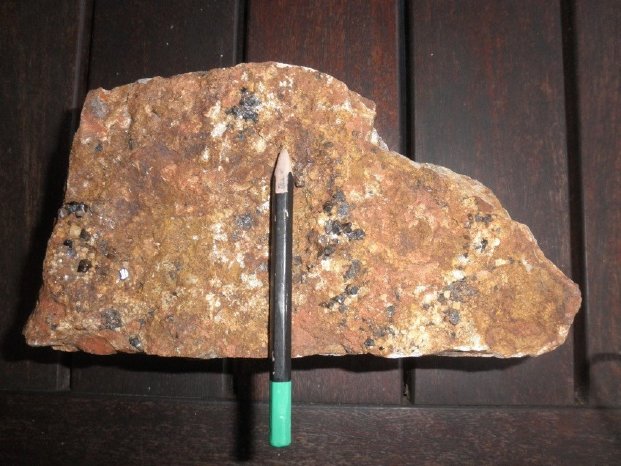

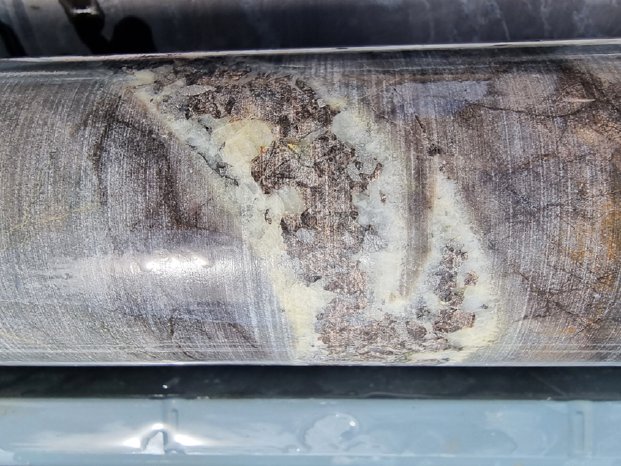

The results confirm First Tin’s hypothesis that due to the selective breakage along veins (Figures 1 to 4), liberation of cassiterite can be achieved simply by coarse crushing to 12mm and screening at 2.8mm. The plus 2.8mm fraction is a discard while the minus 2.8mm fraction goes through the processing plant, thus the mass going through the plant is significantly decreased and the tin grade significantly increased.

Two samples have now been tested, one grading 0.18% Sn (high grade) the other grading 0.10% Sn (low grade).

Results are:

- High grade sample (0.18% Sn)

- Sub 2.8mm size fraction contains 85.3% of the tin in 53.8% of the mass

- This fraction has been upgraded from 0.18% Sn to 0.30%Sn

- Plus 2.8mm size fraction contains 14.7% of the tin in 46.2% of the mass - Low grade sample (0.10% Sn)

- Sub 2.8mm size fraction contains 84.2% of the tin in 57.5% of the mass

- This fraction has been upgraded from 0.10% Sn to 0.15% Sn

- Plus 2.8mm size fraction contains 15.8% of the tin in 42.5% of the mass

This crushed sample was screened at 2.8mm with the oversize then put through a single pass vertical impact crusher (VSI) to scavenge any tin (cassiterite) not already liberated. This product was again screened at 2.8mm and the minus 2.8mm fraction re-combined with the minus 2.8mm fraction from the conventional crushing. The plus 2.8mm material is considered as waste and is sent directly to a waste rock emplacement facility.

The results confirm the premise that the cassiterite (SnO2 - tin ore mineral) is easily liberated at a coarse crush size. The grade of material is increased by 50-67% and the mass is reduced to 54-58% of the original mass, making the rest of the processing facility smaller than would otherwise be required and the starting grade higher.

After the crush stage, the remainder of the plant involves simple gravity separation. Gravity separation testwork on the -2.8mm product of the crushing is currently underway and overall results will be announced shortly.

The first stage of the gravity separation involves screening at 0.4mm with the oversize (60%) going to jigs and the undersize (40%) to spirals.

Results for jigging of the high grade sample show that 27% of the total mined ore can be rejected, with the accepts being upgraded to a 1.21% Sn concentrate.

Results for rougher spiral separation of the high grade sample show that 20% of the total mined ore can be separated to a middling product grading 0.17% Sn for further treatment, with the accepts being upgraded to a 4.57% Sn concentrate.

Putting this data together from the crush, jig and spiral testwork from the 0.18% S sample then, prior to any grinding or additional gravity separation testwork:

- 73% of the mass containing 21% of the tin can be rejected

- 7% of the mass containing 64% of the tin can be concentrated to a product grading 1.94% Sn (pre-concentrate)

- 20% of the mass containing 15% of the tin grading 0.17% Sn reports to a middling product requiring further processing via grinding and gravity concentration to produce a pre-concentrate

This front end and low cost beneficiation shows why the Taronga deposit is unique, and why the initial low grades can be handled economically.

First Tin CEO Thomas Buenger said: “We are very pleased that we have now confirmed our previous hypothesis that the mineralisation at Taronga can be simply and cheaply upgraded at a very early stage in the processing circuit using a simple coarse crushing and screening technique followed by simple jigs and spirals. It is particularly encouraging that even toward the lower end of the grades we are likely to mine, this large upgrading effect still works at the coarse crushing stage ..

The significant increase in the grade of material after simple crushing, jigging and rougher spirals is a major milestone in turning the Taronga deposit into a viable mining proposition, as is the significant reduction in tonnage which will mean lower opex and capex.”

The project is owned by First Tin’s 100% owned Australian subsidiary, Taronga Mines Pty Ltd (“TMPL”).

Enquiries:

First Tin Via SEC Newgate below

Thomas Buenger - Chief Executive Officer

Arlington Group Asset Management Limited (Financial Advisor and Joint Broker)

Simon Catt 020 7389 5016

WH Ireland Limited (Joint Broker)

Harry Ansell 020 7220 1670

SEC Newgate (Financial Communications)

Elisabeth Cowell / Molly Gretton FirstTin@secnewgate.co.uk

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Notes to Editors

First Tin is an ethical, reliable, and sustainable tin production company led by a team of renowned tin specialists. The Company is focused on becoming a tin supplier in conflict-free, low political risk jurisdictions through the rapid development of high value, low capex tin assets in Germany and Australia.

Tin is a critical metal, vital in any plan to decarbonise and electrify the world, yet Europe has very little supply. Rising demand, together with shortages, is expected to lead tin to experience sustained deficit markets for the foreseeable future. Its assets have been de-risked significantly, with extensive work undertaken to date.

First Tin's goal is to use best-in-class environmental standards to bring two tin mines into production in three years, providing provenance of supply to support the current global clean energy and technological revolutions.