Snip 2021 Phase 3 Drilling Highlights:

- 00 g/t Au over 0.80 m (UG21-178)

- 89 g/t Au over 1.19 m (UG21-180)

- 31 g/t Au over 4.17 m (UG21-181)

- 51 g/t Au over 3.50 m (UG21-182)

- 91 g/t Au over 4.00 m (UG21-183)

- 68 g/t Au over 1.94 m (UG21-184)

- 50 g/t Au over 1.00 m (UG21-189)

- 00 g/t Au over 0.50 m (UG21-192)

- 04 g/t Au over 12.50 m (UG21-202)

- 87 g/t Au over 2.44 m (UG21-205)

- 59 g/t Au over 2.76 m (UG21-214)

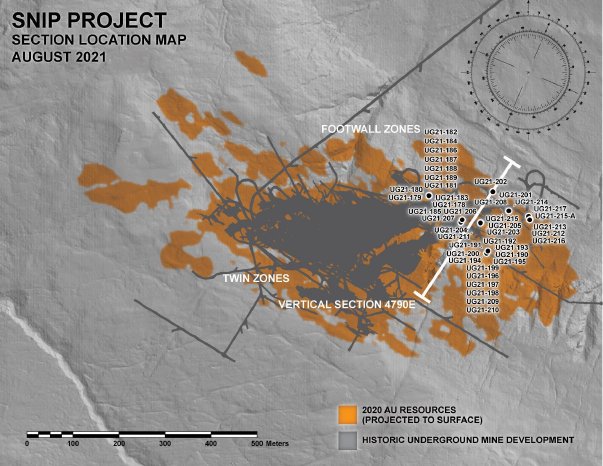

Additional Footwall Mineralization Intersected with Infill Drilling

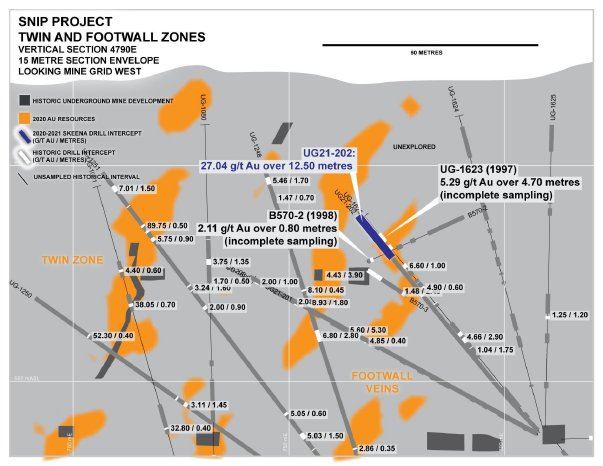

Infill drilling in the eastern footwall of the Snip deposit has confirmed and upgraded the modelled vein mineralization from the Company’s 2020 MRE, as highlighted by intersection 27.04 g/t Au over 12.50 m, including high tenor subintervals grading 209.00 g/t Au over 0.67 m and 203.00 g/t Au over 0.69 m (UG21-202). This drill hole is located only metres away from partially sampled 1998 historical drill hole, which due to a lack of sampling, only reported 2.11 g/t Au over 0.80 m (B570-2). Furthermore, UG21-202 is drilled parallel to another incompletely sampled historical drill hole UG-1623 which was drilled in 1997. The latter drill hole was only sampled over a 4.70 m interval that averaged 5.29 g/t Au. The incompletely sampled historical drill holes form the basis of the Company’s 2020 MRE in this area.

Implications of Selective Sampling

The historical drilling database that was inherited from the previous operators of the Snip Project is plagued with incompletely sampled drill holes. During resource estimation, best practices dictate that unsampled intervals be nulled to a value of zero grade. Unfortunately, during the reclamation of the Snip Mine, all drill core was destroyed, hence no physical records remain for modern QAQC validation or resampling purposes. As such, a small portion of the Company’s 2021 infill drilling program is designed to confirm the historical drill database and add confidence to the existing MRE. The significance of the new intersections as exemplified by UG21-202 is twofold. Primarily, the new drilling provides spatial confidence to the resource as currently modelled. Secondly, the improved widths and grades have the potential to translate into larger volumes (tonnage) in subsequent resource estimates. These considerations combined with the newly enhanced grade in this area, may ultimately translate into increased ounces.

Further High-Grade Mineralization Intersected in Footwall Corridor

Additional results from the previously reported high-grade vein discovery on the 412 Level of the Snip Mine are highlighted by 109.89 g/t Au over 1.19 m (UG21-180), 29.31 g/t Au over 4.17 m (UG21-181), 85.51 g/t Au over 3.50 m (UG21-182), 84.68 g/t Au over 1.94 m (UG21-184) and 164.50 g/t Au over 1.00 m (UG21-189). This cluster of previously unidentified, high-grade intersections have been intercepted during the Company’s Phase 3 infill program. A total of 21 fanned underground drill holes were collared from this single drill station and were purposed to recategorize Inferred Resources in the deeper footwall rocks. New high-grade veining intersections were discovered by all holes only metres into the face possessing above average grades and widths as highlighted by previously reported intersection 110.22 g/t Au over 4.41 m which included 730.00 g/t Au over 0.58 m (UG21-177). This newly drilled mineralization is open for expansion up dip 25 m and greater than 100 m downdip due to a lack of drill hole sampling by previous operators. The westward strike extension is open for 40 m. High tenor intersections in the deeper footwall rocks have also corroborated the modelled Inferred mineralization as demonstrated by intersections 390.00 g/t Au over 0.80 m (UG21-178), 164.50 g/t Au over 1.00 m (UG21-189) and 126.50 g/t Au over 0.73 m (UG21-182).

About Skeena

Skeena Resources Limited is a Canadian mining exploration and development company focused on revitalizing the past-producing Eskay Creek gold-silver mine located in Tahltan Territory in the Golden Triangle of northwest British Columbia, Canada. The Company released a Prefeasibility Study for Eskay Creek in July 2021 which highlights an open-pit average grade of 4.57 g/t AuEq, an after-tax NPV5% of C$1.4B, 56% IRR, and a 1.4-year payback at US$1,550/oz Au. Skeena is currently completing both infill and exploration drilling to advance Eskay Creek to full Feasibility by Q1 2022. Additionally, the Company continues exploration programs at the past-producing Snip gold mine.

On behalf of the Board of Directors of Skeena Resources Limited,

Walter Coles Jr.

President & CEO

Company Website: www.skeenaresources.com

Qualified Persons

Exploration activities at the Snip Project are administered on site by the Company’s Exploration Managers, Raegan Markel, P.Geo. and John Tyler P.Geo. In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Paul Geddes, P.Geo. Vice President Exploration and Resource Development, is the Qualified Person for the Company and has prepared, validated and approved the technical and scientific content of this news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting the exploration activities on its projects.

Quality Assurance – Quality Control

Once received from the drill and processed, all drill core samples are sawn in half, labelled and bagged. The remaining drill core is subsequently securely stored on site. Numbered security tags are applied to lab shipments for chain of custody requirements. The Company inserts quality control (QC) samples at regular intervals in the sample stream, including blanks and reference materials with all sample shipments to monitor laboratory performance. The QAQC program was designed and approved by Lynda Bloom, P.Geo. of Analytical Solutions Ltd., and is overseen by the Company’s Qualified Person, Paul Geddes, P.Geo, Vice President Exploration and Resource Development.

Drill core samples are submitted to ALS Geochemistry’s analytical facility in North Vancouver, British Columbia for preparation and analysis. The ALS facility is accredited to the ISO/IEC 17025 standard for gold assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is crushed and 1 kg is pulverized. Analysis for gold is by 50 g fire assay fusion with atomic absorption (AAS) finish with a lower limit of 0.01 ppm and upper limit of 100 ppm. Samples with gold assays greater than 100 ppm are re-analyzed using a 50 g fire assay fusion with gravimetric finish. Analysis for silver is by 50 g fire assay fusion with gravimetric finish with a lower limit of 5ppm and upper limit of 10,000 ppm. Samples with silver assays greater than 10,000 ppm are re-analyzed using a gravimetric silver concentrate method. A selected number of samples are also analyzed using a 48 multi-element geochemical package by a 4-acid digestion, followed by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) and Inductively Coupled Plasma Mass Spectroscopy (ICP-MS) and also for mercury using an aqua regia digest with Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) finish. Samples with sulfur reporting greater than 10% from the multi-element analysis are re-analyzed for total sulfur by Leco furnace and infrared spectroscopy.

Cautionary note regarding forward-looking statements

Certain statements made and information contained herein may constitute “forward looking information” and “forward looking statements” within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management’s expectations. Forward-looking statements and information may be identified by such terms as “anticipates”, “believes”, “targets”, “estimates”, “plans”, “expects”, “may”, “will”, “could” or “would”. Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters. While the Company considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guarantees of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. The Company does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws.

Neither the Toronto Stock Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

True widths range from 60-100% of reported core lengths. Length weighted Au composites are constrained by geological considerations. Grade-capping of individual assays has not been applied to the Au assays informing the length-weighted Au composites. Samples below detection limit were nulled to a value of zero. NSA – No Significant Assays.