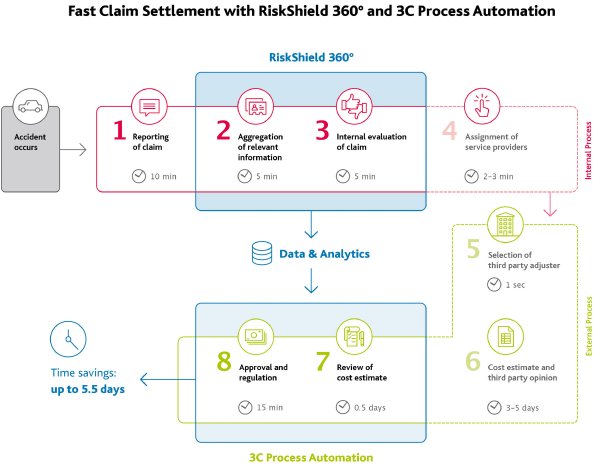

When a customer makes a claim, this entails significant processing for insurers. The industry is therefore relying on the highest possible level of process automation. In RiskShield 360° by Arvato Financial Solutions, such a highly automated solution for verifying claims is long-established. It is mainly used in motor vehicle claims to identify fraud patterns and to quickly manage claims in accordance with a clear risk profile.

Following successful verification, the insurer then commissions different service providers for the rectification and settlement of the loss. Trusted partner for this is 3C Deutschland GmbH, which specializes in the automation of claims processes. Through a modern and user-friendly portal, the 3C solutions quickly and easily manage processes. As an innovative technology partner and outsourcing service provider, the company with its sites in Heilbronn and Erfurt specializes in the flexible and individual management, quality management and monitoring and controlling of claims processes.

With the purchase of 3C by the Bertelsmann subsidiary, not only will the outstanding expertise of the two companies be combined, but the digital and automated technologies will also be merged. “Combining RiskShield 360° and the 3C solutions allows us to offer a fully automated and digitalized claims management process on the insurance market first of all, from a single source, at the highest level of quality and with outstanding benefits for insurers and policyholders. Without our solutions, the processing of claims settlement takes up to six days, and we will now need five to ten minutes in the best case,” says Kai Kalchthaler, Executive Vice President Risk Management DACH at Arvato Financial Solutions.

For the founder of 3C Deutschland GmbH Dietmar Hartinger, it was the substantive criteria that were pivotal in his choice of buyer: "The positive development of both sites, the future-proof development of the products and the consistent expansion of customer relations were for us the most important points in our choice of successor. Arvato Financial Solutions meets all those criteria and also brings its own expertise and products to 3C. We made the best possible decision. I will be available to the newly formed management team on an advisory basis for the next two years in order to ensure a good transition.”

Dietmar Hartinger decided to sell as part of a succession plan. The continuity and the empirical knowledge of the business model is also maintained with 3C co-founder Uwe Mengs, who along with the long-standing risk management insurance specialists from Arvato Financial Solutions Björn Hinrichs and Thorsten Haag will form the new management team. Together they will bring together the previously separate strands and provide customers with the first fully automated digital claims management process and outstanding expertise in the insurance industry.