- Meridian drills layers of shallow Au-Cu-Ag high-grade mineralization at Cabaçal

- CD-639: 9m @ 6.5g/t AuEq (4.4% CuEq) from 95.3m; including:

- 1m @ 9.2g/t AuEq (6.2% CuEq) from 104.0m

- CD-636: 6m @ 2.6g/t AuEq (1.8% CuEq) from 176.3m including:

- 7m @ 4.1g/t AuEq (2.7% CuEq) from 187.2m

- CD-606: 3m @ 5.9g/t AuEq (4.0% CuEq) from 78.7m

- Near surface up-dip extensions of high-grade Au-Cu-Ag mineralization added

- High-grade gold dominant zone grading up to 56.7g/t Au drilled at Cabaçal

Mr. Gilbert Clark, CEO, comments: “Today’s excellent results are all adding to the strengths of the advanced stage Cabaçal Au-Cu-Ag project. Since October last year, an updated geological model has been guiding the ongoing drill program, and these new “targeted” intercepts are the result of this model. We are in the last phases of Cabaçal’s PFS, and these and the future results will be used in Cabaçal’s subsequent studies. With the recent capital raise of CAD 17.2M now closed, the Company is focused on advancing Cabaçal’s and Santa Helena’s resource development program and its belt scale exploration programs in 2025.”

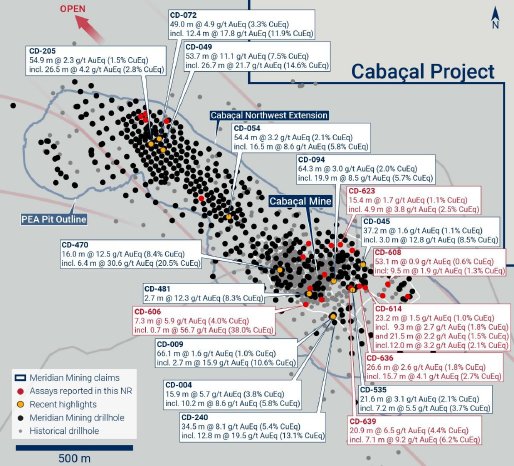

Cabaçal Update

Today’s results reported from Cabaçal have returned excellent results following the completion of our geological review of Cabaçal.

Several holes were drilled into the up-dip section of Cabaçal’s Eastern Copper Zone (“ECZ”), the northeast and shallowest flank of the deposit. These were designed as infill holes for further confidence in the early phases of the potential starter pit. Results include:

- CD-623: 15.4m @ 1.7g/t AuEq (1.1% CuEq) from 16.2m; including:

- 9m @ 3.8g/t AuEq (2.5% CuEq) from 24.0m;

- CD-634: 14.4m @ 1.1g/t AuEq (0.7% CuEq) from 39.0m; including:

- 4m @ 1.9g/t AuEq (1.3% CuEq) from 39.0m; and

- CD-625: 9.9m @ 1.1g/t AuEq (0.7% CuEq) from 23.5m.

A number of holes have been drilled into the Central Copper Zone (“CCZ”) of Cabaçal. CD-639 traversed the upper stacked layers of disseminated mineralization before traversing the Cu-rich basal layer. This basal zone returned 20.9m @ 6.5g/t AuEq (4.4% CuEq) from 95.3m, including 7.1m @ 9.2g/t AuEq (6.2% CuEq) from 104.0m.

CD-614 confirmed shallow Cu dominant mineralization, returning 23.2m @ 1.5g/t AuEq (1.0% CuEq) from 17.8m, including 9.3m @ 2.7g/t AuEq (1.8% CuEq) from 21.6m. Peak grades of up to 8.1% Cu[1] were returned from this intersection. The hole continued onto the lower layers of mineralization including 22.4m @ 0.6g/t AuEq (0.4% CuEq) from 43.0m, 21.5m @ 2.2g/t AuEq (1.5% CuEq) from 111.2m, including 12.0m @ 3.2g/t AuEq (2.1% CuEq) from 119.0m, and 8.8m @ 1.6g/t AuEq (1.1% CuEq) from 165.0m.

Strong supporting positions assisting with modelling in this area include results from adjacent holes:

- CD-636: 6m @ 2.6g/t AuEq (1.8% CuEq) from 176.3m; including:

- 7m @ 4.1g/t AuEq (2.7% CuEq) from 187.2m;

- CD-608: 1m @ 0.9g/t AuEq (0.6% CuEq) from 64.3m; including:

- 5m @ 1.9g/t AuEq (1.3% CuEq) from 82.1m; and

- CD-617: 3m @ 2.8g/t AuEq (1.9% CuEq) from 90.4m.

Several holes were drilled into Cabaçal’s Southern Copper Zone (“SCZ”) down-dip section. CD-606 twinned a hole with lost data, but records indicating that a sample returning >5g/t gold had been encountered. CD-606 intercepted a gold-dominant zone returning 7.3m @ 5.9g/t Au from 78.7m, including a sample returning 0.73m @ 56.7 g/t Au from 80.5m. CD-611, drilled at a slight rotation to strike, returned multiple intersections including 7.0m @ 1.3g/t AuEq (0.9% CuEq) from 112.7m, 23.2m @ 0.8g/t AuEq (0.6% CuEq) from 128.1m, and 14.6m @ 1.5g/t AuEq (1.0% CuEq) from 153.8m. CD-626 drilled through various upper disseminated mineralization layers and a lower layer which included 14.9m @ 0.8g/t AuEq (0.5% CuEq) from 144.7m, 5.6m @ 1.2g/t AuEq (0.8% CuEq) from 161.9m, and 9.6m @ 3.5g/t AuEq (2.4% CuEq) from 182.9m. CD-609 traversed a mining void but returned intersections including 2.1m @ 5.2g/t AuEq (3.5% CuEq) from 47.0m, 14.5m @ 1.3g/t AuEq (0.9% CuEq) from 65.0m.

A number of holes were drilled to test lower grade sectors of the Cabaçal’s Northwest Extension, returning mineralization but without a projection of the higher-grade lodes. The principle focus of the infill program which is expected to conclude in the first half of the year will be on consolidating information where data has been lost from the historical records, after attempts to locate those were exhausted. Drilling will also contribute core to the final phase of metallurgy for the definitive feasibility study, which will include samples representing the first five years of planned production.

About Meridian

Meridian Mining is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

- The initial resource definition at the second higher-grade VMS asset at Santa Helena as the first stage of the Cabaçal Hub development strategy;

- Regional scale exploration of the Cabaçal VMS belt to expand the Cabaçal Hub strategy; and

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold, 0.3% copper and 1.4g/t silver and Inferred resources of 10.3 million tonnes at 0.7g/t gold, 0.2% copper & 1.1g/t silver (at a 0.3 g/t gold equivalent cut-off grade).

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianmining.co and under the Company's profile on SEDAR+ at www.sedarplus.ca.

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

8th Floor, 4 More London Riverside

London SE1 2AU, United Kingdom

Email: info@meridianmining.co

Ph: +1 778 715-6410 (BST)

In Europe

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Technical Notes

Samples have been analysed at ALS laboratory in Lima, Peru. Samples are dried, crushed with 70% passing 85% passing 200µm. Routine gold analyses have been conducted by Au‐AA24 (fire assay of a 50g charge with AAS finish). High‐grade samples (>10g/t Au) are repeated with a gravimetric finish (Au‐GRA22), and base metal analysis by methods ME-ICP61 and OG62 (four acid digest with ICP-AES finish). Visible gold intervals are sampled by metallic screen fire assay method Au‐SCR21. Samples are held in the Company’s secure facilities until dispatched and delivered by staff and commercial couriers to the laboratory. Pulps and coarse rejects are retained and returned to the Company for storage. The Company submits a range of quality control samples, including blanks and gold and polymetallic standards supplied by Rocklabs, ITAK and OREAS, supplementing laboratory quality control procedures. Approximately 5% of archived samples are sent for umpire laboratory analysis, including any lots exhibiting QAQC outliers after discussion with the laboratory. In BP Minerals sampling, gold was analysed historically by fire assay and base metals by three acid digest and ICP finish at the Nomos laboratory in Rio de Janeiro. Silver was analysed by aqua regia digest with an atomic absorption finish. True width is considered to be 80-90% of intersection width, except in the case of those listed in Table 1 as “Subparallel , for which true width is 40-60% of intersection width. Assay figures and intervals are rounded to 1 decimal place. Gold equivalents for Cabaçal are calculated as: AuEq(g/t) = (Au(g/t) * %Recovery) + (1.492*(Cu% * %Recovery)) + (0.013*(Ag(g/t) * %Recovery)), and Copper equivalents are calculated as: CuEq(%) = (Cu(%) * %Recovery) + (0.670*(Aug/t * %Recovery)) + (0.0087*(Ag(g/t) * %Recovery)) where:

- Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856

- Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

- Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

Qualified Person

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management’s experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

[1] Sample CBDS89751: 22.05- 22.5m; 8.12% Cu, 0.559g/t Au & 17.5g/t Ag.