Ambition 2025 Update

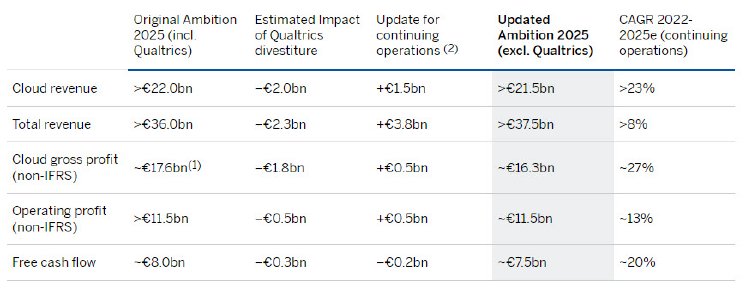

SAP’s Ambition 2025 update demonstrates SAP’s strong cloud momentum, with a cloud revenue ambition of more than €21.5bn excluding Qualtrics. The updated ambition reflects the expected divestiture of Qualtrics (NASDAQ: XM) as well as an update on the expected 2025 performance of SAP’s continuing operations. This update on SAP’s continuing operations is mainly driven by the anticipation of continued rapid cloud revenue growth, a great degree of resilience from the increasing share of recurring revenues, the value of the support and services business, as well as a more favorable currency environment as compared to the original ambition, published in October 2020.

For 2025, the company now expects:

- Cloud revenue of more than €21.5bn

- Total revenue of more than €37.5bn

- Non-IFRS cloud gross profit of approximately €16.3bn

- Non-IFRS operating profit of approximately €11.5bn

- A share of more predictable revenue of approximately 86%

- Free cash flow of approximately €7.5bn

“Today’s Ambition 2025 update demonstrates SAP’s momentum in this new phase of our transformation. Our strong, resilient cloud growth drives accelerating total revenue and operating profit growth. We are increasing our total revenue ambition for continuing operations by close to €4 billion, expect significant further acceleration of revenue growth towards 2025 and beyond,” said Christian Klein, CEO.

“Since the strategy reset in 2020, SAP has made tremendous progress in its cloud transformation. Quarter after quarter, the company has delivered strong results amidst a challenging macroeconomic environment. Looking out at the next 2.5 years, we are now well positioned to accelerate our growth. We are confidently refreshing our mid-term ambition and reiterating our goal of double-digit operating profit and free cash flow growth over that period, while at the same time setting ourselves up for sustainable, dynamic growth beyond 2025,” said Dominik Asam, CFO.

New Share Repurchase Program

Considering its strong business momentum and the expected Qualtrics divestiture, SAP has decided to further step up its capital returns. The new share repurchase program, with a volume of up to €5 billion, is scheduled to start in the second half of 2023 and expected to be fully executed by the end of 2025. It will be implemented based on the authorization granted by the Annual General Meeting of SAP SE on May 11, 2023, and in compliance with the restrictions set forth therein.

The program is conditional on the expected successful closing of the Qualtrics divestiture in the second half of 2023.

“Consistently returning capital to shareholders is a priority and an expression of our financial discipline. This is reflected in our strong policy of increasing dividends, as well as in regular share repurchases which have protected shareholders from ownership dilution,” Dominik Asam, CFO said.

The new share repurchase program follows SAP’s 2020 and 2022 repurchases of around 14 million shares for about €1.5 billion, and around 16 million shares for about €1.5 billion, respectively.

Webcast:

The company will discuss details at its SAP Sapphire Financial Analyst Conference on Tuesday, May 16th at 7:00 PM (CEST) / 6:00 PM (BST) / 1:00 PM (Eastern) / 10:00 AM (Pacific). The conference will be webcast on the Company’s website at https://www.sap.com/investors and will be available for replay.

Visit the SAP News Center. Follow SAP on Twitter at @SAPNews.

This document contains forward-looking statements, which are predictions, projections, or other statements about future events. These statements are based on current expectations, forecasts, and assumptions that are subject to risks and uncertainties that could cause actual results and outcomes to materially differ. Additional information regarding these risks and uncertainties may be found in our filings with the Securities and Exchange Commission, including but not limited to the risk factors section of SAP’s 2022 Annual Report on Form 20-F.

© 2023 SAP SE. All rights reserved.

SAP and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP SE in Germany and other countries. Please see https://www.sap.com/copyright for additional trademark information and notices.