Silver can be found in electric vehicles, in photovoltaic technology and even in nuclear power plants. In nuclear reactors, there are so-called control rods. These ensure safety in the reactor, as they are used to control the power in the reactor core. The control rods absorb neutrons and are made of alloys of silver or other materials. With the construction of many new nuclear power plants worldwide, the demand for silver will also increase in this area. As the price of gold is expected to rise in the coming months, especially if the Fed starts to cut interest rates, the price of silver is also expected to rise as a result. In addition, as already mentioned, the sectors in which silver is used are growing. The gold-silver ratio is currently just under 90, and if the gold-silver ratio is higher than 80, silver is considered extremely undervalued. The higher the value, the greater the likelihood of an appreciation. Silver is therefore currently cheap.

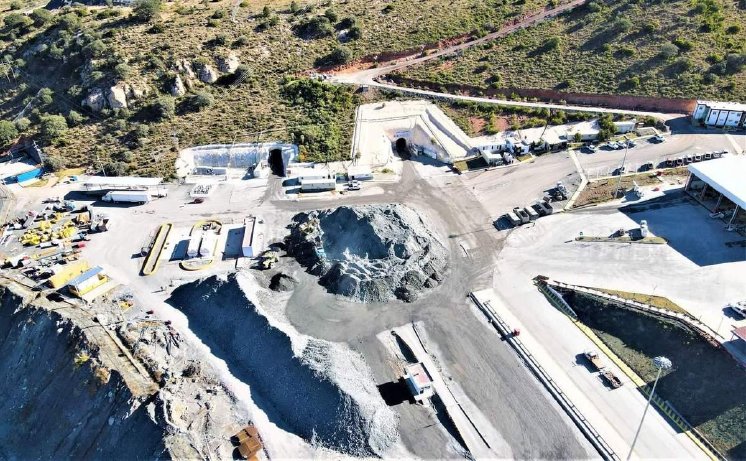

MAG Silver - https://www.commodity-tv.com/ondemand/companies/profil/mag-silver-corp/ -, a primary silver company, is one of the high-quality silver companies. In addition to its stake in the Juanicipio property (44%), MAG Silver owns 100% of a silver project in the Abitibi area in Canada and one in Utah.

Some analysts believe that the price of copper could rise to USD 15,000 per tonne in 2025. This is because, on the one hand, demand is increasing while, on the other, supply is subject to restrictions. Ore grades are generally falling, and some large copper mines have announced a reduction in copper production for this and next year, such as Anglo American. The energy transition is causing demand to rise. And once again, it is China's economy and Chinese infrastructure investments that are having a decisive impact on the copper price.

In Alaska, U.S. GoldMining - https://www.commodity-tv.com/ondemand/companies/profil/us-goldmining-inc/ - owns the promising Whistler gold-copper project.

Current company information and press releases from MAG Silver (- https://www.resource-capital.ch/en/companies/mag-silver-corp/ -) and U.S. GoldMining (- https://www.resource-capital.ch/en/companies/us-goldmining-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/