The PEA, completed by Ausenco Engineering Canada ULC (“Ausenco”), supported by Entech Mining Ltd. (“Entech”) and SGS Canada Inc. (“SGS”), provides a robust base case assessment for developing Panuco as a long-life, high-margin underground precious metals mine with low initial capital requirements and a fast timeline to production.

“An estimated after-tax NPV (5%) of more than US$1.1 billion, an after-tax IRR of 85.7% and a payback period of approximately nine months, helps solidify Panuco as a world class development project in the precious metals space,” commented Michael Konnert, President and CEO. “The PEA, based on conservative metals prices of US$26/oz silver and US$1,975/oz gold, outlines a high-margin, underground silver primary mine with substantial silver-gold production of 162.1 million silver-equivalent ounces over an initial 11-year mine life. Annually, the mine is projected to produce an average of 15.2 million silver-equivalent ounces, providing exceptional free cash flow, particularly in the early years, allowing for a very rapid payback of the estimated low initial Capex of US$224 million. It’s important to note, that this PEA represents only a snapshot of the potential value of Panuco, as we have only explored less than 30% of the known targets in the district. Furthermore, ongoing drilling with two drill rigs continues to expand and convert high-grade veins in and around the proposed mine plan, enhancing the potential for improved economics in a feasibility study planned for the second half of 2025. Panuco benefits from excellent access to existing infrastructure, significant exploration upside potential to discover new mineralized centers and potentially new standalone projects hosting similar economics to that outlined in today’s study. As such, it’s becoming increasingly clear that Panuco will be a meaningful contributor to the silver industry for decades to come. I would like to thank everyone at Vizsla Silver, our stakeholders and community members for all the hard work over the years to reach this monumental milestone.”

The Company cautions that the results of the PEA are preliminary in nature and include inferred mineral resources that are considered too speculative geologically to have economic consideration applied to them to be classified as mineral reserves. There is no certainty that the results of the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

PEA Webcast

Vizsla Silver will be hosting a webcast to discuss the PEA at 10:00 am PT (1:00 pm ET) on Thursday, July 25, 2024. To register, please click here.

PEA Highlights (Base Case)

- 3,300 tonnes per day (“tpd”) production rate for the first three years, expanding to 4,000 tpd in year 4, producing silver-gold doré with an initial mine life of 10.6 years.

- High-grade underground mine with mineralized material1 averaging US$253/t NSR value (diluted) comprising Copala deposit with 5.3 Mt averaging 316g/t Ag, 1.97 g/t Au.

- Life of Mine (“LOM”) average annual payable production of 15,225 koz AgEq2 per year (9,268 koz Ag per year and 78 koz Au per year).

- Years 1-2 average annual payable production of 20,185 koz AgEq per year (13,756 koz Ag per year and 85 koz Au per year).

- LOM cash costs3 of US$7.98/oz payable AgEq on a co-product basis, LOM all-in sustaining costs (AISC4) of US$9.40/oz payable AgEq on a co-product basis.

- Initial capital expenditures of USD$224M.

- After-tax NPV (5%)of US$1,137M and 85.7% IRR at US$26/oz Ag and US$1,975/oz Au.

- After-tax payback period of 9 months.

- Underground mineralized material contains, Indicated and Inferred Resources

- Payable Silver Equivalent (AgEq.) calculated by dividing gross sales revenue by $26.00 (silver price)

- Total cash costs consist of operating cash costs plus royalties and offsite (refining & transport) charges

- AISC consist of total cash costs plus sustaining capital

The PEA considers two contiguous underground mines, the Copala Mine and the Napoleon Mine, with on-site treatment of the mined material processed through a 3-stage crushing-grinding circuit, along with a leach and Merrill Crowe circuit to produce silver-gold doré bars. The mines will be contractor-operated utilizing ramp-access and a combination of long-hole stoping and drift-and-fill mining methods.

The processing throughput capacity of 3,300 tonnes per day for the first three years, expanding to 4,000 tonnes per day in year four, results in an initial mine life of 10.6 years. The PEA leverages Panuco’s existing infrastructure, including all-weather access roads, permits, power and its proximity to the Concordia Municipality with its skilled labour pool.

The PEA is derived using the Company’s mineral resource estimate published on September 01, 2023 (the “MRE”). The effective date of the PEA is July 24, 2024, and a technical report (the “Technical Report”) will be filed on the Company’s website and SEDAR+ within 45 days of this news release.

* Total cash costs consist of operating cash costs plus royalties and offsite (refining & transport) charges

** AISC consist of total cash costs plus sustaining capital

Table 1: Panuco PEA Detailed Parameters and Outputs

NPV remains positive for changes of +/-20% in revenue drivers including metal prices, head grade, recovery, initial capital expenditure and operating costs. After-tax economic sensitivities are presented in Tables 2 and 3 below. Additional project sensitivities will be presented in the Technical Report.

Table 2: Sensitivity Summary Post Tax NPV 5% (US$M)

Table 3: Sensitivity Summary Post Tax IRR (%)

Mineral Resources

The MRE forms the basis for this PEA. The MRE is based on a total drill database of 822 holes (302,931 metres) completed by Vizsla Silver between November 2019 and September 2023.

Indicated mineral resources are estimated in the MRE at 9.5 Mt grading 289 g/t silver, 2.41 g/t gold, 0.27% lead, and 0.84% zinc (511 g/t AgEq). The MRE includes indicated mineral resources of 88.2 million ounces (“Moz”) of silver, 736 koz of gold, 25.4 kt of lead, and 79.9 kt of zinc (155.8 Moz AgEq).

Inferred mineral resources are estimated in the MRE at 12.2 Mt grading 239 g/t silver, 1.93 g/t gold, 0.29% lead, and 1.03% zinc (433 g/t AgEq). The MRE includes inferred mineral resources of 93.7 Moz of silver, 758 koz of gold, 35.4 kt of lead, and 125.3 kt of zinc (169.6 Moz AgEq).

Table 3: Sensitivity Summary Post Tax IRR (%)

Mineral Resources

The MRE forms the basis for this PEA. The MRE is based on a total drill database of 822 holes (302,931 metres) completed by Vizsla Silver between November 2019 and September 2023.

Indicated mineral resources are estimated in the MRE at 9.5 Mt grading 289 g/t silver, 2.41 g/t gold, 0.27% lead, and 0.84% zinc (511 g/t AgEq). The MRE includes indicated mineral resources of 88.2 million ounces (“Moz”) of silver, 736 koz of gold, 25.4 kt of lead, and 79.9 kt of zinc (155.8 Moz AgEq).

Inferred mineral resources are estimated in the MRE at 12.2 Mt grading 239 g/t silver, 1.93 g/t gold, 0.29% lead, and 1.03% zinc (433 g/t AgEq). The MRE includes inferred mineral resources of 93.7 Moz of silver, 758 koz of gold, 35.4 kt of lead, and 125.3 kt of zinc (169.6 Moz AgEq).

Table 4: Mineral Resources Reported at 150 g/t AgEq cut-off (effective date September 01, 2023)

Capital and Operating Costs

The PEA estimates initial capital requirements of US$224 million and cumulative sustaining capital of US$230 million. LOM operating costs for Panuco are estimated to average US$76.4 per tonne processed.

Sustaining capital is expected to average approximately US$21.6 million per year largely attributable to continual mine development. In Year 3, with the mill expansion and increase in underground development associated with opening up the Napoleon Area veins, an expansion cost of US$11.1 million is added (to be funded through initial cash flows). The projected timing of increases in capital expenditures in year 3 may be pushed further into the future with continued exploration success along the Copala structure.

The PEA is based on contractor underground mining, which has an estimated LOM cost of US$47.21 per tonne milled. Processing costs are estimated at US$21.96 per tonne milled, which includes TSF handlings of US$0.33 per tonne milled. G&A costs are estimated at US$7.24 per tonne milled.

The capital and operating cost estimate was developed in Q3 2024 United States Dollars (US$). The capital cost summary is presented in Table 5 and the operating cost summary is presented in Table 6.

Table 5: Project Capital Cost Estimates (US$M) (totals may differ due to rounding)

Table 6: Project Operating Cost Estimates (US$M) (totals may differ due to rounding)

Mining

The Panuco Project is a collection of silver-gold deposits located in the Panuco-Copala mining district in Sinaloa, Mexico, which extend from surface to over 600 m in depth. The deposits range in thickness from 1.5 m to greater than 20 m.

Based on the characteristics of the deposit, long-hole stoping (“LHS”) was selected as the primary mining method for all deposits, with drift-and-fill (“DAF”) selected for the northern portion of the Copala North Zone which is located directly under the Copala township. A sublevel spacing of 20 m was selected with variable stope strike lengths for LHS to be used dependant on prevailing ground conditions, and 4 m high DAF drifts (five lifts per sublevel).

The mining methods considered for the Panuco Project are proposed to use a combination of cemented rock backfill (“CRF”), uncemented rock backfill, and paste backfill for stope support.

For the preliminary design of the Panuco Project, planned dilution and unplanned rock dilution were accounted for using the Datamine Mineable Shape Optimiser® (“MSO”). Mineralized and unmineralized dilution within MSO was estimated at 52.8% and additional unplanned dilution from backfill dilution, stope development and DAF mining was estimated at 9.2%. Mining recovery of 92% for LHS and 98% for DAF was applied as a factor to the shapes created by MSO within the production schedule.

A Net Smelter Return (“NSR”) model was used to estimate the revenue of the mineralized material. Preliminary process recoveries, doré grades, smelting and refining terms, and transportation costs were assumed to determine the NSR value. A Cut-Off Value (“COV”) was used to flag material by whether the revenue in a block exceeds the costs of extraction and processing of that block. There were three COVs used to assess mining at Panuco: An Elevated COV, a Fully Costed COV and the Marginal COV.

The Fully Costed COV represents the break-even value of mineralized material required to cover all the associated operating and sustaining capital costs of extraction and processing. Fully costed COVs were assumed for Panuco at US$ 106.6/t for LHS and US$ 120.7/t for DAF. The Elevated COV of US$200/t was considered during the pre-production period and the first two years of processing. The Marginal COV of US$22/t was assumed when the operation has committed to development and preparation of stoping blocks. The Marginal COV includes the assumption that the material value exceeds the costs of the incremental haulage, surface handling, processing, and G&A.

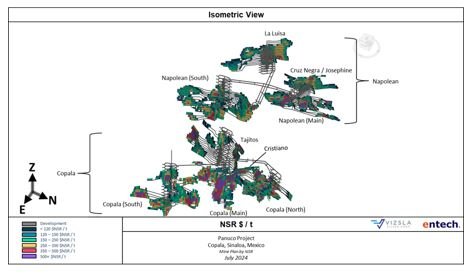

Due to the distance between the various geological deposits, the Panuco Project is separated into two separate underground mines. The Copala Mine, the larger of the two, accesses the Copala, Cristiano, and Tajitos deposits. The Napoleon Mine which is located to the west of the Copala Mine accesses the Napoleon, La Luisa, Cruz Negra, and Josephine deposits.

Contractor mining is currently proposed for the Panuco Project to minimize upfront capital and achieve higher productivity.

Table 7: Total and Annual Material Movement Schedule for the Panuco Project

Processing and Metallurgy

Three rounds of metallurgical test work have been completed to date by Vizsla Silver on the main deposits for the Panuco Project dating back to 2021. Flowsheet development, undertaken by Ausenco using samples from the Napoleon, Tajitos and Copala deposits has focused on comminution testing, Drop Weight tests, bond ball tests, mineralogical assessments, froth flotation tests, cyanide leach and whole feed leaching as well as extrapolation of a primary grind size of 70µm P80. Based on the envisioned circuit and corresponding laboratory test response, the overall process recoveries based on the samples tested for all deposits were indicated to be roughly 85-92% Ag and 90-94% Au after 96 hours of leach residence time. The PEA assumes LOM average recoveries of 92.2% for silver and 93.8% for gold. Ongoing test work continues to highlight improved recoveries.

The PEA envisages a two phased approach to mill development. Phase 1, with an initial throughput of 3,300 tpd, assumes run-of-mine (“ROM”) material is crushed and screened before grinding using a ball mill. The ground material reports to the leach circuit for a total of 96 hours. Discharge from the whole ore leaching tank will gravitate to the counter current decantation (“CCD”) circuit where leached solids will be cleaned of pregnant solution through a series of counter-current decantation thickeners to facilitate extraction and recovery of silver and gold by cyanide leach - Merrill Crowe process and refining to doré bars. Part of the plant tailings is distributed to the paste plant and the rest is deposited onto a wet tailings storage facility.

In Phase 2, the process plant expands to process 4,000 tpd and a flotation and concentrate leaching circuit is introduced to the flowsheet to support improved recoveries from Year 4.

Project Enhancement Opportunities

The PEA demonstrates that Panuco has the potential to become a commercially robust project. Additional opportunities to enhance Project value include:

- Continued exploration and infill drilling for conversion of Inferred Mineral Resources to the Measured and Indicated

- Mine scheduling investigations allowing for the further optimization of blending

- Supplementary metallurgical optimizations including deposit-wide variability testing and host rock characterization.

- Optimization of the flotation recovery and concentrate quality as well as the leach-Merrill Crowe process.

- Further optimization of tailings and water management infrastructure, including surface geotechnical site investigations, laboratory testing, physical waste characterization, water balance modelling, and engineering studies.

With the PEA completed, Vizsla Silver is moving forward with a feasibility study for the Panuco Project (the “Feasibility Study”). The Company is targeting completion of the Feasibility Study in the second half of 2025 and intends to make a production decision only following the release of a positive Feasibility Study. There are currently two drill rigs focused on infill drilling to upgrade inferred resources into the indicated category and indicated resources to the measured category, for inclusion in the Feasibility Study reserves.

The fully funded and permitted bulk sample test-mine will commence at Copala in the fourth quarter of 2024. Access to high-grade mineralization at Copala will allow us to conduct detailed feasibility work including reconciling underground grades with the resource model, assess geotechnical conditions, determine more accurate development costs, complete test mining to define the optimum mining method and stockpile high-grade mineralization on surface for plant commissioning.

Qualified Persons

In accordance with NI 43-101, Jesus Velador, Ph.D. MMSA QP., Vice President of Exploration, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

Additionally, a team of independent Qualified Persons (as such term is defined under NI 43-101) at Ausenco, Entech and SGS have led the PEA and have reviewed and verified the technical disclosure in this press release, including:

- Peter Mehrfert, P.Eng., of Ausenco is an independent Qualified Person responsible for process and recovery methods, market studies and contracts and economic analysis in the PEA.

- James Millard, P.Geo., of Ausenco is an independent Qualified Person responsible for the environmental and permitting studies in the PEA.

- Allan Armitage, P.Eng., FEC, CET., of SGS is an independent Qualified Person responsible for the Property description and location, mineral resource estimate and discussion of adjacent properties in the PEA.

- Ramon Mendoza, P.Eng., of Entech is an independent Qualified Person responsible for the mining methods and mining cost estimation in the PEA.

- Ben Eggers, P. Geo of SGS is an independent Qualified Person responsible for the history, regional geology, exploration and drilling and sampling work in the PEA.

Vizsla Silver’s flagship Panuco project is host to a high-grade epithermal silver-gold deposit which has been the subject of the PEA with an effective date of July 24, 2024, and a Mineral Resource Estimate1 on the Panuco Property with an effective date of September 01, 2023. The Mineral Resource Estimate is centered on the western portion of Panuco, encompassing ~8 km of the known 86km of cumulative vein strike in the district. The Mineral Resource Estimate includes 178 infill/expansion holes (100,222 metres) completed by Vizsla Silver between September 2022 and September 2023. In total, the Mineral Resource Estimate is based on a total drill database of 822 holes (302,931 metres) completed by Vizsla Silver since November 2019 (please refer to the Technical Report on Updated Mineral Resource Estimate for the Panuco Ag-Au-Pb-Zn Project, Sinaloa State, Mexico, by Allan Armitage, Ben Eggers and Peter Mehrfert, dated February 12, 2024 and to the Company´s press release dated January 8, 2024).

- Indicated: 48 Mt grading 289 g/t silver, 2.41 g/t gold, 0.27%

- Inferred: 19 Mt grading 239 g/t silver, 1.93 g/t gold, 0.29% lead, and 1.03% zinc (433 g/t AgEq). The current MRE includes inferred mineral resources of 93.7 Moz of silver, 758 koz of gold, 78 Mlbs of lead, and 276 Mlbs of zinc (169.6 Moz AgEq).

Ausenco is a global diversified engineering, environmental, construction and project management company providing consulting, project delivery and asset management solutions to the resources, energy, and infrastructure sectors. Ausenco’s experience in poly-metallic projects ranges from conceptual, pre-feasibility and feasibility studies for new project developments to project execution with EPCM delivery. Ausenco is currently engaged on several global projects with similar characteristics and to the Panuco Project.

Information Concerning Estimates of Mineral Resources

The scientific and technical information in this news release was prepared in accordance with NI 43-101 which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the “SEC”). The terms "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" used herein are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the “CIM Definition Standards”), which definitions have been adopted by NI 43-101. Accordingly, information contained herein providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder.

You are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, “inferred mineral resources” are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the “SEC Modernization Rules”), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. Information regarding mineral resources contained or referenced herein may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be “substantially similar” to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Definitions Standards. Accordingly, there is no assurance any mineral resources that the Company may report as “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the resource estimates under the standards adopted under the SEC Modernization Rules.

Contact Information: For more information and to sign-up to the mailing list, please contact:

Michael Konnert, President and Chief Executive Officer

Tel: (604) 364-2215

Email: info@vizslasilver.ca

Website: www.vizslasilvercorp.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward‐Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward‐looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: the exploration, development, and production at Panuco, the highlights of the PEA, the publication of the Technical Report, enhancement opportunities at the Panuco Project, and next steps at Panuco including the completion of the Feasibility Study and test mining.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla Silver, future growth potential for Vizsla Silver and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold, and other metals; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla Silver’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla Silver’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Vizsla Silver has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company's mining activities in Mexico; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding mineral resources and reserves; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities and artisanal miners; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Vizsla Silver’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Vizsla Silver has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Vizsla Silver does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.