Very recently they announced a drill program for Alvalade, a 4:1 rollback and closed a small C$500k raise to pay G&A and other ongoing costs, after receiving the all-important experimental exploitation license back in June of this year. The 4:1 roll-back will take place after shareholder approval is obtained at the AGM on December 14, 2020. The raise comprised of 16.88M units, consisting of a share and a full warrant, the share being priced at C$0.03 (pre-consolidated) and the warrant at C$0.05 (pre-consolidated) for a period of 36 months. The proceeds from the issuance of the units will be used to provide working capital for exploration programs in Portugal, Kosovo, potential new acquisitions, and for general corporate purposes.

I don’t usually regard a rollback without a complete overhaul of the company a welcome development as it dilutes existing shareholders, but in this case I view the Alvalade JV as such a robust and high quality JV that the company shouldn’t have to toil around with share prices of sub 5c when doing the rounds during financings. Furthermore, the roll-back isn’t that excessive, and this company doesn’t have to do large raises for a while, as MATSA is doing the heavy lifting of exploration funding.

After this quick catch-up regarding the company, it might be interesting to get something of a big picture update first, before Avrupa is discussed in further detail.

COVID-19 has hampered Avrupa for the most part of this year, and is returning to the spotlights with a second wave now. Even Trump ending up in a hospital recently as a COVID-19 patient didn’t hurt market sentiments, although no one really knows what exactly went on, how sick he was, and for how long. It even seems nowadays that his physicians seem to have invented an effective method to cure from virus, as a cocktail of synthetic antibodies and an anti-ebola medicine got Trump back on his feet and working miraculously fast. In Europe where I live, people who suffered and recovered from the virus at a much younger age than Trump remain in a so-so condition for weeks or even months, although health care isn’t really inferior, to say the least.

As the markets, and to a lesser extent the real economy, were saved/backstopped by a massive US$2T stimulus package, expectations are that this will happen again if the second wave starts to create lockdowns, etc. for the second time around. Trump and Treasury Secretary Steven Mnuchin are hesitant so far, but since a bill can be signed in 3-7 days if needed, I assume they are waiting until actual lockdowns are announced and eventual effects on the markets become more visible. I do expect the markets to react less violently compared to March, as they didn’t know what to expect from government stimulus back then, and they do now.

Stimulus isn’t only confined to Trump politics, as Joe Biden is a big supporter of stimulus programs, as well, when looking at his election program, so Republican or Democratic, the markets will see stimulus if needed, and not left to crash into depression. On the back of a real economy which is recovering from the first wave, mining and metal prices are doing well, and especially copper, which is the most important metal for Avrupa’s flagship project, is doing very well since the March outbreak as can be seen in this chart by Macrotrends.

Copper prices are even closing in on 5-year highs set in 2017, but could be in for a small correction due to the upcoming second wave and potentially a chaotic presidential election. For next year a considerable deficit is forecasted, so if the economy recovers further, I see copper prices going past US$3.25/lb levels. I do believe that, if a vaccine is developed successfully, economy and markets are eager to leave the current situation behind them, and a second stimulus package can help bridge the period between now and the moment the vaccine can be applied successfully at a large scale. This will take some time, as several programs by Big Pharma are paused or reconfigured as tests yield several undesired side-effects in some cases. Considering the amount of research dedicated to this task worldwide, I hope and assume there will be a solution somewhere in H1 2021.

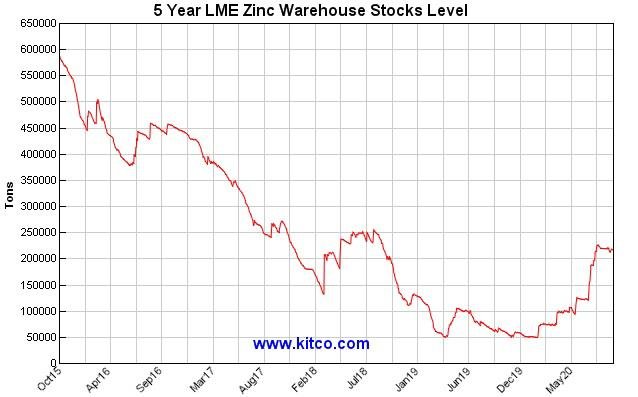

COVID-19 aside, I’m always checking the second most important metal for Avrupa as well, which is zinc. Zinc prices saw more of a breather compared to copper in the last month or so, but is overall certainly enjoying a strong and robust recovery comparable to copper, since an estimated 25% of world production came to a halt in March 2020 due to the pandemic, as can be seen here in this chart of Kitco.

As can be seen above, the zinc price is actually only just hovering along a long term US$1/lb average, so if a real economic recovery takes place, despite a bottleneck in zinc smelter capacity, we could see zinc prices go above US$1.20/lb levels again next year. An interesting detail around doing zinc due diligence was the ongoing discrepancy between a formerly assumed fundamental for the zinc price, LME inventory levels, and the actual zinc price.

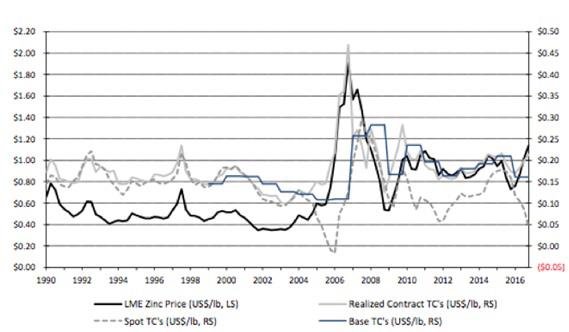

A rising zinc price only corresponded with lower inventory levels until June 2018, after this it all didn’t make any sense anymore. Something much more specific to the zinc market, spot zinc treatment charges (TC’s) going down (there is no zinc offered to smelters so no supply) are usually a front runner to the zinc prices, as can be seen here in this old chart coming out of a January 2017 zinc report by RBC.

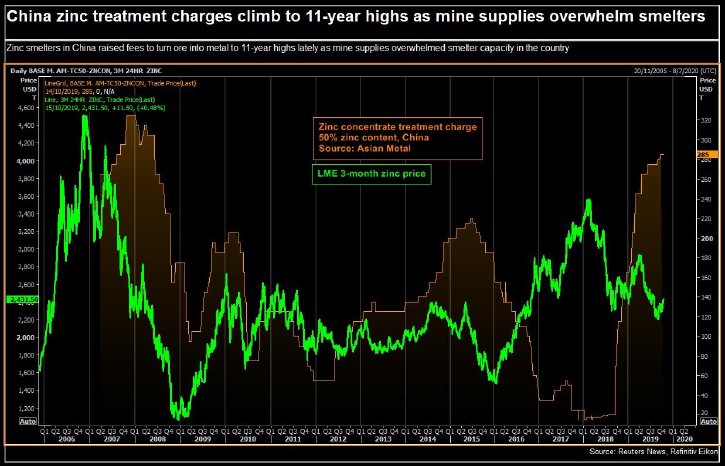

It wasn’t easy to find a more updated chart regarding TC pricing, but one of the results was a Reuters chart from last year, showing high realized contract treatment charges as increased mine supply is creating the aforementioned bottleneck with smelter capacity.

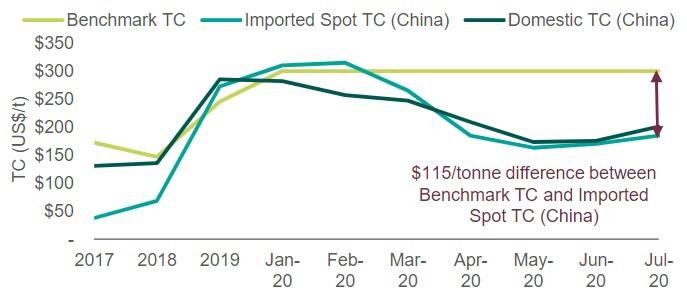

COVID-19 caused many temporary mine closures with major producers like China, Mexico and Peru, so TC’s came down as expected, and can be witnessed in this more recent chart by Wood Mackenzie, taken from a Trevali Mining presentation.

I am actually surprised to see the benchmark (= contract) TC’s remain at US$300/t during the COVID-19 crisis, as supply dropped off by about a quarter, and has seen spot TC’s coming down a lot since the outbreak as well. The zinc price responded in reverse lockstep with the falling spot TC’s as usual, but the gradual recovery in restarting mine production has seen spot TC’s rising again and the zinc price correcting. What to expect next? Interesting to see is supply ramping up production to return to pre-pandemic levels on the back of recovering demand and also weather the high contract TC’s, but on the other side there has been a lack of investments in smelter capacity the last few years, creating the ongoing bottleneck, and in the end creating zinc ingot shortages, which in the end could result in higher zinc prices when the economy fully recovers. As there is oversupply going on from mine production, I don’t see a sharp spike in zinc prices coming anytime soon, usually created from a significant production supply/manufacturing demand deficit. According to the International Lead and Zinc Study Group (ILZSG), a platform formed by the United Nations, consisting of all major producing countries and industry players in the lead and zinc sector, several mines could experience problems to nameplate capacity again, but global supply for refined zinc metal will exceed demand significantly in 2020 (620kt), and for 2021 this surplus is expected to be 463kt. Notwithstanding this, the somewhat artificial deficit created by smelters could provide the markets with a zinc price at or above US1.10-1.20/lb levels for quite some time. This is about it for copper and zinc, let’s have a closer look to the company as promised.

After receiving the new Alvalade Experimental Exploitation License (EEL) from the Portuguese Mining Bureau on June 15th, the MATSA JV could be finalized, and exploration programs and budgets finally planned. MATSA also acquired two greenfields exploration licenses close to Alvalade at the same time as the Alvalade license issuance.

As a reminder, the EEL covers an area of approximately 115 square kilometres, is valid for up to five years, and includes the Sesmarias massive sulfide discovery, the nearby historic Lousal Mine, the Monte da Bela Vista stockwork zone, and a number of other already-known massive sulfide targets noted on the map. Avrupa will operate the Project through a joint technical committee with full funding by MATSA for up to three years, subject to project milestones.

I talked to President and CEO Paul Kuhn about the status of their exploration program as laid out in the news release of October 5, and this is the updated information:

- Re-log historic Avrupa-drilled Sesmarias core with MATSA to integrate their knowledge of the Pyrite Belt into the overall understanding of the massive sulfide deposit (remember that they have three operating Pyrite Belt mines in Spain, and at least one new un-announced discovery in the same rocks).

- Initial logging and possibly sampling of historic core prior to Avrupa’s involvement at Alvalade. They have access to at least 10,000 meters of old core that has not be looked at for years.

- Considering use of ionic leach geochemistry, to help identify and follow the trend of the Sesmarias mineralization. This is a relatively new geochemical technique that utilizes ultra-trace detection methods to find ions of many different elements that may indicate the presence of buried massive sulfide mineralization. We have done some orientation surveys over known mineralization at Sesmarias, and it seems to work quite well.

- Review all of the old Lousal Mine data and geology in order to consider new drill targets. It is reasonable to assume that Lousal and Sesmarias were all part of the same deposit a long time ago. Are there more sulfide lenses out there between Lousal and Sesmarias (7 km apart)? How much more of the remaining Lousal mineralization might be available for exploitation? Possibly 30-35 million metric tonnes of massive sulfide remaining within the old Lousal workings?

- Review old core from the Monte da Bela Vista stockwork zone to see where the ore deposit may be hiding. MBV is located 1.5 – 2 km north of Lousal, giving us over 9 km of strike length in this district.

- Review the old Caveira Mine data and drilling. Caveira is under-explored and is located only 9.5 km north of Monte da Bela Vista. We only drilled one or two holes in the area when we were working with Antofagasta years ago.

- Review and compile exploration data for the rest of the license, as there are lots of targets to be explored.

- Drill targeting with the hope of starting drilling by the beginning of September

On a closing remark, Paul Kuhn stated the following:

“Even with help from MATSA’s team of geos, things are moving slower than anticipated. We are all learning a new geological data reporting system in order to coordinate with MATSA’s mine team. This includes both partners of the JV entity, PorMining. Both teams are working together to learn the geology and the targeting characteristics. This has expanded work for all of us, but is giving us a lot of new opportunities. Drilling will start on the Alvalade Project as soon as we can complete this first stage of work and get a drill rig from Spain.

MATSA sent over an experienced logging geologist from the mine a couple of weeks ago, to help us all integrate into their system. We’ve made quite a bit of progress, but there is more to do, and we will request the return of the geo for next week, probably. The work that we are doing at Sesmarias is further updating the model of the deposit from the previous iterations and putting it into the MATSA database will help us immensely with a proper 3D targeting model for the Sesmarias – Lousal - Monte da Bela Vista district. This means many new drillable targets in the upcoming drilling program beyond Sesmarias.”

Unfortunately, this all means a delay for the commencement of drilling, and the earlier communicated timeframe of the 7,000-8,000m program being October 2020 will be moved towards later into Q4, 2020, probably November as mentioned. It is anticipated that the second wave of COVID-19 won’t have a further delaying impact, barring a complete lockdown as we have witnessed in March-April of this year.

As a reminder, the Sesmarias discovery combined with the Lousal historic resources/workings is the obvious target for MATSA, as it generates a 40-50Mt resource potential (Sesmarias 10 Lense is guesstimated by me to contain about 19-20Mt, Lousal a potential 20-30Mt, both guesstimated at 1% Cu or better). Avrupa and MATSA are looking to see if Sesmarias, Lousal and also Monte Da Bela Vista, all several kilometers apart from each other, could form a district scale system. In my last article about Avrupa, I calculated JV project/NPV potential estimates for the company at many multiples of the current share price (C$0.035 now vs. C$0.29-0.45 at FS stage, unconsolidated). Even the rock bottom cash compensation for the Avrupa interest per the JV deal (C$10M) is almost a 3-fold of the current market cap, and as this compensation has been negotiated with metal prices at significantly lower levels, I see potential to renegotiate terms if these prices remain at current levels or go even higher in the next few years.

Conclusion

Although it seems to take a little while longer, Avrupa as the operator has been planning their exploration program for Alvalade together with the technical people of MATSA, and it is anticipated that drilling could start in November. As this is a new phase for the company, management thought the timing was right for a 4:1 roll-back, as the share structure and especially the extremely low share price weren’t doing justice to the quality of the Alvalade JV, and could hamper future financing rounds. After closing this one last small C$500k raise, Avrupa is no longer completely dependent on MATSA. Alvalade, being an intensively-drilled and mined brownfield project in the past with 40-50Mt copper/zinc potential, could easily be brought back to life. If there is one JV partner that can do this, it is MATSA, who is backed by two giants and has brought a comparable 40Mt project from development into production in just 3 years. So of course this will not happen overnight, but if the drill bit can start proving up the anticipated resource potential, MATSA is not going anywhere soon, and Avrupa will likely benefit from these developments.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Avrupa Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.avrupaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.