- BaFin approves sale of Eschborn-based payment services provider without conditions

- Next Step of development initiated

- Investments in innovation and further acquisitions are to accelerate growth

- Chairman of the Supervisory Board will be Stuart Gent, Head of European Portfolio Group at Bain Capital Private Equity

‘Over the past two years, Concardis has become one of the leading full-service payment providers thanks to its strategic investments and focused acquisitions,’ says Stuart Gent, Co-Head of Bain Capital Europe Private Equity and the new Chair of the Concardis Supervisory Board. ‘We want to further develop the company and make it an even stronger player in German-speaking Europe through organic and inorganic growth. We will now tackle both targets – the internal transformation into a truly digital payments company and the strategic development of the company.’

‘We have a clear goal ahead of us: to keep developing Concardis as a consistently customer-focused player operating with clear strategic goals,’ adds Marcus W. Mosen, CEO of Concardis. ‘In order to achieve that, we have already started a series of development projects that will be expedited and supplemented as necessary after the change of ownership. At the same time, we need to strengthen our market presence and drive the strategic development of Concardis forward. The industry knowledge and strategic experience of our new shareholders will help us advance our business significantly. Our aim is to offer both small and medium-sized businesses efficient payment solutions for multichannel selling and to accompany large retail chains in their internationalisation strategies with cross-border payment products.’

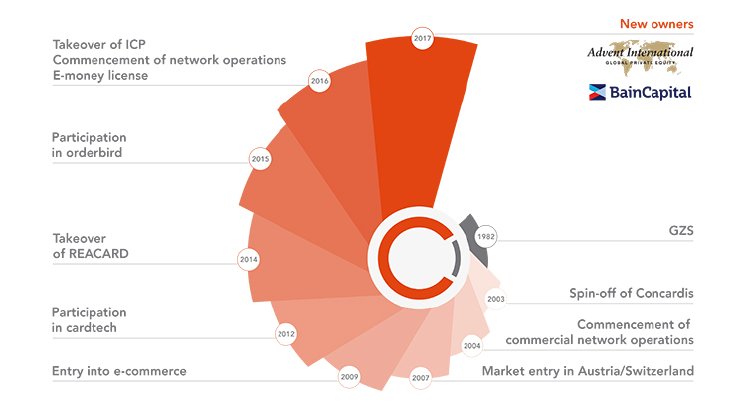

With this change of ownership, Concardis GmbH is leaving the ownership of the German banking industry. The former shareholders were German private banks, cooperative banks, savings banks and DZ Bank. Originally focused on connecting retailers to the credit card system, the company has expanded its core business in the past two years to processing all cashless payments – at the point of sale, in e-commerce and for mobile transactions. With further investments in innovation and strategic acquisitions, Concardis is to continue on this track with the goal to establish a payment champion based in Germany.

The acquisition of Ratepay by Advent International and Bain Capital Private Equity that was announced in April this year forms part of this growth strategy. By bringing this invoice purchase specialist into the corporate group, Concardis will be rolling out a key German online payment method across the entire German-speaking region. A study by EHI Retail Institute puts the share of e-commerce transactions completed by invoice in Germany in 2016 at 29 per cent. The growth potential of shopping against invoice in the whole German-speaking area is estimated to be significant. In German-speaking countries, Concardis offers all offline and online payment methods from a single source.