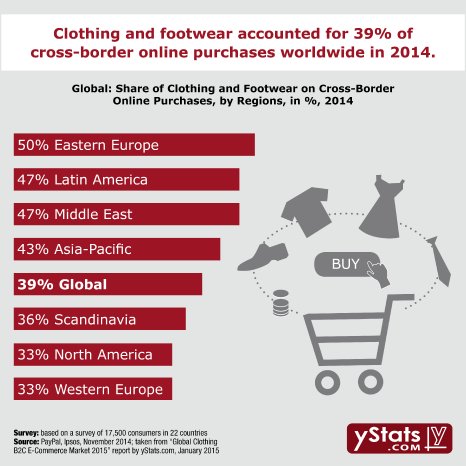

Clothing has been the most purchased physical product in recent years in many countries across all regions, including the UK, Russia, China, India, Spain, Italy, Turkey, Mexico. In selected developed markets, such as Germany, it tops all other categories in terms of sales volume. However, in some emerging markets, like the Middle East, it is significantly behind consumer electronics in terms of market share. Clothing was also the leading category in global cross-border B2C E-Commerce in 2014, accounting for over a third of all cross-border online purchases.

Mobile and omnichannel strategies have become of vital importance for both online and store-based retailers of apparel. While many consumers research clothing and footwear products online, they might eventually buy it online or offline. In the USA, for example, the probability that a shopper would buy clothes in store after researching their purchase online was almost as high as the probability that they would buy offline. Also the majority of consumers in Germany say that they use both online and offline shops to buy clothes and often compare prices between channels. In the UK, click-and-collect has become a popular option in shopping for apparel and is actively used by store-based retailers to drive sales. Meanwhile, the example of South Korea, where close to one in three online buyers of clothing conducted their last purchase via smartphone, shows that mobile optimized websites, applications and a seamless shopping experience across different channels has become of vital importance.

The competition landscape features online pure-plays, store-based and multichannel retailers, clothing specialists, brands and mass merchants. In China and Japan online mass merchants and marketplaces are the most popular destinations among online shoppers who want to buy clothing. Tmall has a dominant share of the online clothing market in China, hosting local and foreign brands and sellers. In India, the largest general online retailers merge with clothing specialists to increase their share of the booming market: Flipkart acquired the online fashion store Myntra in 2014 and Amazon was reported to be in talks to buy another one, Jabong.

In the USA, on the other hand, apparel and footwear brands are second in popularity after online mass merchants for buying clothes. One of the largest store-based apparel specialists in terms of online sales in 2013 was Gap. In Europe, German online clothing retailers Zalando and Bonprix operate across several countries, as also do France-based La Redoute and UK-based Asos. European store-based retailers of apparel such as H&M, C&A, Marks&Spencer and Next were also popular among online shoppers in the UK and Germany. Meanwhile, in South Africa online mass merchants Kalahari and Amazon dominated by share of online buyers of clothing, and in Latin American countries MercadoLibre's marketplace was a popular shopping destination, along with online fashion specialists such as Dafiti.