Highlights

- Expands GCOM’s lithium portfolio into the mining friendly jurisdiction of Ontario, Canada.

- Adds a third project in a known lithium belt, recognized for its recent exploration successes including the development of the nearby Seymour Project owned by Green Technology Metals Ltd. (“GT1”).

- Potential upside of critical metals – Molybdenum, Copper, Silver with untested exploration upside.

- Opportunistic acquisition with compelling acquisition terms.

Terms of the Sale and Purchase Agreement

Pursuant to the Transaction, GCOM has acquired an existing Option to purchase a 100% interest in the Armstrong Project for consideration comprised of (i) 1,500,000 common shares of GCOM (the “Common Shares”) to be issued on the closing date of the Transaction; and (ii) CAD$60,000 in cash, payable within five business days after the date upon which GCOM has first completed one or more equity offerings for gross proceeds of a minimum of CAD$5,000,000 in the aggregate.

In order to exercise the Option, GCOM has agreed to assume the remaining obligations under the original option agreement, including: (i) 100,000 Common Shares issuable immediately upon closing of the Transaction; (ii) $15,000 in cash payable on or before November 21, 2023; and (iii) $20,000 in cash payable on or before November 21, 2024. In addition, in respect of the first financing that the Company completes following the exercise of the Option, the Company has agreed to grant the optionor the right to participate in such financing and subscribe for a maximum of 100,000 Common Shares upon the same terms as the financing.

Completion of the Transaction is conditional upon the approval of the TSX Venture Exchange (the “TSXV”) and the satisfaction of certain other closing conditions customary in transactions of this nature.

The Common Shares issued in connection with the Transaction will be subject to a hold period expiring four months and one day from the date of issuance. There are no finders’ fees payable in connection with the Transaction and each of the vendors of the Option and the optionor is an arms-length party with respect to the Company.

About the Armstrong Project

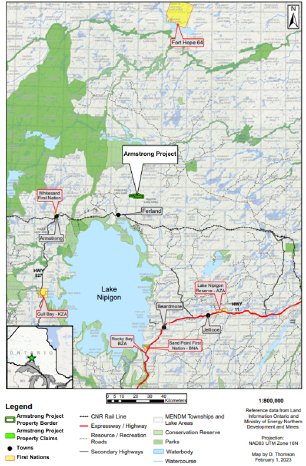

The Armstrong Project resides in the Seymour-Crescent-Falcon lithium trend which is known to host thirteen spodumene-bearing pegmatites along a 26 km trend between the South Aubrey and the Falcon East pegmatite occurrences. Located near the town of Armstrong, significant infrastructure exists nearby including an airport, and rail. The Armstrong Project is road accessible and workable year-round.

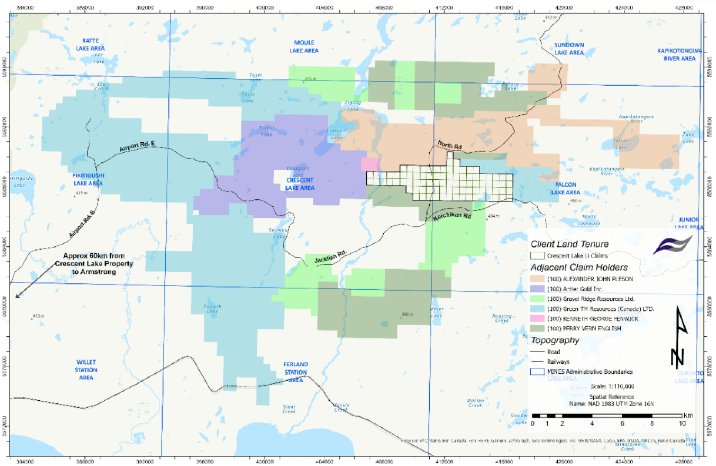

The Project property is within a general area that has been highly focused on the exploration of lithium, however the Armstrong Project appears to have had little or no lithium focused exploration. The neighbouring properties are held by GT1 and Antler Gold Inc. (Figure 2). Both neighboring properties have lithium in drilling and GT1’s Seymour Project boasts a mineral resource estimate of 9.9 Mt @ 1.04% Li2O, with 5.2 million tonnes @ 1.29 % Li2O and remains open along strike and down dip. (GT1 website - Seymour Project)

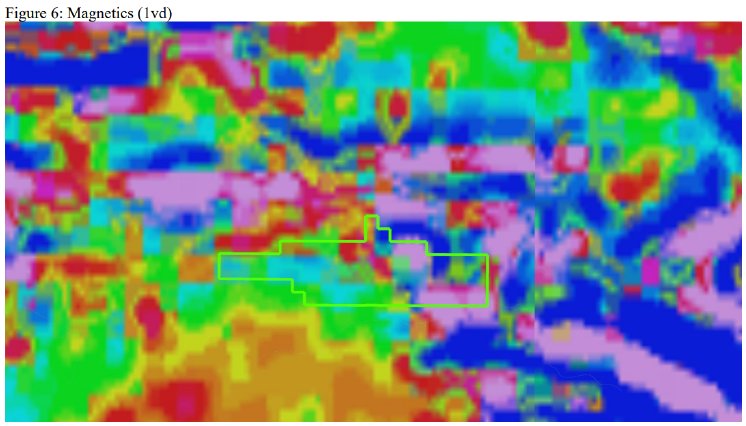

Previous work on the Armstrong Project includes lake sediment work that confirms the presence of various base and precious metals including gold, silver, platinum, palladium, copper, nickel, cobalt, chromium, lead and Zinc. The Project has seen little work in recent times and requires a systematic sampling and mapping program. While the entire property appears to be prospective, traversing and sampling the dikes and faults are expected to be a focus of the Company. The sharp contrast in the first vertical derivative magnetics (Figure 3) is a plausible location for alteration. Another prospective area shows a cluster of pegmatites immediately to the Northwest of the Project property boundary which may be a focus for further exploration work.

Technical Disclosure and Qualified Person

The scientific and technical information contained in this news release was reviewed and approved by Peter Mullens (FAusIMM), Executive Chairman of the Company, who is a “Qualified Person” in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Changes to the Board of Directors The Company also announces that Dr. Richard Spencer has resigned from the Board of Directors in order to focus on other business and personal matters. GCOM would like to thank Mr. Spencer for his contributions to the Company over his 16-year tenure, holding roles such as CEO, Chairman and Director and wish him the best success going forward. About Green Shift Commodities Ltd.

Green Shift Commodities Ltd. is focused on the exploration and development of commodities needed to help decarbonize and meet net-zero goals. The Company is advancing the recently acquired Rio Negro Project in Argentina, a district-scale project in an area known to contain hard rock lithium pegmatite occurrences that were first discovered in the 1960s with little exploration since.

The Company is developing the Berlin Deposit in Colombia. Apart from uranium, for clean nuclear energy, the Berlin Deposit contains battery commodities including nickel, phosphate, and vanadium. Phosphate is a key component of lithium-ion ferro-phosphate (“LFP”) batteries that are being used by a growing list of electric vehicle manufacturers. Nickel is a component of various lithium-ion batteries, while vanadium is the element used in vanadium redox flow batteries. Neodymium, one of the rare earth elements contained within the Berlin Deposit, is a key component of powerful magnets that are used to increase the efficiency of electric motors and in generators in wind turbines.

For further information, please contact:

Green Shift Commodities Ltd.

Trumbull Fisher

Director and CEO

Email: tfisher@greenshiftcommodities.com

Tel: (416) 917-5847

Website: www.greenshiftcommodities.com

Twitter: @greenshiftcom

LinkedIn: https://www.linkedin.com/...

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Forward-Looking Statements

This news release includes certain “forward looking statements”. Forward-looking statements consist of statements that are not purely historical, including statements regarding beliefs, plans, expectations or intensions for the future, and include, but not limited to, statements with respect to: closing of the closing of the Acquisition; the approval of the TSXV; the completion of future exploration work and the potential results of such test work; the future direction of the Company’s strategy; and other activities, events or developments that are expected, anticipated or may occur in the future. These statements are based on assumptions, including that: (i) the ability to achieve positive outcomes from test work; (ii) actual results of exploration, resource goals, metallurgical testing, economic studies and development activities will continue to be positive and proceed as planned, (iii) requisite regulatory and governmental approvals will be received on a timely basis on terms acceptable to Green Shift (iv) economic, political and industry market conditions will be favourable, and (v) financial markets and the market for uranium, battery commodities and rare earth elements will continue to strengthen. Such statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in such statements, including, but not limited to: (1) changes in general economic and financial market conditions, (2) changes in demand and prices for minerals, (3) the Company’s ability to source commercially viable reactivation transactions and / or establish appropriate joint venture partnerships, (4) litigation, regulatory, and legislative developments, dependence on regulatory approvals, and changes in environmental compliance requirements, community support and the political and economic climate, (5) the inherent uncertainties and speculative nature associated with exploration results, resource estimates, potential resource growth, future metallurgical test results, changes in project parameters as plans evolve, (6) competitive developments, (7) availability of future financing, (8) the effects of COVID-19 on the business of the Company, including, without limitation, effects of COVID-19 on capital markets, commodity prices, labour regulations, supply chain disruptions and domestic and international travel restrictions, (9) exploration risks, and other factors beyond the control of Green Shift including those factors set out in the “Risk Factors” in our Management Discussion and Analysis dated May 1, 2023 for the fiscal year ended December 31, 2022 and other public documents available on SEDAR at www.sedar.com. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. Green Shift assumes no obligation to update such information, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.