Africa is considered a late entrant to the global E-Commerce stage. Low internet penetration, underdeveloped logistics and limited cashless payments infrastructure, as well as low incomes and high poverty rates have hindered the uptake of online shopping in this region. However, recent signs of improvements have led to forecasts of B2C E-Commerce sales growing at high rates to a double-digit number in EUR billions in the next three years.

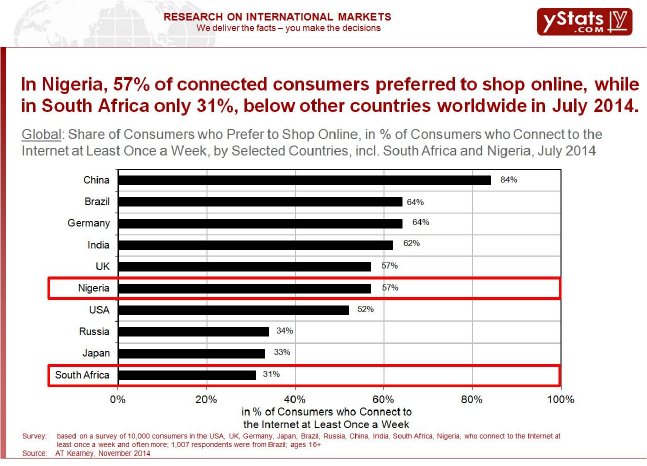

South Africa and Nigeria are the continent's leaders in online retail development. While South Africa has been in view for years as an important emerging market, Nigeria is a rising star. As the regions' most populous country, it already surpassed South Africa in economy size and topped all other African nations by number of Internet users and mobile phone owners. Local online merchants Jumia and Konga are among the country's most popular websites. Jumia has already expanded beyond Nigeria to other markets in the region, while both companies received substantial investment to fortify their positions on the domestic market, as the launch of PayPal in Nigeria in 2014 is expected to bring more international competition.

Still, South Africa is significantly ahead of all other countries in the continent by such important infrastructure indicators as Internet, smartphone and payment card penetration. An important development in South Africa is the declining share of online spending on foreign websites. Fear of hidden charges and the convenience of buying from local merchants are cited as major reasons for not buying cross-border. Nevertheless, US-based global merchant Amazon ranks among the most visited E-Commerce websites in the country, while the two largest South African online merchants Kalahari.com and Takealot.com decided to merge to join their forces against increasing local and international competition. Overall, South African B2C E-Commerce market potential is still largely untapped, as online accounted for only slightly more than 1% of total retail sales last year.

Looking at other African nations, Morocco and Egypt are Africa's most advanced markets in Internet penetration, which reached more than half of the population in these countries, as of 2014. Online shopper penetration stood at below 10% in these countries, though especially in Morocco, the number of users buying over the Internet has grown significantly. In Egypt, a particular characteristic is significance of the social network Facebook, which not only generates traffic for online merchants such as Souq.com and Jumia, but also is cited by online shoppers as a website for direct placement of orders.

Kenya is Africa's leader in all aspects of mobile: mobile connections account for almost all of Internet subscriptions in the country, while the number of people using mobile payment services has been growing each year to reach a significant double-digit number in 2014. Still, the country's E-Commerce market is smaller than that of some other African countries, through by mobile shopper penetration it topped them all, ranking first in this parameter together with Nigeria.