- Jenoptik reported total order intake of approx. 1.1 billion euros and revenue of around 900 million euros in 2021

- Continuing operations with revenue growth of approx. 22 percent and an EBITDA margin of 20.7 percent (incl. one-off effects)

- Successful contribution to growth by acquired companies, TRIOPTICS reported revenue of around 100 million euros and an operating margin clearly above group average

Continuing operations – include the divisions Light & Optics (incl. Jenoptik Medical – former BG Medical – and the SwissOptic Group), Light & Production as well as Light & Safety.

Due to the signing of a contract to sell VINCORION, the division is classified as discontinued operations already for the 2021 fiscal year, in accordance with IFRS 5.

Total – includes the continuing operations plus VINCORION as discontinued operations.

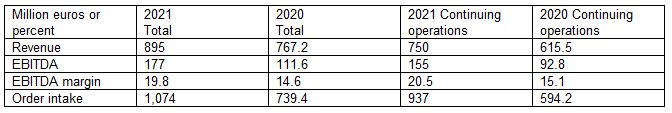

According to the preliminary figures, total revenue in the reporting year came to 895 million euros (prior year: 767.2 million euros) and was thus at the upper end of the forecast range of 880 to 900 million euros.

Revenue from continuing operations amounted to 750 million euros (prior year: 615.5 million euros), an increase of around 22 percent. The strong growth was achieved despite the challenging conditions once again caused by the pandemic, and an appreciable shortage of materials due to worldwide supply chain issues. The ongoing strong demand from the semiconductor equipment industry in the Light & Optics division was outstanding. TRIOPTICS, consolidated for the first time for the full year, also met strong expectations and posted revenue of around 100 million euros. Jenoptik Medical and the SwissOptic Group, consolidated since November 30, 2021, also contributed to this increase.

Total EBITDA came to 177 million euros (prior year: 111.6 million euros), and the EBITDA margin was 19.8 percent (prior year: 14.6 percent). With that, Jenoptik exceeded its target of 19.0 to 19.5 percent. The good operating performance, and positive impacts from restructuring measures contributed to this improvement. In addition, it included one-off effects of around 30 million euros in connection with the acquisitions of TRIOPTICS and INTEROB in 2020 as well as PPA effects of approx. 2 million euros. Excluding the one-off effects, the total EBITDA margin would have been around 16.8 percent.

Continuing operations achieved an EBITDA of 155 million euros including the one-off effects mentioned above (prior year: 92.8 million euros), and thus an EBITDA margin of 20.7 percent (prior year: 15.1 percent).

Order intake of more than one billion euros

Ongoing strong demand, also at the end of the reporting year, bodes well for growth in the new fiscal year 2022. In 2021, the Light & Optics division again posted the strongest growth.

In total, Jenoptik received orders worth 1.074 billion euros in the past fiscal year (prior year: 739.4 million euros).

The order intake in continuing operations grew by approx. 58 percent to 937 million euros (prior year: 594.2 million euros). The order backlog came to 544 million euros (prior year: 299.8 million euros).

Jenoptik’s balance sheet and financing quality remain at a strong level

According to the preliminary figures, the total free cash flow came to around 63 million euros, and was thus at the level of the good prior-year figure of 62,3 million euros.

The continuing operations reported a free cash flow of around 43 million euros (prior year: 52.5 million euros).

“Jenoptik has a very solid financial base, despite large-scale investments we made in 2021 for our future growth,” says CFO Hans-Dieter Schumacher.

Jenoptik expects further profitable growth in 2022

Based on the good order intake in the fourth quarter 2021, the high order backlog, and ongoing promising developments in the core photonics businesses, especially in the semiconductor sector, the Executive Board of JENOPTIK AG is confident to achieve further profitable growth in the fiscal year 2022. As part of its new set-up, Jenoptik will manage its core photonics business in the two new divisions, Advanced Photonic Solutions and Smart Mobility Solutions. The non-photonic activities will in future operate under separate brands within the Jenoptik Group (Hommel, Prodomax, INTEROB).

The final and audited figures for 2021 and the 2021 Annual Report will be published on March 29, 2022.

This announcement can contain forward-looking statements that are based on current expectations and certain assumptions of the management of the Jenoptik Group. A variety of known and unknown risks, uncertainties and other factors can cause the actual results, the financial situation, the development or the performance of the company to be materially different from the announced forward-looking statements. Such factors can be, among others, pandemic diseases, changes in currency exchange rates and interest rates, the introduction of competing products or the change of the business strategy. The company does not assume any obligation to update such forward-looking statements in the light of future developments.