Information from the yStats.com report projects mobile payments to see a global increase. Their share of customer card payments is expected to double from 2016 to 2021. The majority of the mobile payment volume comes from remote online purchases, leaving mobile in-store purchases to make up a small one-digit percentage share from the total from areas like Europe and North America.

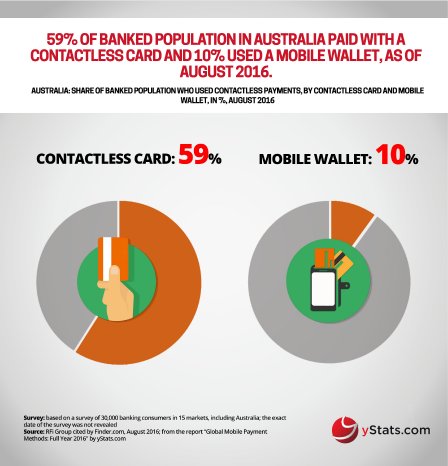

However, the value of in-store global mobile payment transactions has increased. Contactless payment user penetration amounts now to over one in three people of the banked population from select countries across the globe. Cited within this yStats.com report, mobile wallets have reached double digit rates of use from E-Commerce consumers in multiple countries such as China, the UK, and Australia.

Several surveys within the yStats.com report refer to convenience as the top driving factor of increased mobile payment penetration. South Korea provides an example where mobile payments are highly valued due to convenience and quick processing speed. Nevertheless, payment security and personal data protection concerns still persist, deterring customers from making more mobile payments.

For further information, see: https://www.ystats.com/wp-content/uploads/2017/03/20170101_Product-Brochure-Order-Form_Global-Mobile-Payment-Methods_Full-Year-2016.pdf