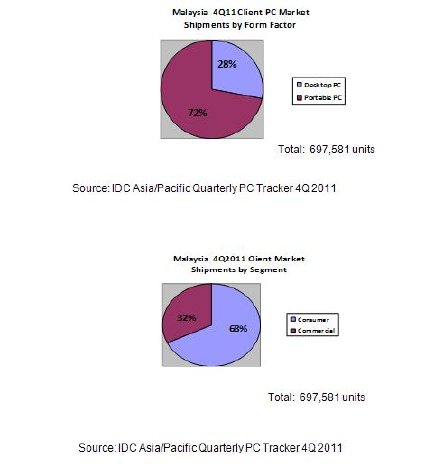

The commercial segment outperformed the consumer segment in 4Q11, growing 22% from the previous quarter compared to a 6% decline for the latter. According to Ng Juan Jin, Market Analyst for Client Devices Research at IDC Malaysia, "The education segment was the primary contributor to the commercial market thanks to a large fulfillment of Classmate PCs to Primary 5 students in Terengganu schools. Public and private tertiary institutions also increased their spending during the months leading up to the year's end." However, overall enterprise spending in 4Q11 showed mixed results. Juan Jin explains, "The large enterprise segment posted a stronger quarter due to large refreshment cycle orders from global accounts. However, hard disk drive shortages resulted in vendors prioritizing these higher revenue generating deals over shipments to SMEs in this quarter."

In the consumer segment, MNC vendors saw hard disk drives meant for local PC and notebook production diverted to higher priority countries in the region, such as China and Indonesia. In light of these shortages, several vendors temporarily raised the price of their product lineups in order to maintain their revenue. However this decision did not pay off as price-conscious consumers avoided spending in this quarter and preferred to wait for an eventual decline in prices. These issues were further compounded by channels facing high inventory levels from previous quarters. Distributors and retailers held off on bringing in new stocks until the retail market recovers.

Juan Jin continues, "We should see improvements in 1Q12 compared to 4Q11. Firstly, over 300,000 netbooks under the Malaysian Communications and Multimedia Commission (MCMC) 1Million Netbooks program will be shipped this quarter. Hard disk drive supplies are also expected to return to normal levels by March while vendors will be stocking up in advance for PC fairs in April. However, significant PC market growth may only be seen in 2Q12 as Intel's new IvyBridge architecture launch has been delayed to May 2012. Till then, vendors may be reluctant to bring in excessive stocks with soon-to-be outdated processors."

For further information on the findings contained in this report, please contact Juliana Lai at +603-2177-9255 or julianalai@idc.com. To set up an interview with Ng Juan Jin, please contact JC Ting at +603-2177-9215 or jting@idc.com.