Silver in the investment portfolio provides diversification that can reduce overall risk. Therefore, investors should not overlook silver. Even though gold and silver often trend in the same direction, there is a big difference. Silver is more than half demanded by industry. As a result, silver tends to be more sensitive to global industrial activity, according to the Silver Institute. This also increases silver's volatility. The Silver Institute compared silver's historical performance with a number of traditional asset classes, from the beginning of 1999 through June 2022, and roughly speaking, it found that silver has a relatively low correlation with assets. This suggests that silver has valuable diversification potential. For this purpose, the Silver Institute performed portfolio optimization simulations.

The outlook for the global economy over the next ten years is fraught with uncertainty. According to the analysis for this period, everything points to a medium risk in a silver investment. Silver has earned a place in the investor portfolio; it is a cheaper alternative than gold and it can benefit from its inherent characteristics. Like gold, the precious metal is a store of value, but gold only accounts for about eight percent of industrial processing. Silver, which is important in the industry, will benefit from its use in various green energy applications, including electric vehicles, and will add value to a well-diversified portfolio. Discovery Silver or MAG Silver might come to mind here.

MAG Silver - https://www.youtube.com/watch?v=lrelPMuItfk -, together with its partner Fresnillo, is taking care of the Juanicipio project in Mexico. In July, more than one million ounces of silver were produced and sold.

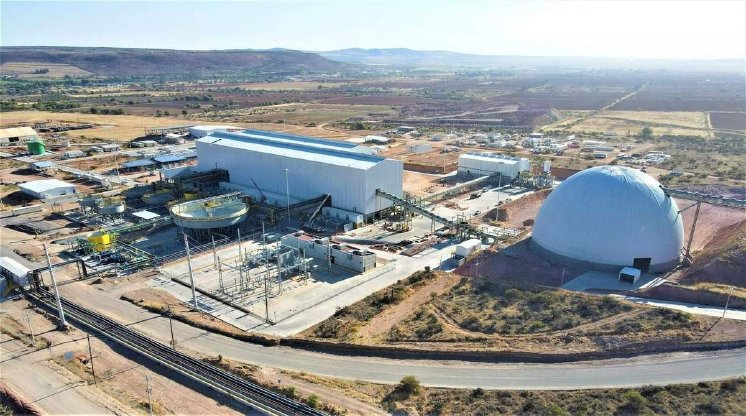

Also in Mexico is Discovery Silver's - https://www.youtube.com/watch?v=MgDgfmsT5UU - Codero Silver Project (silver, zinc and lead). The results of the pre-feasibility study are extremely positive.

Current corporate information and press releases from Discovery Silver (- https://www.resource-capital.ch/en/companies/discovery-silver-corp/ -) and MAG Silver (- https://www.resource-capital.ch/en/companies/mag-silver-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/.