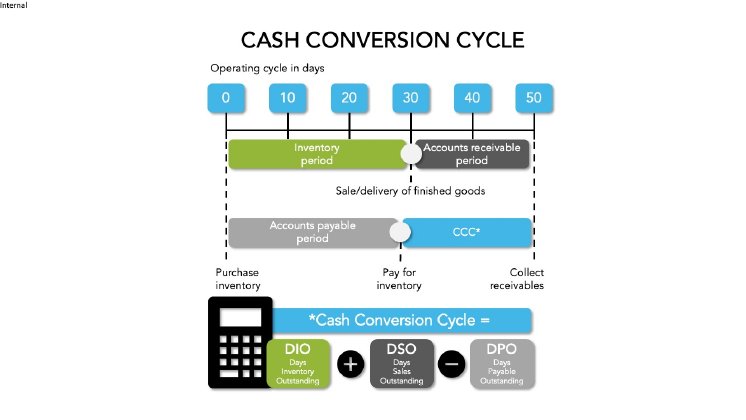

The so-called "Cash Conversion Cycle" is known to be calculated as follows: Cash Conversion Cycle = Days Sales Outstanding (accounts receivable days / accounts receivable days) + Days Inventory Outstanding (inventory days) - Days Payables Outstanding (accounts payable days). Platforms should therefore accompany companies along the entire value chain to improve these levers. Only the use and combination of as many adjusting factors as possible ensures efficient working capital management. This entails everything from risk management to liquidity provision for all those involved in value creation — especially suppliers, regardless of company size, currency, and liquidity situation.

A lower CCC is an indicator of a faster process from inventory to sale. A higher CCC indicates a slower process. A low CCC is generally considered desirable, although this depends on the company and industry. If the CCC is even negative, this means that working capital is not tied up for so long and that the company has very good liquidity management or handles liquidity very efficiently. Within any industry, no matter the case, it is an important comparative indicator that shows possible potential for improvement. The goal of professional liquidity management is to have as much free capital as possible and as little tied up capital. The CCC is an important key figure and is particularly useful if it is calculated regularly and compared with the company's past performance.

Here you can try the calculator: https://www.traxpay.com/...

Cash Conversion Cycle Definition

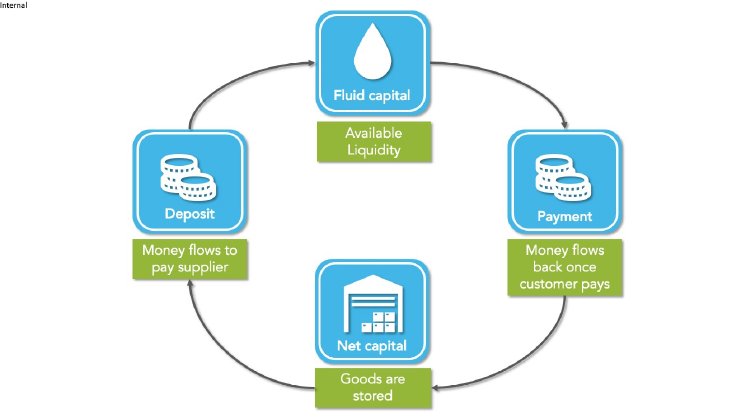

The Cash Conversion Cycle indicates how long (usually in days) it takes for an investment in inventory to be converted back into liquid assets ("cash") through sales.

This insight is made up of Days Sales Outstanding, which expresses the average time in which customers pay their invoices (Days Inventory Outstanding) This can provide an indication of inventory duration, and Days Payable Outstanding — which is determined from payment history with suppliers. The cash conversion cycle is calculated by subtracting Days Payable Outstanding from the sum of Days Inventory Outstanding and Days Sales Outstanding.

The formula is:

CCC=DIO in days+DSO in days-DPO in days.

The Days Sales Outstanding and the Days Inventory Outstanding are added together, as both values represent committed capital. However, Days Payable Outstanding often allows the company to borrow at no cost. Therefore, this value is subtracted from the sum of DIO and DSO.

30 to 60 days are common values for Days Payable Outstanding and support the company in internal financing. All ratios are considered in days and result in the cash turnover period in days.