The Institute of Shipping Economics and Logistics (ISL) is currently updating the annual survey regarding the regional distribution of containers in the hinterland of the Hamburg-Le Havre Range. They survey addresses freight forwarders, shipping lines, transport companies, hinterland hubs and distribution centres alike. This research provides a unique and independent insight into the market shares of the large continental container ports in the hinterland and transhipment markets and thus helps the port authorities to aim their investments in infrastructure or make strategic decisions. The current survey will be running until Aug. 15th 2012. More information about the survey and the questionnaires can be found at: www.nectm-survey.isl.org As usually, all participants will receive a copy of the most up-to-date research findings, which should be available in autumn 2012.

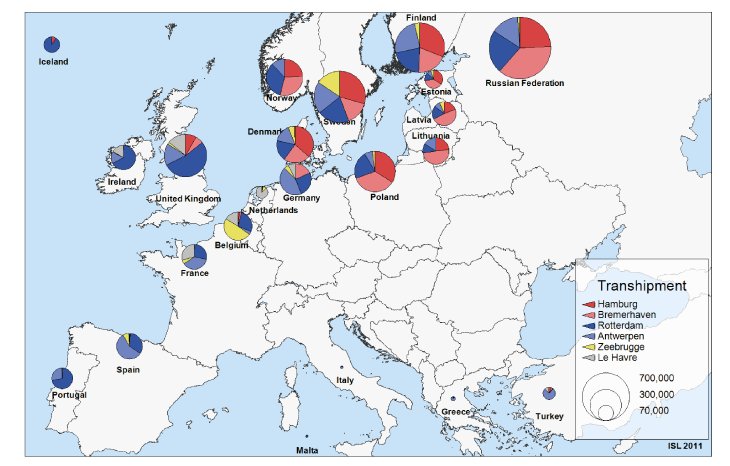

The previous study results for the year 2010 have been shared with the survey participants already at the end of last year. Some of the findings are now presented to the wider public. One finding of the 2010 survey has been that the steep liner shipping crisis of 2009 has in fact seen landslide shifts of market shares in transhipment traffic, but that the market shares in hinterland traffic have remained almost constant - on an aggregated level at least.

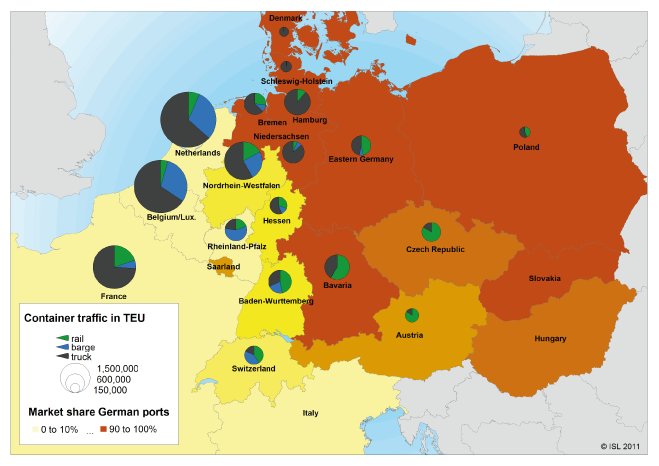

Like in the previous years, the 2010 hinterland market shares are relatively well defined by the - compared to seaborne transport - high costs of hinterland transport and the well-established intermodal connections of the respective hub ports. Together, the six major continental hub ports Hamburg, Bremerhaven, Rotterdam, Antwerp, Zeebrugge, and Le Havre handled a volume of 37.4 M TEU in 2010. Of this, 24.4 M TEU have been hinterland traffic, generating the largest share of activity in the ports. The remaining 13.0 M TEU are attributable to transhipment traffic, hence constituting the smaller, but also the faster growing market segment.

During the current surveys, special attention will be paid to the verification of the modal split of the individual hinterland regions. At this point, the industry expertise, quantifying the truck volumes (for which there is no reliable data) is highly appreciated.

During the years, ISL has established a panel of companies and experts taking part regularly in the survey. This is especially important for time series analyses. At the same time, we always strive to increase the number of participating companies and hence also increase the reliability of our estimates. Therefore, new companies and experts which have not yet been a part of the surveys are always invited to share their insight into the nature of the container traffic flows by taking part in the survey.

It will be exciting to see how the market shares of the rather elastic transhipment markets have aligned in 2011. Based on the port handling figures alone, a preliminary guess is that the Eastern North Range Ports have regained noticeable market shares in the transhipment of containers with the Baltic Sea economies. Yet, confirmation of those estimates will only be available once the current survey of shortsea operators is completed. Like with the hinterland market research, the participating operators regularly receive a detailed summary of the research findings.

Further information:

Despite the high relevance of the container hinterland traffic structure for the development of the port infrastructure, there are very little comparable and reliable transport statistics, especially when it comes to the regional distribution of truck traffic. For several years now, the Institute of Shipping Economics and Logistics (ISL) is providing an independent answer to this and other questions with the help of the transport industry. The feedback of countless interviews, questionnaires and data-collections is embedded and incorporated in the "North European Container Traffic Model" (NECTM).

This NECTM has been developed in cooperation with the Port Authorities of Rotterdam and Hamburg and allows for a detailed portrait of the traffic demand of the individual hinterland and transhipment markets, as well as a unique and standardised insight into the market shares of the ports. Within Germany, the model distinguishes between federal states. Additionally, it features all the European countries serviced by the ports of the Hamburg Le Havre Range.

The data serves as an improved input to the decision-making processes of the various port authorities in Europe.