Online retail made up a mere one-digit percentage share of all retail sales in India in 2016. The yStats.com report also reveals that the Indian E-Commerce market ranks fourth in Asia and is expected to have a faster annual growth rate than other top countries in the region through 2021. Demonetization reforms during 2016 moderated this growth, but expectations are nevertheless high because of the untapped potential.

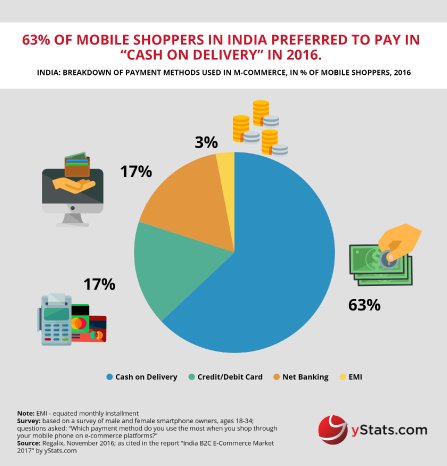

Millennials and consumers from rural areas who utilize mobile Internet technology are compelling E-Commerce expansion in India. Information from the yStats.com report reveals that Millennials will grow to encompass one-third of the population and contain more than three-quarters of digital buyers in India through 2020. M-Commerce surpassed the 50% mark regarding the share of total E-Commerce sales and is expected to continue rising. When using either a desktop or a mobile device, cash on delivery maintains its rank as the top payment method for Indian consumers, though mobile wallets like Paytm also have a growing share.

In India, Amazon and Flipkart own most E-Commerce space, together making up over two-thirds of online gross merchandise value for 2016. According to yStats.com findings, Amazon spent billions of dollars on Indian E-Commerce, resulting in their revenue doubling in fiscal 2016. Flipkart is also experiencing heavy investments from industry giants like Microsoft, eBay and Tencent Holdings. Alibaba, Tencent’s Chinese competitor, raised their investment in Paytm, showcasing India’s lucrative potential.

For further information, see: https://www.ystats.com/wp-content/uploads/2017/05/2017.05.31_Product-Brochure-Order-Form_India-B2C-E-Commerce-Market-2017.pdf