Eastern Europe accounted for a small one-digit share of the global B2C E-Commerce sales last year, dwarfed by the large double-digit shares of North America, Asia-Pacific and Western Europe. However, it terms of growth year over year, some of the nations of the region are among the global leaders.

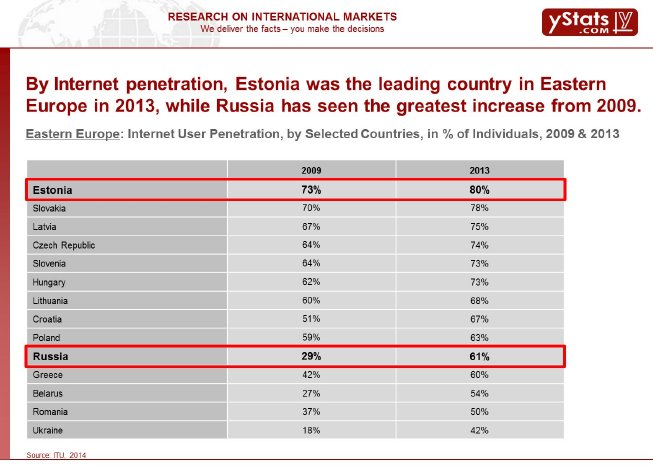

The leading emerging markets in this region in terms of market size are Russia, Turkey and Poland. Russia and Turkey also scored high in year to year growth of B2C E-Commerce in 2013, but were outpaced by close to 50% growth in Ukraine. Some smaller markets, such as Estonia and Slovakia generate significantly smaller sales of a few hundred millions of euros, but outperform the rest of the region in terms of ICT infrastructure metrics, such as Internet penetration.

Among the important trends spreading throughout the region is the development of mobile shopping. M-Commerce is driven by growing smartphone and mobile Internet penetration. In countries such as Ukraine and Turkey over 40% of smartphone owners already have experience with mobile shopping. Another important movement is cross-border B2C E-Commerce. For example, in Slovenia and the Czech Republic close to half of all online shoppers made purchases from foreign online stores in 2013. Regulation of online retail sales is also a trend; the past two years were marked with adoption of important new rules affecting E-Commerce in several Eastern European countries including Russia and Belarus.

Looking at payment methods, the report finds that cash on delivery still predominates in the majority of B2C E-Commerce markets in the region, as it is the most used payment method in Russia, Greece, Czech Republic, Ukraine, Hungary, Romania, Slovakia and Belarus. However, for cross-border purchases, credit cards are often used. For example, in Romania, over 90% of online shoppers paid with cash in 2013, but international transactions account for more than half of the credit card payments made for goods and purchases online that year.

The fast growing markets of Eastern Europe have attracted the attention of international B2C E-Commerce players and investors. The region's largest market, Russia, drew hundreds of millions of dollars in B2C E-Commerce investment over the past several years from companies such as JP Morgan, Kering, IFC, Tiger Global Management, Naspers and others. While on first stages the major beneficiaries were online clothing retailers such as Lamoda and KupiVIP, in 2014 the trend favored online shops of goods for children, such as Esky and Mamagazin. Also the second largest online retail market in the region, Turkey, has raised significant interest of international and local investors, mostly in the clothing sector featuring such players as Markafoni, Modanisa and Lidyana.