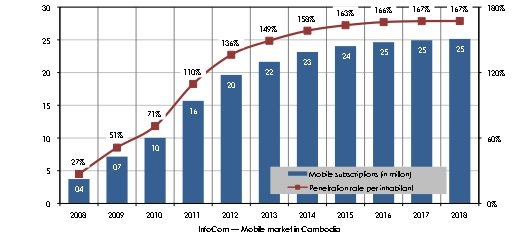

Although official statistics indicate around 19.6 million mobile subscriptions (end-2012) — resul-ting in a penetration at 136% for a country with 14.4 million inhabitants — taking in consider-ation that only 50-60% of the SIM cards are actually active, a much more realistic penetration rate is actually at 80%. This assumption is explained if considering one of the most popular customer acquisition strategy, that is, free SIM card give-aways with minimum phone credits. Additionally, due to a raging price war for on-net and off-net calls, budget-conscious Cam-bodians typically own multiple SIM cards to take advantage of the periodical promotions as otherwise, at standard tariffs, calling other networks would be complex, unreliable and costly. InfoCom expects this practise to be still popular in the next years, with an average middle-income consumer having typically 3 SIM cards: 1 for voice, SMS and mobile Internet, 1 for voice and SMS with another operator and a third one for mobile broadband.

Given the present situation, InfoCom estimates that mobile subscriptions will increase at a 3% a year (CAAGR) until 2018, reaching 25.1 million subscribers, that is, a penetration rate of around 167%.

At present, the major operators claim to have covered all 24 provinces and offer 3G and HSDPA services. Accordingly, mobile Internet (via smartphones and tablets) and mobile broadband (via USB modems and mobile WiFi devices) have become popular in the major cities. Overall, though, the mobile market is predominantly a prepaid voice market, with spe-cial tariffs and top-up discounts for any combination of on-net and off-net minutes and SMS, as well as for mobile Internet. Unlike in other markets, prepaid offers include voice minutes and SMS for on-net and off-net use, to be renewed every 30 to 90 days for the service to con-tinue. To lure users to top-up their cards, operators promote services with huge top-up dis-counts.

There is currently no clear sign that carriers are moving from their aggressive customer acqui-sition stance to a more retention-oriented strategy through postpaid plans, for instance. However, postpaid plans may be in demand in some segments, specifically by the growing number of business users. Consequently, in the near future, the market could show some sign of simple segmentation into residential and business users as opposed to the current situation where there is hardly any differentiation between residential and business offers.