- 5 million tonne Global Mineral Resource (from 67.7 million tonnes2)

- 0 million tonnes of Zinc Metal (from 2.7 million tonnes2)

- 6 million ounces of Gold (from 1.0 million ounces2)

- 8 million ounces of Silver (from 48.5 million ounces2)

- 6 million tonnes of Lead (from 0.2 million tonnes2)

This is an increase of 33.9 Mt (50%) from the previous mineral resource, which incorporated Zone II and III only, of 67.6Mt @ 3.9% Zn, 0.4% Pb, 22.3g/t Ag and 0.5 g/t Au, as reported on 16th June 2020 in Griffin’s 2019 annual report and accounts.

The contained metal has increased from approximately 2.653 to 3.968 million tonnes of zinc metal, 0.242 to 0.606 million tonnes of lead, 48.5 to 88.8 million ounces of silver and 1.025 to 1.593 million ounces of gold.

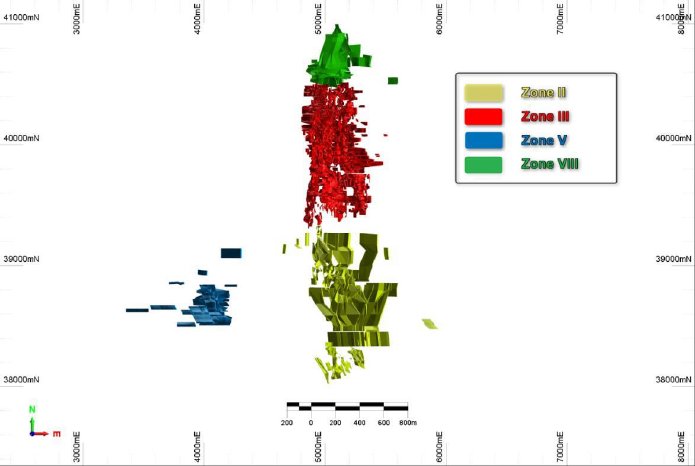

The Mineral Resources at Caijiaying are distributed among four “Zones” with the main line of lodes stretching 3km in strike. Zones II, III and VIII are all accessible from the existing mine infrastructure while Zone V is located just 0.8km west of Zone II. As previously announced by the Company on the 4th January 2021, the Zone II and III Mineral Resources are located within a single newly expanded Mining Licence where the current underground mining activity is focused on the Zone III resources. This recent resource increase has now triggered a development programme to be commenced to enable increased production to 1.5 Mt per annum, delivering an 80% production increase in the next two years.

In the future, an additional mine expansion may be delivered with the inclusion of the Zone V and VIII Mineral Resources that are located within the Company’s Retention Licence adjacent to the west of Zone II and north of Zone III, respectively. The Retention Licence is valid for two years and is the first step in the process of converting the area to a Mining Licence.

The strategy of focusing on near-mine exploration and resource definition drilling has delivered substantial growth to the Caijiaying Mineral Resources. At Zone VIII, surface drilling has defined the northern extension to Zone III a further 500m along strike where it remains open at depth. The Zone V Mineral Resource is the result of detailed research into the historical data set. This significant body of work has enabled the Inferred Mineral Resource estimate to JORC 2012 compliance. Further work is planned to unlock the full potential of these maiden resources.

Further information in relation to the Mineral Resource estimate is set out in the appendix to this announcement, and is also available on the Company’s website, www.griffinmining.com

Chairman Mladen Ninkov said “Finally, the vast potential of Caijiaying has been uncovered and confirms the absolute world class nature of the deposit. I am so delighted for the shareholders, directors and staff of Griffin, and in particular, our great friend and recently departed director Rupert Crowe, who believed in, and toiled so passionately for, Caijiaying. Yet we are still only in the earliest of stages of our journey of understanding what still could lie around us and below us. Remarkable!”

COMPETENT PERSON STATEMENT

The information in this announcement that relates to Mineral Resources is based on, and fairly reflects, information compiled by Mr Serikjan Urbisinov a Competent Person, who is a Member of the Australian Institute of Geoscientists. Mr Serikjan Urbisinov is a full-time employee of CSA Global Pty Ltd. Mr Serikjan Urbisinov has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as Competent Person as defined in the 2012 edition of the Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code). Mr Serikjan Urbisinov consents to the disclosure of the information in this announcement of the matters based on his information in the form and context in which it appears.

[1]The insitu metal value is the result of the Company’s assessment based on LME spot metal prices at 16/02/2021 and does not consider modifying factors such as the cost of metal extraction and recovery.

2 The relative increase in resources compares the current Global Mineral Resource to the total Zone II and Zone III Mineral Resource as at 31st December 2019.

Further information

GRIFFIN MINING LIMITED

Telephone: +44(0)20 7629 7772

Mladen Ninkov – Chairman

Roger Goodwin – Finance Director

PANMURE GORDON (UK) LIMITED

Telephone: +44 (0)20 7886 2500

John Prior

Joanna Langley

BERENBERG

Telephone: +44(0)20 3207 7800

Matthew Armitt

Jennifer Wyllie

Deltir Elezi

BLYTHEWEIGH

Telephone: +44(0)20 7138 3205

Tim Blythe

SWISS RESOURCE CAPITAL AG

Jochen Staiger

info@resource-capital.ch

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) No. 596/2014

Griffin Mining Limited’s shares are quoted on the Alternative Investment Market (AIM) of the London Stock Exchange (symbol GFM).

The Company’s news releases are available on the Company’s web site: www.griffinmining.com

Appendix A

Caijiaying Global Mineral Resource Statement and Parameters

CSA Global Pty Ltd (“CSA Global”) was engaged by Griffin Mining Ltd (“Griffin”) to prepare a Global Mineral Resource estimate for the Caijiaying zinc, gold, silver and lead deposit (“Caijiaying”), located in Hebei Province, People’s Republic of China.

The Global Mineral Resource estimate has been reported in accordance with The JORC Code[1] and is shown in Table 1.

The Mineral Resource for Zone II and Zone III have been depleted using a three-dimensional survey “as built” wireframe which represents the mined-out-voids as at 31st December 2020. The resources at Zone V and VIII are maiden Mineral Resource estimates and therefore have not been reported previously.

The Mineral Resource estimate includes 2.8 Mt of oxidised resource that may require modifications to the processing circuit to enable satisfactory recoveries.

Zone II

The previous Mineral Resource estimate first reported in 2013 is shown in Table 2. As previously announced (See Company Announcement “Zone II Resource January 2021” dated 26th January 2021) the tonnage for the new updated Zone II Mineral Resource has increased by over 100% and the contained zinc metal has increased by over 130%. A total of 109 surface diamond drillholes, 91 reverse circulation surface drillholes and 163 underground diamond drillholes, define the Zone II deposit for a combined total of 91,383 m of drilling. The Zone II deposit was sampled predominantly by diamond drillholes at irregular spacing, but average spacings are approximately 40 m x 40 m. There is already some underground access from the existing Zone III Decline via the 1453 development drive and there has been no stoping of the material defined in the Zone II Mineral Resource estimate.

Zone III

The previous Zone III Mineral Resource estimate shown in Table 3 is based on a block model completed in 2018, which has then been depleted for mining production as at December 31st, 2019.

A total of 192 surface diamond drillholes, 34 reverse circulation surface drillholes and 3,683 underground diamond drillholes, define the Zone III deposit for a combined total of 499,029 m of drilling. The Zone III deposit which is currently in production was sampled predominantly by diamond drillholes at irregular spacing, with a clustering in the main part of the mine, but average spacings are approximately 40 m x 40 m. Holes were generally aligned either to the east or west with dip angles set to optimally intersect the mineralised horizon.

Zone V

A total of 34 surface diamond drillholes, 3 reverse circulation surface drillholes define the Zone V deposit for a combined total of 15,242 m of drilling. The Zone V deposit was sampled by diamond drillholes at irregular spacing, but average spacings are approximately 25 m x 100 m.

Zone VIII

A total of 44 diamond drillholes define the Zone VIII deposit for a combined total of 32,193 m of drilling. Drilling was carried out as close as possible to right angles to the mineralisation. Drill spacing was 50 m to 100 m, to cover the limits of mineralisation in a systematic pattern.

Glossary of key terms

CSA Global

CSA Global Pty Ltd. A private consulting firm providing technical and management services to the global mining industry.

cut-off

The lowest grade, or quality, of mineralised material that qualifies as economically mineable and available in a given deposit. May be defined on the basis of economic evaluation, or on physical or chemical attributes that define an acceptable product specification.

deposit

Natural accumulations of minerals in the earth crust, in form of one or several mineral bodies which can be extracted at the present time or in an immediate future.

diamond drill hole

Method of obtaining cylindrical core of rock by drilling with a diamond-set or diamond-impregnated bit.

g/t

Grams per tonne - a unit of measurement used to express the concentration of an element within a mass of another (same as parts per million).

Indicated Mineral Resources

That part of a Mineral Resource for which quantity, grade (or quality), densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit.

Inferred Mineral Resources

That part of a Mineral Resource for which quantity and grade (or quality) are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade (or quality) continuity. It is based on exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

JORC

An acronym for Joint Ore Reserves Committee. by The Australasian Institute of Mining and Metallurgy (The AusIMM) and the Australian Institute of Geoscientists (AIG) and is binding on members of those organisations. The Code is endorsed by the Minerals Council of Australia and the Financial Services Institute of Australasia as a contribution to good practice. The Code has also been adopted by and included in the listing rules of the Australian Securities Exchange (ASX) and the New Zealand Stock Exchange (NZX)., the purpose of which is to set the regulatory enforceable standards or a Code of Practice for the public reporting of Exploration Results, Mineral Resources and Ore Reserves.

Measured Mineral Resources

That part of a Mineral Resource for which quantity, grade (or quality), densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Mineral Resources A concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade (or quality), and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade (or quality), continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories