Summary

- A high-grade gold exploration project led by Chairman & CEO Gerald Panneton of Detour fame

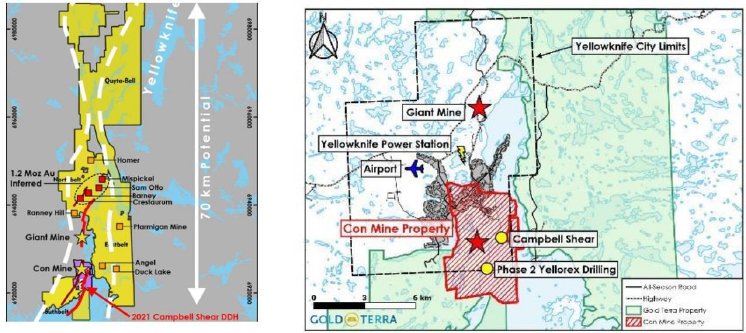

- 14 Moz Au produced @ 16-22 g/t Au in Yellowknife over 5km of Campbell Shear structure, Gold Terra controls remaining 70km

- Underexplored 918km2 brownfield project with infrastructure including 1,900m deep shaft all in place

- Existing near surface 1.78Moz Au resources, historic deep 650koz Au resource

- Historic intercepts of unmined zones assayed 19.3m @ 534g/t Au, 12.4m @ 22.5g/t Au and 6.89m @ 79.3g/t Au

- Deep multi-million ounce potential at Campbell Shear, directional drill program currently underway

- After raising C$2.5M in April (Eric Sprott, Rob McEwen), cash position is C$3.5M

- Gold trading at all-time highs, recently surpassing US$2,400/oz again

An old proverb in mining is to look for deposits in the shadow of a headframe, implying potential mineralization on strike with a deposit of an existing or historic mining operation. Besides this, a practice often seen in exploration is using a different view on existing undeveloped projects. Both these subjects have been applied to the truly district scale 918km2 Yellowknife City Gold Project, containing the 70km long Campbell Shear which had seen 14Moz Au production in the past, owned/earning in by Gold Terra Resource Corp (TSXV:YGT)(OTCQX:YGTFF)(FRA:TXO). After Gerald Panneton of Detour Gold fame came on board as the Chairman in 2019, one of the first things he started out to do was commencing negotiations with Newmont, in order to reach an agreement on the historic Con Mine, as he felt a lot of gold mineralization could still be present at depth. Besides completing various drill programs elsewhere along the Campbell Shear since, he managed to close this important transaction in November 2021.Since then, Gold Terra has delineated the near surface Yellorex deposit (541koz @ 6.95g/t Au Indicated and Inferred, NI43-101 compliant), and is currently drilling deep targets (below -2,000m) by directional drilling, in an attempt to find at least 1.5Moz high grade gold below the former Con Mine workings. An historic resource of about 650koz @ 11-12g/t Au as part of these workings was left behind, and on top of this Gold Terra already delineated another NI43-101 compliant resource of 1.2Moz @ 1.54g/t Au Inferred (mostly open pit) at their Yellowknife Project more to the north.

Once the 1 Moz Au target below the underground workings of the Con Mine is demonstrated, the project will have a critical mass of more than 2 Moz Au alone at the Con Mine. Being a brownfield project in the heart of Yellowknife, this project already looks like a winner according to CEO Panneton.

Management strongly believes there could be an opportunity for a multi-million ounce deposit at depth, and in this analysis, I will discuss the most important subjects of the investment thesis for Gold Terra Resource, which in my view is quite interesting.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. The company

Gold Terra Resource Corp. is a high-grade gold focused exploration and development company with assets in northern Canada. Gold Terra’s 100% owned flagship Yellowknife Project (formerly Yellowknife City Gold Project) in the southern part of Northwest Territories is a district scale land package of 918km2 in the historic district of Yellowknife, which has seen lots of historic gold production.

The Yellowknife Project is located near the city of Yellowknife, and as such close to vital infrastructure including all-season roads, air transportation, service providers, hydro-electric power, and skilled personnel. The district-size property lies on the prolific Yellowknife greenstone belt, covering nearly 70 km of strike length on the southern and northern extensions of the Campbell Shear system that hosts the now closed Con and Giant gold mines, which have produced over 14 million ounces of high-grade gold (Giant mine: 8.1 Moz @ 16.0 g/t Au and Con mine: 6.1 Moz @ 16.1 g/t Au).

Gold Terra Resource is led by Chairman and CEO Gerald Panneton. Panneton is a big name in mining land, being the founder and CEO of Detour Gold (2006-2013), re-discovering the deposit after it closed in 1998 due to low gold price environment, and finally bringing it into production in less than 6 years from acquisition (January 2007 to February 2013). It resulted into one of the largest gold mines in Canada today, producing nearly 600,000 ounces a year with 16 Moz in reserves. Detour Gold was sold eventually in 2020 for C$4.89B to Kirkland Lake Gold. Panneton received the PDAC 2011 Bill Dennis Award for the discovery of Detour Lake.

The second person with a distinguished career in mining is Joe Campbell, He has with over 40 years of global experience in exploration and mining, founded the company as TerraX in 2008, and was instrumental in the acquisition of the Yellowknife Project. . Highlights of his career include the discovery of the Touquoy gold deposit in Nova Scotia (St Barbara), the definition of a 250 million tonne (Voisey’s Bay contains about 140Mt for comparison) nickel laterite deposit in Cuba (Pinares de Mayari), and the discovery of the Meliadine gold deposit in Nunavut (Agnico-Eagle) which he managed through to PFS stage.

Gold Terra Resource has its main listing on the TSX Venture, where it’s trading with YGT.V as its ticker symbol. With an average volume of about 331,513 shares per day and at or above this level for many years now, the company’s trading pattern is liquid, and I expect this to improve further when good drill results for the deep Con Mine Option drilling come in.

The company currently has 331.22M shares outstanding (fully diluted 340.7M), with 9.5M options (all out of the money ranging from 10c to 45c) and remarkably no warrants. This last subject has always been a focus of CEO Panneton, who is a 2% shareholder himself.

A current share price of C$0.075 results in a market cap of C$24.84M. Management has decent skin in the game, as they hold 6.1% together with the Board, the majority held by Gerald Panneton (7.3M shares, and no stock options) and Campbell. Major shareholders are Mackenzie Fund holding 6.6%, SSI Asset Management AG 3,5%, Ingalls Snyder holding 4.5%, US Global 1.1 %, Konwave AG 0.6%, Eric Sprott 6.1 %, Newmont 2.1%, and Rob McEwen holding 1%.

The company currently has about C$3.5M in the treasury. Gold Terra has raised C$2.5M in an oversubscribed, non-brokered flow through financing which closed in April, after CEO Panneton experienced a very good PDAC this year. The chart of Gold Terra Resource looks like this:

Share price; 5 year time frame (Source: Tmxmoney.com)

Gold Terra suffered from deteriorating sentiment after the short lived COVID stimulus package wore off after the summer of 2020, which lasted into the end of 2023. Since then, the gold price has been steadily rising to all-time highs, causing producers and developers to follow suit. Most explorers are still waiting for this renewed enthusiasm, but as most investors will know, if the explorers start showing up on the radars of investors, the leverage to metal prices usually is most significant in this category, especially with a discovery. And this is exactly what Gold Terra is looking for with their current drill program.

3. Yellowknife Project

The Yellowknife Project is a true district scale 918km2 gold exploration project located in the southern part of Northwest Territories. As the location is pretty nordic, Yellowknife's climate is subarctic in nature, with cold winters (-10 to -45°C) and mild to warm summers (+10 to +30°C), but Gold Terra Resource doesn’t have to deal with long winter breaks (5-6 months), as drilling can continue despite snowfall, within limits of course.

Gold Terra’s predominantly 100% owned flagship Yellowknife Project (YP) in the southern part of Northwest Territories is part of a district scale land package of 918 km2 in the historic gold mining district of Yellowknife, very close to the former producing Con and Giant mines (total of 14Moz production at 16-22g/t Au). The project covers a mostly underexplored 70km of the Campbell Shear, which contains all mineralization (present and produced) so far. The only parts not owned or optioned by Gold Terra are around the former Giant Mine, which are owned by the Federal Government, and are subject to a large, extensive clean-up/remediation operation. None of this is applicable to the former Con Mine fortunately, optioned by Gold Terra.

Although the Con and Giant mines are separated by about 5km, it is believed by experts that both mines are part of the same mineralized system, only to be displaced by major faults. The company holds 100% of the project, subject to certain underlying royalties on most of the patented land parcels, on average 1.5%, and Osisko Gold Royalties has an option on a significant part of the claims to purchase up to a 3% total NSR, Osisko’s NSR depending on existing royalties.

The Con Mine Option, part of the flagship project and which for example covers all former Con Mine workings (including an existing 1900m deep Robertson Shaft which is still intact and can easily be dewatered and refurbished) and is currently the focus of Gold Terra, is subject to an earn-in agreement with Newmont. Gold Terra has to spend C$8M before November 2025, of which already C$11M has been spent to the end of 2023, The goal is to outline at least 1.5Moz Au in all categories, after which Gold Terra has to make a C$8M cash payment and grant a 2% NSR to Newmont to gain full ownership, subject to a 51% buyback in case the company delineates a minimum of 5 Moz Au and completes a Feasibility Study..

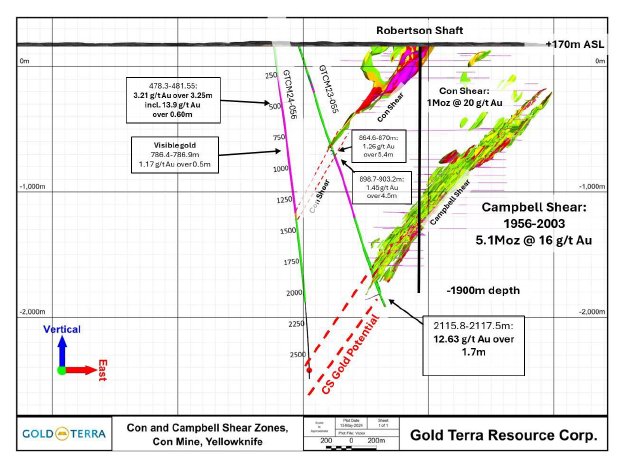

The Yellowknife Project consists of two NI43-101 deposits so far, YP has 1.2Moz @ 1.54g/t Au Inferred and the Con Mine Option has 541koz @6.95g/t Au Indicated and Inferred. The Con Mine Option also has a historic resource of about 650koz @ 11-12 g/t Au at depth, below the former Con Mine workings, all part of the Campbell Shear. The idea is to look at another location below these workings (-2,000M) for more gold, as earlier historic drill results in unmined areas of the old workings identified stellar intercepts like for example 19.3m @ 534g/t Au, 12.4m @ 22.5g/t Au and 6.89m @ 79.3g/t Au at about -1,600m to -1,700m depth.

4. Exploration Focus

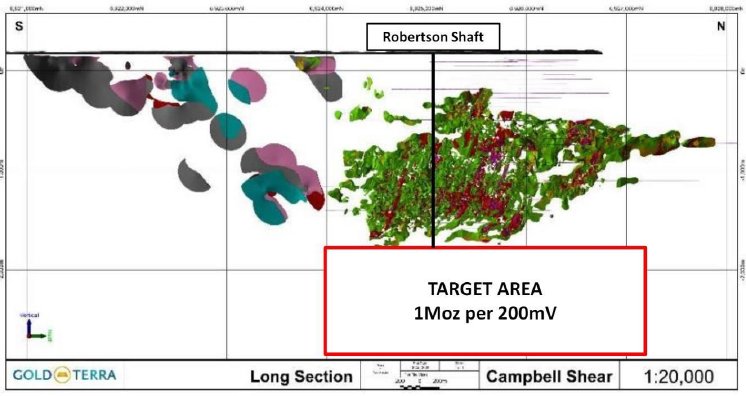

The main exploration target of Gold Terra is the Campbell Shear, with the company recently commencing the start of a deeper 5,000 metre drilling program to test the Campbell Shear at depth, south of the former producing Con Mine, and this Shear is the main subject of the Newmont JV, and also the main reason Gerald Panneton joined Gold Terra. As far as I am concerned, the following long section taken from the presentation is the most important image of the entire article, as it shows what management is after:

Keep in mind this is not an easy task. Please note the significant depth, and the high grade pods (red-magenta) spread out over the Con deposit. I assume these >100 gram*metres intercepts must have been pretty high grade, as the average grade for the entire mined out deposit is 16g/t Au, the majority of tonnage consisting of 5-20gram*meters Au (green color) intercepts. When doing a quick estimate and simplifying the Con deposit as a lense/sheet with dimensions 1000*1000*4m*gravity of 2.75t/m3 and an average grade of 16g/t Au, it resulted in 5.7Moz Au, so close enough to the factual 5Moz Au actually produced accounting for dilution and losses.

This means that the average intercept drilled through the deposit returned 4m @16g/t > 64gram*meter, but the majority of intercepts is much lower when looking at the 3D visualization of the Con Mine deposit (green area), meaning the high grade pods (estimated at 15-20% of tonnage) need to compensate to the tune of say 4m @ 50-60g/t Au or even better. Obviously the average grade doesn’t need to be 16g/t Au anymore at current gold prices, and an average grade of 8-9g/t Au will be pretty economic as well according to my estimates. The historic hole Y88 returning 5.27m @ 13.72g/t Au fits well into that category.

Gold Terra has been drilling at significant depths since April 2023, and hit the Campbell Shear successfully, as shown by an intercept of 1.7m @ 12.7g/t Au. As always, keep in mind that the Con Mine mineralization has been pretty variable, so hitting an almost economic result at the first hole is a good result. The company has been hampered by wildfires in August and September of last year, and in addition the driller made a mistake when setting up a directional hole from the first master hole, which had to be abandoned as a consequence. A new master hole has been drilled since February after a short winter break (most of it compensated by the driller for the mistake), and it is targeting the desired zone a few hundred meters deeper, with the additional advantage of the following directional holes testing a larger area:

Gold Terra just announced that they are progressing well, drilling at a depth of 2,265m, targeting the Campbell Shear at 2,600m depth. Hopefully they will intersect it, so the follow up directional drilling could explore a zone from 1,900m to 2,800m depth, having an estimated strike length of approximately 1,000m long. Interesting tidbit of information is that the new master hole 056 also hit mineralization when intersecting the Con Shear (0.6m @ 13.90g/t Au), which produced 1Moz @ 20g/t Au in the past, so it can’t be ruled out that ounces are waiting to be found there as well.

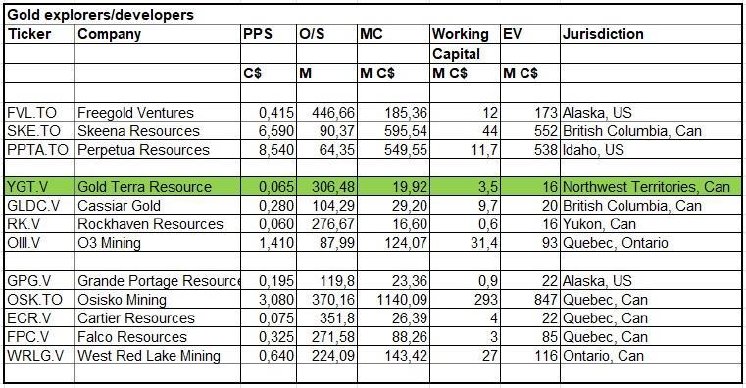

Let’s wait and see what the drill bit could prove up at depth, drill results for hole 056 are expected around the end of June. Of course, any hint on a potential resource increase is pure speculation, but in case Gold Terra might delineate 1.5-2Moz Au or (much) more at depth as management hopes, a peer comparison could shed some light to future valuation potential for the stock.

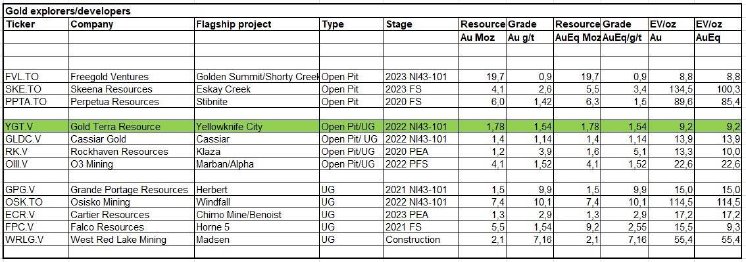

5. Peer comparison

In order to get something of a grasp on upside potential for the share price, I usually revert to peer comparisons based on Enterprise Value (EV)/ounces of gold (oz Au) ratios and Market cap/Net Asset Value (P/NAV) ratios. The EV/oz comparison is very global of course, as for example a project without economic studies being completed on it doesn’t say much about the profitability and economics of those ounces. However, if the resource alone provides investors with certain clues about this profitability, it could indicate a certain broad range of value.

In general as a continuous reminder for investors, a peer comparison as a valuation method isn't perfect as every single company has a unique set of parameters and should actually be analyzed in full and normalized as far as this is possible of course, and EV/oz doesn't say anything about profitability of the project as mentioned, but also not about potential high capex, potential permitting issues, capability of management etcetc, but with some comments to go with such a peer comparison it provides at least an indication, which is my intention.

I picked a number of well-known companies, all having at least a NI43-101 compliant resource, all of them in Canada or the USA, gold-focused, and as Gold Terra has a combination of open pit and underground resources, I rounded up a group with likewise combined projects. For further understanding, I also added open pit only and underground only projects. The latter group is particularly of interest as much of the exploration potential of Gold Terra is believed to be at depth, although most of the currently defined ounces are open pittable.

The EV/oz metric globally indicates that Gold Terra isn’t undervalued at the moment, considering stage, size and quality of deposits. As can be seen, the overall average grades of the open pit/UG projects ranges below 1.54g/t Au, as they consist for the most part of open pit resources. As mentioned, this could change fast if Gold Terra finds sufficient, deep mineralization akin to the historic Con Mine grades, gearing economics more towards a future, more profitable underground operation. The higher EV/oz metrics of these peers (open pit and/or underground) could indicate further advanced stage, more institutional ownership, better profitability and/or more Tier I potential, so if Gold Terra indeed manages to find 2-5Moz Au at high grade at depth as CEO Panneton hopes for, the upside could be very significant. On the other hand, developers like Cartier or Falco have low EV/oz valuations despite being advanced, because of their relatively low grade, impacting economics. This is all still early days of course for Gold Terra, the only way to prove up high grade resources is to delineate them by lots of drilling, and this is exactly what is happening now.

6. Catalysts

Although Gold Terra is already backstopped by 1.78Moz Au in resources, the markets still treat it as a binary exploration play for now. Therefore, only solid drill results that could set the company on a path to a deep, economic 1.5Moz Au resource will have impact. As Gold Terra has almost reached its target depth for the master hole, a compelling drill result from hitting the Campbell Shear is an important catalyst. This master hole will then be followed up by a series of directional holes, taking up far less time to be completed and assayed.

- Drill results for the master hole 056, expected by the end of June, followed by a summer break

- Drill results for the first set of 2-3 directional holes, expected by the end of October

- Other catalysts for 2025 and beyond include:

- 2025 drill program of 5000 to 10,000m aiming for the Campbell Shear high grade target below Con Mine

- Winter 2025 drill program of 10,000m aiming at the Campbell Shear near the C1 shaft

- Winter 2025 drill program of 10,000m aiming at the Campbell Shear North of town + Zone 14

- 2025 Updated Resource / PEA (Target +2 Moz at Con Mine)

- 2026 PFS / FS completion = Production decision

These are exciting times for Gold Terra, as proving up the Campbell Shear a few hundred meters deeper at the Con Mine Option property would increase the mineralized potential and amount of drill targets even further. CEO Panneton is hunting for 2-5Moz high grade gold at depth below the historic Con Mine, as he believes mineralization continues at depth here, just like the Red Lake Mine for example. With a 1,900m deep shaft already in place which can be refurbished for a fraction of development costs, Gold Terra is positioned well in case they find their treasure. The assay results for hole 056 are expected back from the labs around the end of June, and this is only the beginning of much more news flow involving upcoming drill results after the summer. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Gold Terra Resource is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldterracorp.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.