Unaudited results:

- Significant increase in cloud transformations and SAP S/4HANA migration projects

- Further progress with the Group’s own transformation

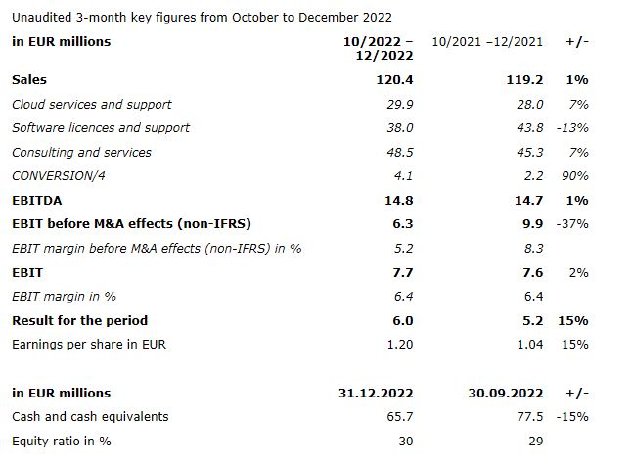

- Sales: EUR 120.4 million (up 1% year on year); adjusted for non-recurring licence revenues plus 7%

- Recurring revenues increase by plus 6%

- CONVERSION/4 business almost doubled

- Licence sales short of strong prior-year figure

- EBIT before M&A effects (non-IFRS) down 37% to EUR 6.3 million; EBIT margin before M&A effects (non-IFRS): 5.2%

- EBIT: EUR 7.7 million (up 2% year on year); EBIT margin unchanged at 6.4%

- Acquisition of outstanding 49% stake in Polish subsidiary brought forward

- New SAP S/4HANA Cloud solution for small and medium-sized enterprises

- brand eins award for Best IT Service Provider 2023

- Guidance 2022/23 confirmed

In a challenging market environment characterised by uncertainty, inflation and waves of illness, All for One Group SE was able to increase its sales by 1% to EUR 120.4 million, or by 7% adjusted for the effect of non-recurring licencing revenues. Despite the 1st quarter 2022/23 getting off to a slightly weaker start, the order situation remains stable and gradual recovery is visible. In the CORE segment (ERP and collaboration solutions) especially, capacity utilisation was less than planned due to a high level of sick leave and postponements in Value Life Cycle Services. The LOB segment (lines of business solutions) got off to a very positive start to the new year.

All for One Group started to adjust its business model promptly to the changing market environment, and to the future requirements of its customers. The Cloud First approach, expansion of the Group's portfolio of products and services, and innovative solutions focusing on SAP S/4HANA migrations are expected to pay off.

Michael Zitz, Co-CEO: »Our base of around 3,000 customers appreciate the broad portfolio of products and services and our expertise, excellent quality and also – increasingly – the innovative strength of All for One Group. Accordingly, we are witnessing a pleasing increase in demand for our new SAP S/4HANA Cloud solution for small and medium-sized enterprises, which we are able to offer as currently one of very few SAP partners. The unique element of this solution is our integration platform FlowOne, which is capable, for example, of linking Teams, Power Platform, Azure Services and other Microsoft technologies to SAP. The acceptance of such innovative solutions among our customers is confirmed, for example, by the brand eins award for Best IT Service Provider 2023.«

At EUR 63.4 million (plus 6%), recurring revenues account for 53% (Oct – Dec 2021: 50%) of total sales. Cloud Services and Support performed well (plus 7% to EUR 29.9 million) while Software Support stagnated at EUR 29.5 million. With the trend towards the cloud continuing, licence revenues decreased, as expected, to EUR 8.6 million in the 3-month period 2022/23, a decline of 40% compared to the unusually strong prior-year quarter (where business was catching up after the effects of the pandemic in 2020). The fact that sales of the Group’s customised technology-based service model »CONVERSION/4« virtually doubled is testament to the continued growth in demand for transformation projects to SAP S/4HANA.

All for One Group CFO, Stefan Land: »The integration of the new companies and the establishment of our Regional Delivery Centers in Egypt, Poland and Turkey are progressing on schedule. With a clear focus on consolidation, integration and margin improvement. We were delighted to be able to acquire the outstanding 49% stake in All for One Poland ahead of schedule in December. Holding all the shares will strengthen our ability to implement SAP S/4HANA transformations and deliver international projects and, as such, will boost the continued growth of our Group.«

EBIT before M&A effects (non-IFRS) decreased to EUR 6.3 million (minus 37%), while EBIT increased by 2% to EUR 7.7 million. EBITDA was EUR 14.8 million (plus 1%) and EBT totalled EUR 7.1 million (minus 2%). The result for the period increased by 15% to EUR 6.0 million, while earnings per share increased to EUR 1.20 (plus 15%).

The equity ratio as of 31 December 2022 was 30% (30 Sep 2022: 29%). The headcount has increased substantially year on year to 2,787 as of 31 December 2022 (31 Dec 2021: 2,504). In light of the Group's growth targets, it will continue to invest in recruiting, developing and retaining staff.

The management board is holding firm to its guidance for financial year 2022/23 and expects sales to be in a range of between EUR 470 million and EUR 500 million (2021/22: EUR 452.7 million). In derivation, EBIT before M&A effects (non-IFRS) is predicted to be between EUR 27.5 million and EUR 30.5 million (2021/22: EUR 27.3 million). The board also reaffirmed its mid-term outlook of robust organic growth in the mid-single-digit percentage range and a margin of between 7% and 8% for EBIT before M&A effects (non-IFRS) up to financial year 2025/26.

Renewed economic setbacks caused by pandemic waves, inflation, supply chain problems among customers, etc., cannot, however, be entirely ruled out and pose the greatest risk to achieving this guidance.

All for One Group SE will be publishing its full quarterly statement for the 3-month period 2022/23 as scheduled on 13 February 2023.