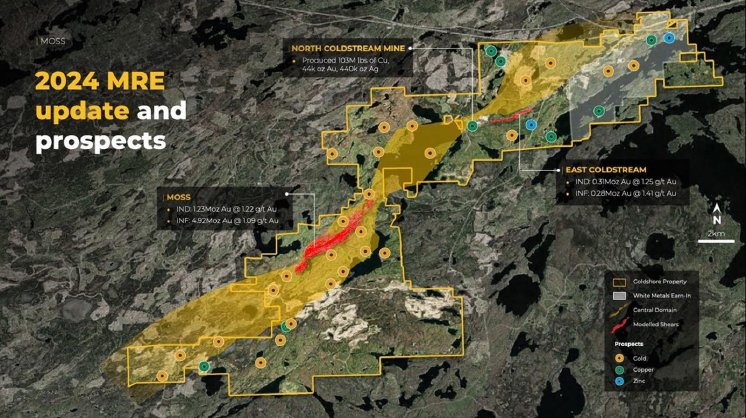

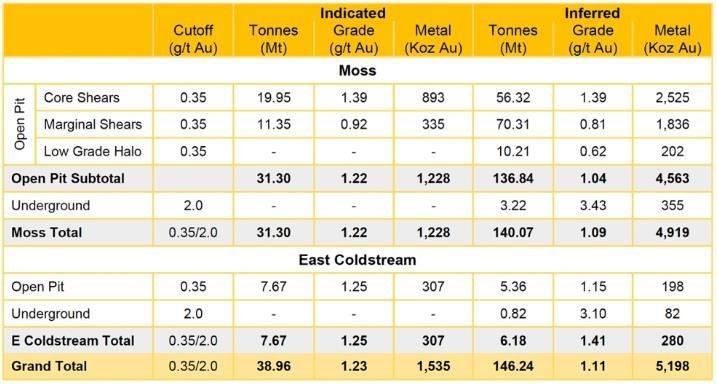

The NI43-101 compliant 1.5Moz Au Indicated and 5.2Moz Au Inferred Mineral Resource was slightly larger than the last 6Moz Au Inferred resource, at a combined total of 6.7Moz Au. It was good to see Goldshore starting to convert Inferred into Indicated, with increasing grades. A higher confidence level is always good to have when engineering a Preliminary Economic Assessment (PEA), which is scheduled for later this year, always a useful first indication of economics. There is a lot to talk about regarding resource modeling, strategy and valuation, and I will do so with CEO Brett Richards and VP Ex Pete Flindell in this article.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Goldshore Resources’ resource potential/economics including the non-NI43-101 compliant combining of Indicated and Inferred resources are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Goldshore or Goldshore’s management. Goldshore Resources has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

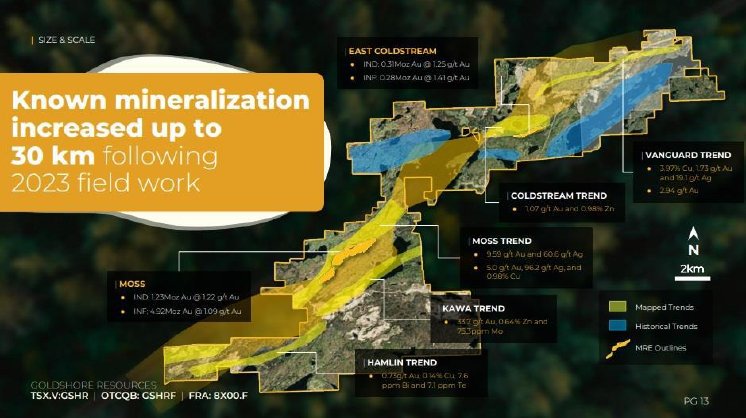

When Goldshore Resources announced the new updated NI43-101 compliant resource estimate for their Moss Gold project on February 6, 2024, the company not only showed resource growth and grade improvement, but also a partial conversion of Inferred ounces into Indicated, which is important for Moss. As the last updated resource caused a lot of confusion due to the overly conservative QP, CSA Global, investors definitely wanted to see a report that crossed the t’s and dotted the i’s this time around. New QP, APEX Geoscience, did just that, and although tonnage remained almost the same, new constraints and insights on modeling and the use of historic results generated a combined Indicated and Inferred resource of 6.7Moz Au, at an average grade of about 1.12g/t Au, versus 6.0Moz @ 1.02g/t Au Inferred for the last May 2023 resource estimate.

The indicated open pit total of 1.5Moz Au @ 1.23g/t Au is a significant advantage when contemplating a smaller 5,000tpd PEA scenario, as for example a 100koz per annum 2Moz Au total production scenario as calculated in my last article would be mostly covered by higher confidence Indicated ounces. Also of interest is the sensitivity table, as no less than 3.5Moz Au @ 1.98g/t Au remains for Moss at a cut-off of 1g/t Au, which is a very good grade for an open pit project. Of course as a lot of the higher grade ore is located below 200-300m depth, which requires a lot of sub-gram material to be mined, so Goldshore can’t just carve out a 2Moz @ 1.9g/t Au open pit production profile.

VP Exploration Pete Flindell notes the flexibility of the project saying: “Our paused PEA showed a 30Ktpd operation can sustain grades over 1 g/t Au for the first 7-10 years, an average annual production rate in excess of 250Koz Au and a life of mine strip of 3.4:1. The new model looks like it may support a smaller open pit operation with a grade north of 1.5 g/t Au, producing ca.150Koz Au per annum with a life of mine strip below 3:1. This is because of the density of shear-hosted mineralization along the core of the Moss Trend in the upper 200m.”

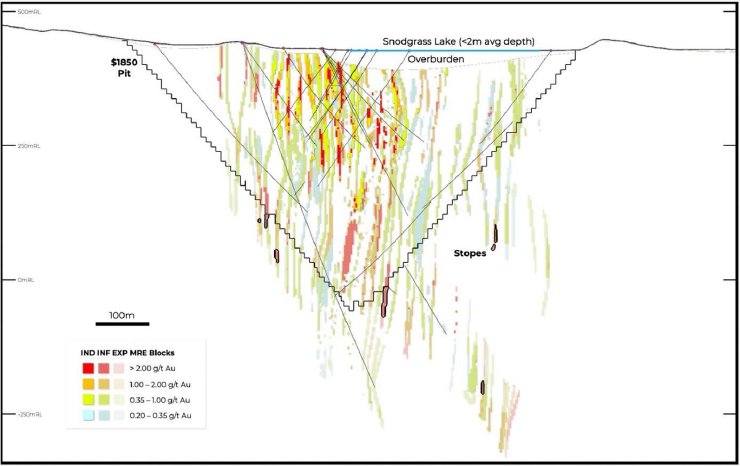

APEX optimized the open pit using costs from the paused PEA and an $1850 gold price. This creates a “superpit,” projecting to a depth of 400-500m, which shows that the Moss Gold deposit can sustain a large scale project. However, this would require a lot of infill drilling to convert as much as possible into Indicated for a PFS, plus metallurgical test work to prove up the viability of heap leaching for lots of low grade material. Furthermore, this would be the large capex option for Moss. Therefore, the smaller production scenario focusing on the upper 200m as mentioned above would be cheaper to develop and of course the small capex option.

Let’s get back for a minute and see how APEX reinterpreted the available data from 738 drill holes in total (historic and current drilling), and saw possibilities to convert into Indicated after all, after CSA refused to do so. First of all, they did an in-depth review and validation of all historical assays, and they also reviewed previous evaluation of twin drilling and resampling programs. APEX found that the twin holes generally exhibited corresponding mineralization with the historic holes with a degree of variability expected for a gold deposit, and resampled historic core showed no significant bias in resampled assay values versus original values. They did note that the amount of twinning and resampling wasn’t enough to draw definitive conclusions, but is adequate for a PEA, which is scheduled to be completed later this year once the viability of heap leaching is determined, and Goldshore/APEX can scope the proper process and project around the deposit.

As a consequence, APEX conducted a spatial paring analysis, comparing distribution of historical assays with modern drilling data. APEX compared assays from similar geological settings, noting that historical assays from low grade mineralization were not well represented because of high detection limits (effectively 0.35 g/t Au) or because the core was not sampled. This dataset contained thousands of paired samples, providing sufficient certainty for this current MRE. They concluded that the historical and modern paired data were similar without evident bias for lab methods or generations of data, providing sufficient confidence regarding historic drill data to complete this MRE.

It was interesting to see that APEX, after comprehensive modelling, developed shear-hosted gold estimation domains, based on Goldshore’s geological model to guide this domain modelling, and facilitate density assignment by geological unit. As a result, gold mineralization is represented by so-called Core Shears and Marginal Shears, with Core Shears containing higher grade gold in granodiorite units, and Marginal Shears containing lower grade gold in different host rocks. In total, 94% of gold mineralization of the MRE is contained in these 2 shear types. This constrained model reduced the amount of low grade diluting the shear-hosted gold mineralization, which is why the average grade increased by more than 10% in the new MRE. Through lots of cross sections, the potential for shears continuing to depth, along strike and in parallel settings is obvious, but the exploration for deeper mineralization will have to wait as comprehensive, deeper drilling would cost a small fortune.

VP Ex Pete Flindell was pleased with the work APEX had done so far: “APEX have completed a thorough and objective review of the geology of the Moss and East Coldstream Gold Deposits, and the underlying drill database. Their implicit modelling of core and marginal shears has led to a more accurate model of the gold distribution. This has resulted in a significant improvement in the Mineral Resource Estimate, which can now form the basis for infill and step out drill planning, and a definitive PEA. Their work also highlights immediate potential to grow the MRE in and outside of the RPEEE pits.”

As there is no sufficient budget for a costly drill program at the moment, Goldshore Resources will continue with a less expensive, but extensive program of relogging and resampling of all historical drill holes whose collars have been located and accurately surveyed. Where possible, these drill holes are also being surveyed using modern downhole surveying equipment. Resampling of historical drill core will continue, although most core blocks are now illegible rendering resampling impossible.

It is good to see them having the budget and time to optimize their PEA scenario, after members of the SAF Group came in, with Brian Paes Braga providing most of the money himself. I wondered what Paes Braga’s idea is for scenarios to create shareholder value. CEO Brett Richards commented the following: “BPB now owns 11% of the company – 31M shares. SAF Group are now the strategic partner which comes in to buy the back end of a charity flow deal if we decided to finance a drill campaign, which is great to have. However, we are both not interested in doing this on this valuation, so we will let the market determine when we are able to drill.”.

This all makes sense, and to be honest it is strange to see a junior with an economic and significant resource being in this position, entirely at the mercy of the markets. It is what it is as sentiment hasn’t been helpful the last year or so, despite the gold price doing very well. I discussed the extremely cheap valuation of Goldshore and what to do about it with CEO Richards at length.

The Critical Investor (TCI): Would you like to use the 1.5Moz Ind and for example 1Moz Inf as a base for a small 5000tpd PEA scenario regardless of met work results, or do you want to increase Ind further before including into the PEA?

CEO Brett Richards (BR): “I can’t answer whether we will do a PEA on this resource or whether we step out, drill and add ounces to our global inventory. I don’t know – because the market is not giving us anything right now, and we can’t make decisions on a $25M MC. So I guess the answer is “yes” for both stepping out and adding ounces; and “yes” for infilling and commencing a study (PEA / PFS). I am just not certain of the timing or the sequence, as the market will determine that based on how it values our higher quality resource.”

“If we were to conduct a PEA right now – I think we would look to delineating a quantity of ore sufficient for a 5K tpd operation (+/-) as we discussed before, and focus on where that is in relative to the pit shells put on the resource; and then hang together a project around that. However, there is an argument for continuing to step out some of these (many) targets, with a strategy to take this to 10M – 15M oz next stage of development. Through our summer field programs, the team has mapped a path to 10-15Moz Au in targets that lie within 5km of Moss.’

“Given the nature of this ore body – I think we would be jumping ahead by predicting what processing method we should be looking at, relative to the quantity or type of ore or grade of ore we have. I think methodically, we need to understand whether we drill for quality or quantity – as that will shape the discussion around what a study looks like after that. Only the market will tell us this.”

TCI: Would you ever skip a PEA and go for a PFS?

BR: “I think the Moss Gold Deposit needs to be better understood from a quantum perspective before we scope a project. That being said, we may not have the share price luxury of either infilling the current resource to PFS levels; or fully exploring (drilling) the size of the upside. We will eventually need to validate the economic viability of what we have by doing a PEA on whatever size resource we determine we want to work from as the starting point.”

“One critical component of scoping the correct process is also understanding the metallurgical performance of all of the possible processing permutations. The key missing element of this is whether heap leach recoveries are high enough (>50%) and can be combined with flotation (re-grind and CIL) of the sulphide associated material. Is that the most optimum – we will hopefully answer that in the coming months.”

“To design a flotation plant plus HL, delivers a meaningful production profile of >350K oz per annum for >+14 years, this would require circa 10ktpd going through a flotation plant on a (low grade to high grade) cutoff at or above 0.8-1 g/t Au (so head grade for LOM would be > 1g/t Au, and in the early years close to 2 g/t Au.)”

“If heap leach column tests come back positive, then this option changes the project profile completely, and makes for a very economically robust option (HL + Flotation @ 10ktpd).

The heap leach results will not be known until June – so we have time to either consider moving right to a PEA on the current resource; or consider a step out drilling campaign to advance the size and quality of the current resource.”

Pete Flindell (PF): “The hybrid process still requires mining at 20-40ktpd, so this is not the small project. We need to evaluate the 5ktpd mill option, but this would be a more selective mining scenario that has not been evaluated. It is likely to be less economic than the above operation, but is probably the stepping stone that Goldshore may need in order to manage initial capex.”

BR: “We are currently trading at less than C$4/oz Au in the ground, and it costs $10-$15 per ounce (discovery costs – depending on season) – so there is no current rationale to support raising funds until we are at least a C$75M market cap company. Historical trading norms are C$20-$25/oz Inferred and $40-$60/oz Indicated – which illustrates a C$137M market cap potential just on Inferred ounces– hence showing the potential for GSHR’s share price to re-rate closer to historical trading norms. But current trends are far from historical norms – and we are uncoupled to trading norms as any gold junior.”

TCI: This all makes a lot of sense. Since you are talking metrics per ounce, one could say these numbers are prohibited to more advanced projects with at least a PEA on them, or more obviously economic resources. I made a case for the small 5ktpd scenario in my last article, based on 2Moz Au production, but this is of course not the entire resource. Don’t you think you are discounted for a good part of the resource, as a big capex project is out of the question for now, and heap leach not a reality yet?

BR: “I think we are discounted to the historical trading norms because of the state of the capital markets, and investors thinking size and scale = big cap ex = only exit is M&A to a major. We have explored all project size options from the largest to the smallest, and everything in between. We will continue to assess them as we get the heap leach met test work back as well. I think we are discounted beyond that (and beyond our peers) because of retail and blog rhetoric on whether or not we have a lake to move (we don’t); what the cost of re-routing the river will cost (it will be reasonable – estimated at $3M in the paused PEA), do we have power (we do), and is the resource real (it surely is) and so on. Let’s face it, we have a Canadian retail market that promulgates mis-information in the public and trades on the margin (and even naked shorts) on that information. We are vulnerable because we have good liquidity; however there will be a day of reckoning and this market could move towards its largest precious metal bull run in our history. In my view, it is not a case of if – it is a case of when.”

TCI: As you once told me you had a 3-5 year timeframe in mind for Goldshore, to explore, develop and sell it. We are 3 years underway now, are you looking around for a suitor for the entire project at the moment if you can disclose?

BR: “I think I caveated that we have 3-5 years to explore develop and then decide what the quasi-exit strategy is: “proceed to construction/build” or “proceed to partner/sell”. As far as the timeframe, you are right – we are in that window, but the market has impaired our (and everyone’s) ability to advance their project in a normal timeline, so we are not at that “fork in the road” yet. So no, we are not shopping the resource or the company to the general market. There is very little M&A appetite in the junior space currently, and we are as undervalued as they come, so why would we engage. Our job is to deliver value to our shareholders, not to someone else’s.”

“I guess the obvious question is: “Why would we sell – for what value ?” We would be better to wait this out for at least 12 months if we were sellers. On an EV basis, we would be more attractive in 12-16 months (all things being equal). Do we sell on the back of a PEA ? I guess that depends if we are at $50M MC or $250M MC. – and the higher the valuation, the closer we are to making a decision to built it ourselves (as we would be closer to financing it ourselves).”

TCI: Interesting to hear the mine-building scenario isn’t out of the question. Something else, since you mentioned earlier on that the required amount of drilling for a PFS might be an issue, let alone the entire 8km long mineralized trend with numerous targets, could you estimate how much drilling you would think you might need for these subjects?

BR: “The question is akin to the length of a piece of string. It can be as long as you want it to be – given the mineralization of the land package we manage. We feel that we could bring a large percentage of the existing MRE resource to M&I for a PFS with 40-50,000m of drilling. We also feel we could add another 5-7Moz Au to the resource with 50,000m of strategic step out and scout drilling, followed by infill and delineation drilling. That tests less than half of the 36 known satellite targets to Moss we have identified as high priority targets for resource addition. So it is a good problem to have, but a problem nevertheless at our current C$26M current market cap.”

“So what is going to deliver the best value ? Proving up a project on the current resource and leaving the upside – or testing the upside and bringing more inventory to a future MRE (albeit most at Inferred). History tells us that quality over quantity usually wins out, due to historical valuation norms – and it may in our case – but we don’t know at this stage until we get the met test work back for heap leach testing, and we can decide a path from there.”

“Recent history has also told us that multi-billion-dollar capex projects tend to get the least valuation – as the probability of financing is quite low; and the probability of M&A is always unknown. So bigger is not always better – but we need some more answers before we scope the processing methodology and plant throughput.”

TCI: Sure, and a 50,000m program isn’t cheap at say C$300/m all-in ( C$15M). Bigger isn’t always better in gold mining, as for example Freegold has about 20Moz Au Ind & Inf but economics aren’t prolific due to partly refractory ore, low grade and high strip ratio, hence the market cap of C$158M, generating EV/oz of about C$8/oz Au. Goldshore doesn’t have all that, and I am convinced a small scenario for Moss could be pretty economic at US$1850 gold and despite the 8.75% NPI (low impact royalty), but I’m also convinced investors like to see a thorough PEA as proof for economic viability first at this stage versus expanding mineralized potential first to say 12-14Moz Au, as a 7Moz Au project would already have an undoable capex at this point. What is your view on this?

BR: “I would tend to agree with your assessment, but even though we announced that we had commenced a PEA with Ausenco in April 2023; the market didn’t respond at all (in fact pulled back) and we paused the PEA, as the market showed us there was no support for any definitive economic results. Quite frankly, good news has been a platform for sellers to get liquid; leading to share prices getting beat up on good news flow (case in point Goldshore).”

TCI: In my view robust economics are important for this project for investors, more important than size at this point. Don’t you think, let’s assume the heap leach testing is successful, it would be best to scope a medium sized 4-5Moz Au project, high grading as much as possible for superior economics, going to a 200-250koz Au per annum production profile, affordable for not only majors but also midtiers?

BR: “I have no other point of reference here other than my experience and opinion, and I would say that there is no (reasonable) small scale capex project for any of these styles of deposits in Canada (even where there is significant and accessible infrastructure). By small I mean sub $200M – so it is about optimizing (and maximizing) the production profile for as low a capex as possible, which is a very delicate balance. Whether there is appetite down the road for M&A to majors or mid-tiers – that is a question for them; as all we can do at Goldshore is focus on what we can control and play within the confines of a gold price environment that we think is reasonable. The size that we scope this project will be right for us – it may not be right for others (who have a different view or a different agenda). “

TCI: I’m curious what size Moss will be scoped at eventually, and what parameters will be decisive. What happens next for Goldshore?

BR: “We continue to utilize our FT dollars to conduct the heap leach column testing; we prepare a (non-drilling) field program for the summer and fall for Pete and his geologist; we prepare a (drilling) field program (and people program) for when we are in a position to raise capital to drill (and that is seasonal – as it requires a different program for a winter start than a summer start); we continue to complete the field mapping and structural modelling we are doing outside the existing resource...and I try and tell the story to as many new people who love the gold macro-dynamic that is in front of us (geo-political / macro-economic / US election impact / global chaos).”

“Gold is going to stay strong (in my view) and gold equities are currently “un-coupled” versus a historic valuation perspective. This won’t stay like this – and shouldn’t stay like this for long. That can only mean good things for Goldshore and Goldshore shareholders in the future – but patience is a virtue I am getting sick of having!”

TCI: As you brought up FT dollars for various things, we also discussed your burn rate, which was quite substantial well into 2023, and has come down since the summer of last year. What have you done to accommodate the current lean and mean MO for Goldshore?

BR: “As we have reduced our staff by 80% and a large part of the team (including me) are on 25-50% salary and no incentives – our G&A is <$60K a month (in fact it is $50K a month average). We have very little marketing and advertising budget (zero) – and are attending one conference this year other than PDAC.”

“We need to be prepared (cash preservation) for a capital market environment that doesn’t come back for 2 years, and currently, we have 24 months of working capital (HD and FT) should we have to wait this out.”

“I have over C$1.5M of my own money into Goldshore as I believe it is a world class gold deposit – and it will be a winner. I will continue to buy more in the future, as this is a project that will go into production one day.”

TCI: Such a low burn rate is good to hear, skin in the game is also important. You can still deliver significant value with the PEA on a skeleton crew I’d say, waiting for better times. What is the status of things for permitting, like baseline work for the EIA? I take it you will need at least a PEA to apply for an EIA?

PF: “We are continuing the background work with the environmental team and community that will give us a head start on the permitting. We will need to complete a PFS to define the scope of the project for the EIA and other aspects of the permitting program, but our current work streams will reduce the post-PFS studies and shorten the permitting timeframe.”

“With respect to the heap leach test work, the paused PEA shows that Moss is a highly economic project without heap leach. It’s just that with it, we can bring production forward, thereby adding ounces to the annual production profile, while reducing the amount of tailings capacity required. So this test program adds real value to a PEA if successful, but it’s not a bust if it turns out not to be viable.”

TCI: As we discussed in the last article, the met work results involving all scenarios including heap leach, are expected in March/April, and the PEA was being scheduled to be complete before Beaver Creek (usually around mid-September), so Moss can be properly marketed to financiers. What is the current status on this?

BR: “We will get the test work back in May/June and present the findings to the market at that time.”

As a reminder for investors, here is the explanation again for any water issues investors might see with the Moss project. Keep in mind just a small local river needs to be diverted, a river that widened at the project and formed a shallow lake, without any protected fish species in it or others that could cause problems. VP Ex Pete Flindell explains:

PF: "Our independent environmental consultants, CSL, have re-evaluated the bathymetric data for inclusion in the upcoming Technical Report. In the process they found errors in the previous statements but noted that measurements of depth assume surface elevations that can change by meters over the seasons. This is what they have written into the Technical Report: Moss Lake and Kawawiagamak Lake occur in the vicinity of the Moss Gold Deposit. Bathymetric surveys show these to average 4.6m and 2.7m, respectively, with maximum depths of 15m and 16m, respectively. The Wawiag River runs along the axis of the Moss Gold Deposit and widens over the Main Zone to form Snodgrass Lake, which averages 1.7m deep and reaches a maximum depth of 4m. This explains why the Ministry of Environment considers the “lake” a river for the purpose of defining water limits for our Permit to Take Water (required for drilling).”

As another reminder, here is the estimated DCF calculation for the Moss Gold project. Considering the amount of infrastructure and power that needs to be constructed, together with the diversion of the small river etc, management expects to start up with a 5,000tpd operation, producing 100-110koz Au per annum, with ballpark capex numbers around US$250-300M. This would mean US$50-60k/tpd which is extremely conservative. For example Nighthawk Gold used US$29k/tpd for their 17ktpd combined open pit/underground operation in their 2023 Colomac PEA. Using an average head grade of 1.75g/t Au, recovery of 94%, strip ratio of 10 : 1 (treating the low grade ore as waste in the operation without the HL part), a total high grade production of 2Moz Au for a life of mine of 18 years, and a conservative average AISC of US$1100/oz because of high strip ratio, stockpiling (Nighthawk used a strip ratio of 9 : 1 and AISC of US$828/oz), my discounted cash flow model (DCF) generated an after-tax NPV8 of US$353M, and an after-tax IRR of 27.3%:

These are very decent numbers, which might be even improved further after met work is completed, and the resource further high graded and/or converted. I’m looking forward to the Moss PEA for sure.

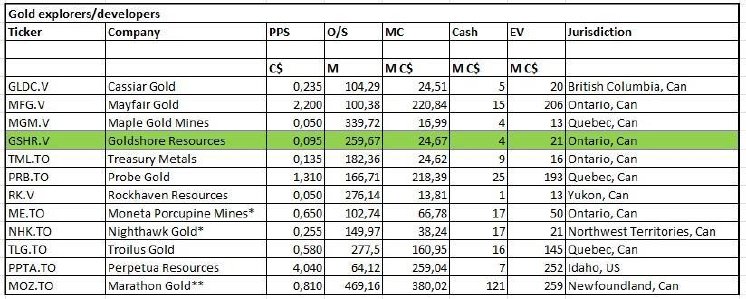

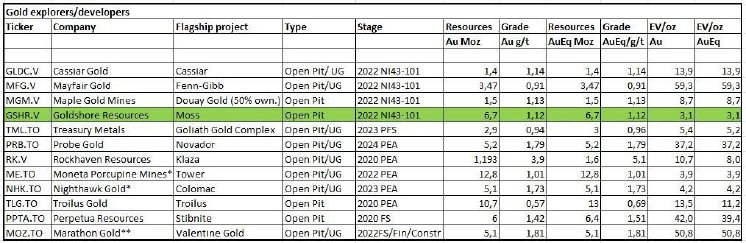

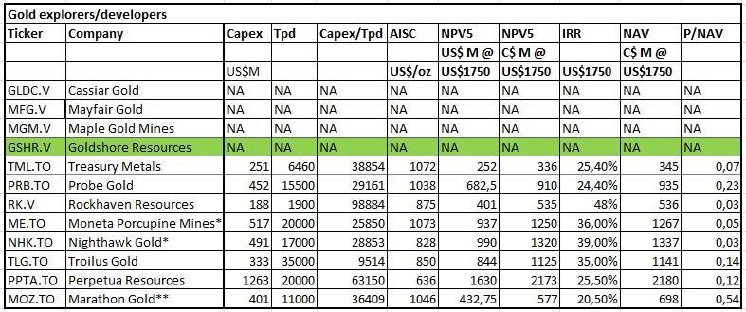

By mentioning hypothetical PEA numbers for Moss Gold, it could be useful to see where the project stands when doing a peer comparison. Here are several Canadian gold project in various stages and either open pit or combinations of open pit and underground. Keep in mind Moneta and Nighthawk merged recently (indicated by *) into STLLR Gold (I assume they mean Stellar Gold), and Marathon was taken over recently by Calibre Mining (indicated by **). As there aren’t too many single open pit projects around in Canada, I added them with their last data as an stand-alone company, as they were delisted only recently.

Next up is the table that provides the EV/oz metric, it is actually the only metric there is for explorers with just a resource estimate, although it doesn’t say anything about economic viability of course without a study.

It will be clear that Goldshore sits among the cheapest peers, and is in fact the cheapest based on EV/oz, but for example Moneta and Nighthawk aren’t far away, of which Moneta has a much bigger resource and Nighthawk a much better grade, and both have recent PEA’s completed. I haven’t studied the other projects in detail, and don’t have explanations why they traded so cheap, or why other comparable projects trade at much higher multiples. However, the projects with the relatively higher grade have this grade predominantly because of underground resources, which often sport higher grades in order to be economic. In my view Goldshore could go a long way high-grading their exclusively open pittable resource at Moss, generating great economics because of it, and in turn separating them from the low-valuation pack. Time will tell.

Goldshore would also end up around 0.05-0.06, firmly in the bottom quartile. It is fascinating how for example a Rockhaven with a very low capex and very high IRR still ends joined last with a P/NAV of 0.03. I haven’t looked into this but there must be a good reason. The same goes for Moneta and Nighthawk. It seems that US$300-450M capex projects aren’t punished for their higher capexes, even Perpetua with a US$1.26B capex has a much higher multiple although it is more advanced and in the process of receiving substantial government grants. Overall it seems the current bad junior mining sentiment drags most metrics down to irrational levels not seen before at these metal prices, high inflation skewing capex and opex or not. Normally a PEA of a strong, decent sized economic project should have a P/NAV of 0.15-0.20 at a gold price discounted by 10-15%, so undervaluation is present across the board here. All wisdom to Richards, Flindell and their team to scope the right project after they received all necessary data, and hopefully the markets cooperate, making things much easier.

Conclusion

With the SAF Group behind them backstopping any future financing, Goldshore seems to have found their coveted “strategic partner / investor”, helping them out when it matters most. The latest resource update provides Goldshore with options, and the ongoing met work will determine which scoping scenarios for the PEA are feasible. It was good to see them converting 1.5Moz Au from Inferred to Indicated, increasing confidence, and all done by desktop study and assay analysis, without new drilling. The upcoming met work results will determine heap leachability and in turn project scope, and the following PEA will show economic potential, and hopefully sentiment has improved by then, potentially causing a re-rating as Goldshore looks pretty undervalued at the moment, together with many peers. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in Goldshore Resources. Goldshore Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldshoreresources.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.