of the Arrangement.

In addition to shareholder and court approvals, closing of the Arrangement is subject to applicable regulatory approvals including, but not limited to, TSXV approval and the satisfaction of certain other closing conditions customary in transactions of this nature.

The Arrangement Agreement customary representations and warranties for a transaction of this nature as well as customary interim period covenants regarding the operation of American Future Fuel and Premier American Uranium’s respective businesses. The Arrangement Agreement also provides for customary deal protection provisions, including non-solicitation covenants of American Future Fuel, “fiduciary out” provisions in favour of American Future Fuel and “right-to-match superior proposals” provisions in favour of Premier American Uranium. In addition, the Arrangement Agreement provides that, under certain circumstances, Premier American Uranium would be entitled to a C$1 million termination fee.

Following completion of the Transaction, the PUR Shares will continue trading on the TSXV and the AMPS Shares will be de-listed from the CSE.

Premier American Uranium and American Future Fuel will file material change reports in respect of the Arrangement in compliance with Canadian securities laws, as well as copies of the Arrangement Agreement and the voting support agreements, which will be available under Premier American Uranium’s and American Future Fuel’s respective SEDAR+ profiles at www.sedarplus.ca.

Full details of the Arrangement will also be included in the management information circular of American Future Fuel to be delivered to AMPS Shareholders in respect of the AMPS Meeting, which will be available under American Future Fuel’s SEDAR+ profile.

Advisors and Counsel

Cassels Brock & Blackwell LLP is acting as legal counsel and Red Cloud Securities Inc. is acting as financial advisor to Premier American Uranium in connection with the Arrangement.

Farris LLP is acting as legal counsel and Cormark Securities Inc. is acting as financial advisor to American Future Fuel in connection with the Arrangement. Cairn Merchant Partners LP has provided a fairness opinion to the AMPS Board.

Technical Disclosure and Qualified Person

The scientific and technical information contained in this news release was reviewed and approved on behalf of American Future Fuel by Mark Mathisen, CPG, SLR International Corporation, Denver, CO, an independent geological consultant to the company, who is a “Qualified Person” as defined in NI 43-101.

About Premier American Uranium

Premier American Uranium Inc. is focused on the consolidation, exploration, and development of uranium projects in the United States. One of PUR’s key strengths is the extensive land holdings in two prominent uranium-producing regions in the United States: the Great Divide Basin of Wyoming and the Uravan Mineral Belt of Colorado. With a rich history of past production and historic uranium mineral resources, PUR has work programs underway to advance its portfolio.

Backed by Sachem Cove Partners, IsoEnergy and additional institutional investors, and an unparalleled team with U.S. uranium experience, PUR’s entry into the market comes at a well-timed opportunity, as uranium fundamentals are currently the strongest they have been in a decade.

About American Future Fuel

American Future Fuel Corporation is a Canadian-based resource company focused on the strategic acquisition, exploration and development of alternative energy projects. The Company holds a 100% interest in the Cebolleta Uranium Project, located in Cibola County, New Mexico, USA, and situated within the Grants Mineral Belt, a prolific mineral belt responsible for approximately 37% of all uranium produced in the United States of America.

For More Information, Please Contact:

Premier American Uranium Inc.

Tim Rotolo, Chairman

info@premierur.com

Toll-Free: 1-833-572-2333

Twitter: @PremierAUranium

www.premierur.com

American Future Fuel Corporation

David Suda, CEO and Director

info@americanfuturefuel.com

www.americanfuturefuel.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Neither TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

None of the securities to be issued pursuant to the Transaction have been or will be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and any securities issuable in the Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities laws. This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Cautionary Statement Regarding “Forward-Looking” Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to activities, events or developments that Premier American Uranium and American Future Fuel expect or anticipate will or may occur in the future including, but not limited to, the timing and outcome of the Transaction, including required shareholder, regulatory, court and stock exchange approvals, the anticipated benefits of the Arrangement to the parties and their respective shareholders, anticipated strategic and growth opportunities for the Company, expectations regarding the U.S. uranium industry, including the demand for uranium, the prospects of the Cebolleta Project, including mineralization of the Cebolleta Project and plans with respect to preparation of a current mineral resource estimate on the Cebolleta Project, the anticipated timing of completion of the Arrangement, Premier American Uranium’s strategy, plans or future financial or operating performance, any expectations with respect to defining mineral resources or mineral reserves on any of Premier American Uranium’s projects, expectation with respect to any permitting, development or other work that may be required to bring any of the projects into development and any other activities, events or developments that the companies expect or anticipate will or may occur in the future. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof. Such forward-looking information and statements are based on numerous assumptions, including assumptions regarding the combined company following completion of the Arrangement, that the anticipated benefits of the Arrangement will be realized, that the historical mineral resource estimate for the Cebolleta Project can be converted into a current mineral resource estimate, completion of the Arrangement, including receipt of required shareholder, regulatory, court and stock exchange approvals, the ability of the parties to satisfy, in a timely manner, the other conditions to the closing of the Arrangement, other expectations and assumptions concerning the Arrangement changing, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the parties’ planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by Premier American Uranium and American Future Fuel in providing forward-looking information or making forward-looking statements are considered reasonable by management of each company at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: the failure to obtain shareholder, regulatory, court or stock exchange approvals in connection with the Arrangement, failure to complete the Arrangement, failure to realize the anticipated benefits of the Arrangement or implement the business plan for the combined company, negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known current mineral reserves or resources, reliance on key management and other personnel, potential downturns in economic conditions, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, and risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals and the risk factors with respect to Premier American Uranium set out in the Form 2B Listing Application of Premier American Uranium dated November 27, 2023 and with respect to American Future Fuel set out in American Future Fuel’s management discussion and analysis for the year and the fourth quarter ended December 31, 2022, each of which have been filed with the Canadian securities regulators and available under Premier American Uranium’s and American Future Fuel’s respective profiles on SEDAR+ at www.sedarplus.ca.

Although Premier American Uranium and American Future Fuel have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. Premier American Uranium and American Future Fuel undertake no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

[1] Premium is calculated using the 20-day VWAP of PUR Shares and AMPS Shares over all Canadian exchanges for the period ending March 19, 2024.

[2] Calculated using the closing share price of PUR Shares on the TSXV on March 19, 2024 and the pro forma basic shares outstanding of the combined company.

[3] Based on public disclosure as of September 30 2023, adjusted for the December 2023 private placement for gross proceeds of C$3.45M.

[4] This estimate is considered to be a “historical estimate” under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and is not considered by American Future Fuel or Premier American Uranium to be current. See “NI 43-101 Technical Report on Resources Cebolleta Uranium Project, Cibola County, New Mexico, USA” with an effective date of date of March 24, 2014. The historical Cebolleta mineral resource estimate presented herein use the appropriate mineral resource categories and modern statistical techniques as per CIM Definition Standards on Mineral Resources & Reserves (2014), however, a Qualified Person (QP) does not have enough information to verify the resource estimate as a current mineral resource, as per the CIM Estimation of Mineral Resources & Mineral Reserves Best Practices Guidelines (2019), therefore the estimate is considered historical in nature. The historical resource estimation discussed is relevant in that it was prepared and calculated by reputable companies that were intimately familiar with, and knowledgeable about, the property and the geology and resource potential of the Project. The historical resource does provide an indication of the extent of mineralization identified by previous operators at the Project. A QP has not done sufficient work to classify the historical estimate as a current mineral resource, therefore, the historical estimate is not being treated as a current resource.

[5] NI 43-101 Technical Report on Resources Cebolleta Uranium Project Cibola County, New Mexico, USA – effective date March 24, 2014.

[6] The Jackpile-Paguate Uranium Mine, Grants Uranium District: Changes in perspectives from production to superfund site Virginia T. McLemore, Bonnie A. Frey, Ellane El Hayek, Eshani Hettiarachchi, Reid Brown, Olivia Chavez, Shaylene Paul, and Milton Das.

[7] Uranium resources in the Grants uranium district, New Mexico: An update Virginia T. McLemore, Brad Hill, Niranjan Khalsa, and Susan A. Lucas Kamat 2013.

[8] Premium is calculated using the 20-day VWAP of PUR Shares and AMPS Shares over all Canadian exchanges for the period ending March 19, 2024.