Based on the assumption that genuine accounting data should follow a so called Newcomb Benford Distribution or at least should origin out of a stable delivery, production and sales process, we can now test for accounting data irregularities.

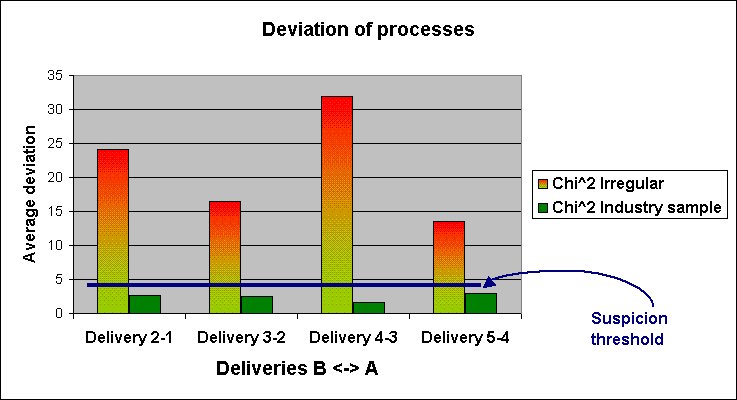

To prove the methods reliability, we applied it to several raw asset files which originated from real corporates. These corporates have been known to either possess irregular processes or even frauds. The results where very unambiguous. It can be concluded with a confidence exceeding 90%, that the data from one delivery did not comply with the process which generated the data from other deliveries. This raises the suspicion of a very irregular sales or invoicing process. For example the detected deviations where at least 5 times higher than the ones of comparable industries (see graphic below).

Implementing this analytical method can help to detect irregularities early, thus allowing for counter measures to be taken in advance. The method can be applied to practically all accounting data, e.g. to historical data even before the first purchase.

This testing method will be part of future releases of PoolArranger but is also available as a stand alone service. Should you be interested in this service or have further questions, please do not hesitate to contact us.

Contact

Acrys Consult GmbH & Co. KG

Dr. Ralf Salzgeber, Manager

Untermainkai 29-30

D-60329 Frankfurt am Main

T: +49-69-244506-0

F: +49-69-244506-50

ralf.salzgeber@acrys.com

www.acrys.com