The US ban on the import of enriched uranium from Russia comes into force on August 11. Many industrialized nations are expanding their nuclear energy. There is a race for physical uranium. After all, nuclear power is the clean energy source of the future. China is already buying up large supplies of uranium and plans to develop around 150 new nuclear power plants by 2035. This development can be seen from the fact that China imports more uranium than it needs domestically. As it only takes an average of seven years to build a new nuclear power plant in China, the country's nuclear capacity is set to increase significantly.

The USA still has the largest number of nuclear reactors, but this could change in a few years. China, for example, has almost tripled its nuclear energy capacity in the past ten years. In the USA, the government is investing in new nuclear reactors. At the same time, global energy demand is increasing, partly due to the triumph of artificial intelligence. The shift towards uranium energy can easily be seen in the development of the price of uranium. Estimates suggest that demand for uranium could exceed supply by 50 percent by 2040.

This is because not only the USA, but also 20 other countries are planning to triple their nuclear power capacity by 2050. An excellent source of uranium is the Athabasca Basin in Saskatchewan, Canada. Uranium deposits there are abundant and of high quality. Thanks in part to these deposits, Canada has become the second largest uranium producer in the world. This is also supported by the Canadian government, which offers tax credits for exploration expenditure in the uranium sector. Major US banks predict that uranium prices will continue to rise in 2024 and 2025. Therefore, a look at uranium companies such as Uranium Energy or Premier American Uranium should not be missed.

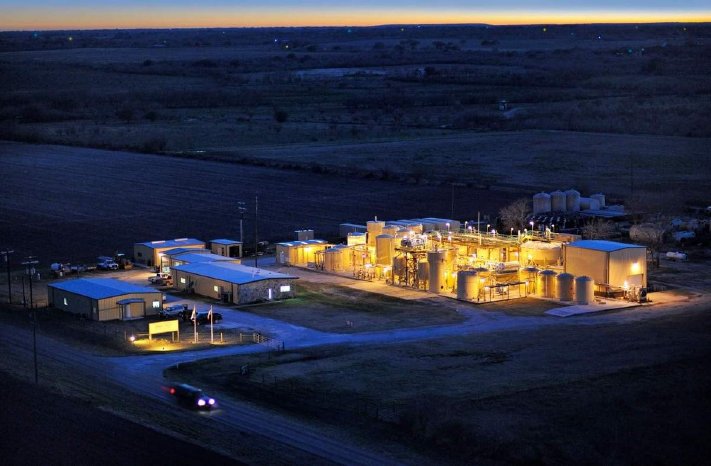

Uranium Energy - https://www.commodity-tv.com/ondemand/companies/profil/uranium-energy-corp/ - is advancing uranium projects in Canada and owns prospective ISR uranium projects in the USA.

Premier American Uranium - https://www.commodity-tv.com/ondemand/companies/profil/premier-american-uranium-inc/ - also has outstanding uranium projects in Wyoming and Colorado.

Current company information and press releases from Premier American Uranium (- https://www.resource-capital.ch/de/unternehmen/premier-american-uranium-corp/ -) and Uranium Energy (- https://www.resource-capital.ch/de/unternehmen/uranium-energy-corp/ -).

In accordance with §34 WpHG, I would like to point out that partners, authors and employees may hold shares in the companies mentioned and that there is therefore a possible conflict of interest. No guarantee for the translation into German. Only the English version of this news is valid.

Disclaimer: The information provided does not constitute a recommendation or advice. The risks involved in securities trading are expressly pointed out. No liability can be accepted for damages arising from the use of this blog. I would like to point out that shares and in particular warrant investments are always associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the correctness of all content. Despite the utmost care, I expressly reserve the right to make errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but in no way claims to be accurate or complete. Due to court rulings, the contents of linked external pages are also to be answered for (e.g. Hamburg Regional Court, in the ruling of May 12, 1998 - 312 O 85/98), as long as no explicit dissociation from these is made. Despite careful control of the content, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/....